The dollar smile theory: what is it and is it still valid in the new market regime?

30 MAR, 2023

By Schroders

By Caroline Houdril, Portfolio Manager at Schroders, and Joven Lee, Multi-asset Strategist at Schroders.

“Good news” about the economy can be taken as “bad news” for financial markets in an environment like the one in 2022, where inflation was firmly in charge and monetary policy normalization was underway.

In such a setting, equities and bonds can lose money simultaneously, meaning there are fewer places for investors to hide. The US dollar can then play a unique role, as it did last year; benefitting from rising interest rates and worries about the path of growth.

Looking into 2023, it might be growth – not inflation – that keeps investors up at night.

Given this shift in investor focus, we felt it was worth putting last year’s standout winner in the spotlight and revisiting the role of the US dollar in portfolios.

What is the dollar smile?

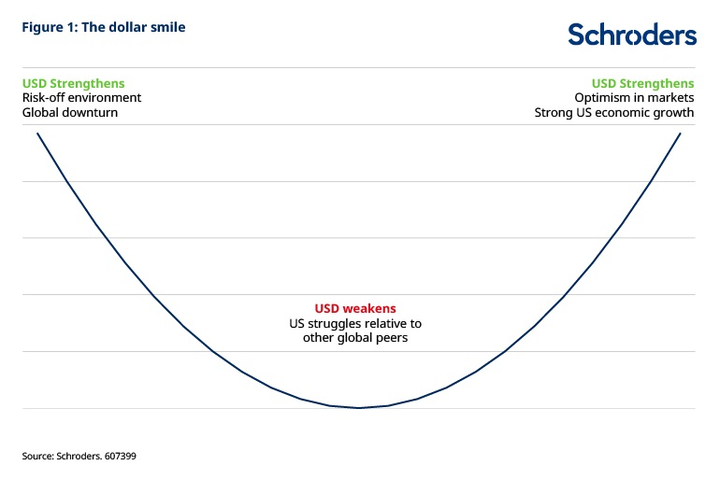

First, we should highlight that what happened with the US dollar last year reflects a phenomenon known as the “dollar smile”. The dollar smile was observed 20 years ago by Stephen Li Jen and referred to when the US dollar outperforms other currencies in two extremely different scenarios:

The theory is that when the US economy is strong and enjoys strong GDP growth, investors will invest heavily in US assets, thereby further driving up the value of the US dollar. Conversely, in risk-off environments, investors will flock to perceived safe-haven assets like the US dollar and the sheer demand will again drive up its value.

In the middle of the two extreme situations, the US dollar will flounder if US equity markets struggle to perform well relative to other global markets, as flows from the US dollar will be redirected into riskier but better-performing assets. This is where we are today.

How much does a dollar cost?

Looking ahead, we are potentially in a rare situation where the US may enter a recession ahead of other countries. Historically, a recession in the US is always followed by a recession in the rest of the world. In global recessions, how does the US dollar typically perform? Here, we calculate the returns using the US dollar index (DXY Index) during global recessionary periods as determined by our Global Wave model.

The Global Wave model is made up of seven equally-weighted components, standardized to a z-score. The seven components are industrial confidence, consumer confidence, capacity utilization, unemployment, producer prices, credit spreads, and earnings revision ratio. The Global Wave model covers over 30 countries that are GDP-weighted, and the final Global Wave indicator is then converted into an index that oscillates around a threshold of 50.

Returns of the USD during global recessionary periods

| Recessionary period | USD returns over the period |

| 31 Oct 1990 to 30 Apr 1991 | +9,9% |

| 31 Oct 1991 to 31 Mar 1992 | -0,3% |

| 31 Aug 1992 to 31 Jan 1993 | +17,2% |

| 31 Aug 1993 to 31 Dec 1993 | +3.1% |

| 31 Mar 1996 to 31 May 1996 | +1,5% |

| 31 Oct 1998 to 31 Jan 1999 | +2,5% |

| 30 Apr 2001 to 31 Jan 2002 | +3,8% |

| 31 Aug 2002 to 30 Nov 2002 | -0,5% |

| 31 Oct 2008 to 31 May 2009 | -7,5% |

| 31 Oct 2011 to 29 Feb 2012 | +3,4% |

| 30 Jun 2012 to 31 Oct 2012 | -2,1% |

| 31 Jun 2013 to 31 Jul 2013 | -0,2% |

| 31 Jan 2015 to 31 Mar 2016 | -0,2% |

| 30 Oct 2019 to 31 Dec 2019 | -1,9% |

| 31 Mar 2020 to 31 Jul 2020 | -5,8% |

| Average | +1,5% |

Source: Schroders, Economics Group, February 2023. Recession is defined as the Global Wave falling below 50, and a declining one-month change in the indicator. 607399

How about periods when the US is in recession, but other economies have yet to catch up? Here, we analyze the average returns of the dollar index when the US is in recession but the rest of the world is not, and when both the US and the rest of the world are in a recession.

USD performs very differently based on the cycle

| Average returns (annualised) | |

| If US is in recession, but Global ex-US not | -5,5% |

| If both US and Global ex-US are in recession | +4,6% |

Source: Schroders, Economics Group, February 2023. Recession is defined as the Global Wave falling below 50, and a declining one-month change in the indicator. 607399.

Here we can identify two things:

What role did the US dollar play in portfolios, and how can we think of it going forward?

In 2022, both equity and bond markets sold off. In a straightforward 60/40 portfolio, there were little to no diversification benefits from owning bonds, because of monetary policy normalization through central bank rate hikes.

In the entire investment universe, only a small handful of asset classes provided positive returns over the year, and the US dollar was one of them. Investors used the US dollar as the ultimate safe haven. In currency baskets, the US dollar practically trumped all others and investors were hard-pressed to find any alternatives.

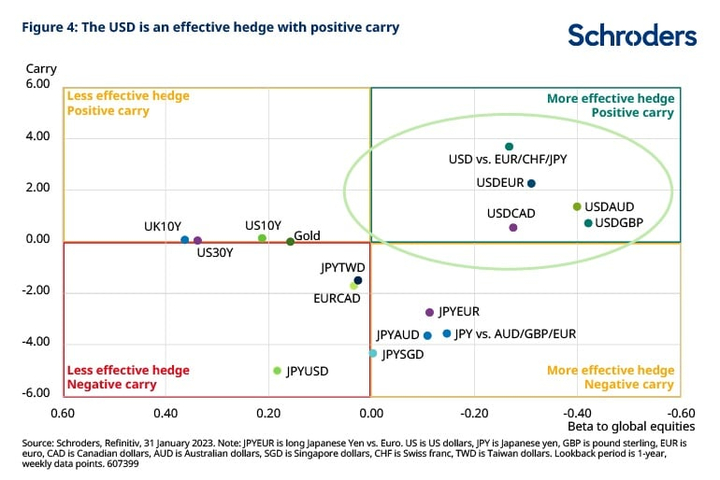

Our hedge monitor, which allows investors to consider the efficiency of a hedge against the cost of holding it, supports this picture. The US dollar currency pairs (where an investor goes long on USD and short on another currency) currently fare better on the hedge monitor than assets that were traditionally viewed as a hedge, such as government bonds and gold.

We think that the dollar smile theory remains valid in this new regime. As our economists are forecasting the US economy to enter a recession before the rest of the world later in the year, the US dollar may be subdued until a time comes when global economies follow suit. In situations where a US recession precedes the rest of the world, we believe other drivers such as rates trajectory, the safe-haven status and - more importantly - liquidity are better indicators to focus on.

When the rest of the world finally follows the US into a recession, what returns might we expect from the US dollar? We analyzed the average returns of the US dollar index in a global recession and found that the most consistent strengthening of the dollar was achieved during scenarios when the US economy outperformed others - the US outperformed the rest of the world more frequently.

The USD displays more consistent returns when the US economy outperforms the rest of the world

| In a global recession | Average returns (annualised) | Frequency of gains | Frequency of losses |

| If US economy > Global ex-US | +6,8% | 61.5% | 38.5% |

| If US economy < Global ex-US | +3,0% | 51.4% | 48.6% |

Source: Schroders, Economics Group, February 2023. Economic performance is determined on relative Global Wave indicators (US vs. Global ex-US) 607399.

Conclusion

Everything is relative. The growth prospects of the US relative to the rest of the world are crucial to the US dollar’s outperformance. Right now, our economic models point to a global slowdown, with the US market expected to underperform its peers. As a result, we believe we should focus on drivers such as monetary policy and liquidity conditions when analyzing the potential benefits of investing in the US dollar.