European fund flows 2022: contrasts and turning points

30 JAN, 2023

By Philip Kalus from Accelerando Associates

2022 was a remarkable year indeed. Some even call it a year for the history books. Major economic and geopolitical headwinds resulted in global equities and fixed income falling in tandem. Yet, 2022 was far more heterogeneous in active versus passive, asset manager and fund category flows than widely assumed.

All in all, European fund flows dropped from the 2021 record high of EUR 825 billion to EUR 131 billion of net outflows in 2022. Assets in OE funds and ETFs fell by 17%. Active funds booked painful outflows amounting to EUR 238 billion, while passive funds garnered EUR 107 billion of inflows.

However, not all passive providers made it to heaven, nor did all active managers go through hell. In fact, November and December could have well been the months the active industry has been waiting for, with a sound return to net positive flows, also in relative terms versus passive funds.

In spite of the strong passive flow numbers in 2022 and the omnipresent passive talk all over, active funds still had a market share of 76% as of YE 2022. Passive funds accounted for 24%, including 12% ETFs.

In terms of broad fund categories, multi asset was by far the best-selling fund category in Europe in 2022, however with a relatively moderate sum of inflows at EUR 4 billion. Given the extremely challenging environment in 2022, it may not be too surprising that the category took the lead, but at the same time, many multi asset managers were rather wrong-footed by simultaneous falls in fixed income and equities last year, raising a lively debate about the multi asset case in 2023, in particular about more static 60/40 portfolios.

Fixed income interest from the buy-side started to emerge again in Q3, resulting in very notable inflows throughout Q4. Just in December, fixed income funds booked net inflows of EUR 22.6 billion. Nonetheless, fixed income finished the year with net outflows of EUR 84.7 billion. In this context, according to the December 2022 edition of Bank of America’s monthly fund manager survey, investors are overweight bonds relative to other asset classes in their portfolios for the first time since 2009.

Within equity fund categories, Global Large-Cap Blend Equity continued its extraordinary winning run from 2021 and 2020 with 2022 net inflows amounting to EUR 59 billion, followed by US Large-Cap Blend Equity (EUR 21.6 billion), Global Equity Income (EUR 20.8 billion), Sector Equity Ecology (EUR 9.5 billion) and Sector Equity Infrastructure (EUR 8.9 billion). In particular, the latter should be emphasised given the relatively low fund category size. Nevertheless, overall equity fund flows finished the year with a net negative number of EUR 28 billion, in spite of December inflows worth EUR 9.7 billion.

Looking at asset managers, combining OE funds and ETFs, BlackRock took the best-selling crown again posting EUR 27 billion in net inflows. Yet, BlackRock was prominently positioned in the best-selling and worst-selling provider tables. Its ETF franchise garnered EUR 43.5 billion while its OE range suffered net outflows of EUR 16 billion. Mercer GI impressively ranked 2nd in 2022, collecting EUR 17.8 billion, up from rank #17 in 2021 (EUR 10.8 billion). Although net inflows, in comparison to 2021, almost halved for Vanguard in 2022, Vanguard scored 2nd, up from #7 in 2021.

PIMCO was the worst-selling asset manager with net outflows of EUR 21.8 billion, although with an improving picture in Q4, particularly throughout November and December. Insight IM scored as the second worst-seller with outflows of EUR 17 billion, followed by BlackRock’s OE funds (EUR -16.3 billion).

In between the top 20 best and worst-selling asset managers, 47 asset managers posted net inflows larger than EUR 1 billion, 81 garnered more than EUR 500 million and 232 asset managers more than EUR 100 million. On the net negative side, 73 managers experienced outflows larger than EUR 1 billion, 116 lost more than EUR 500 million and 205 managers experienced outflows larger than EUR 100 million.

All in all, many asset managers managed to post rather resilient flow numbers, particularly in the context of the 2022 environment and also 2021 record flows.

When we look at managers with inflows and those with outflows, segmenting them into different size buckets, a fascinating picture emerges. While inflows were mostly evenly split between boutiques, small, medium and large asset managers (measured on OE and ETF assets), outflows mainly occurred in the segment of medium sized asset managers, while large sized managers proved to be most resilient.

In terms of best-selling funds passive funds, including ETFs, dominated - albeit with an astonishingly broad spectrum of respective asset classes and fund categories.

2022 was also a year of remarkable contrasts for Europe's largest ETF providers. iShares took the lead with inflows worth EUR 44.2 billion, ahead of Vanguard and Invesco. On the other side of the spectrum, DWS's Xtrackers, Europe’s 3rd largest ETF provider experienced the biggest outflows at EUR 3.9 billion.

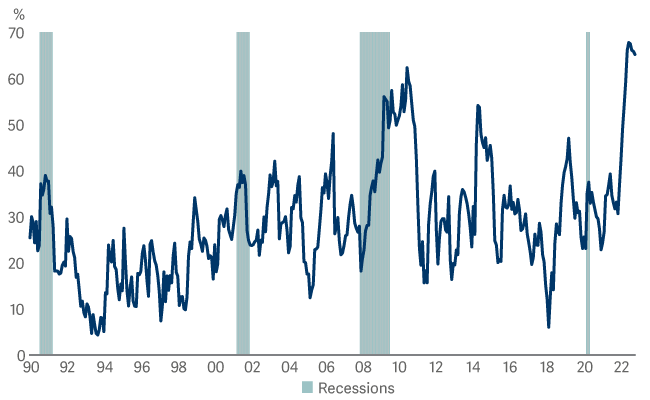

As per prospectus definitions, sustainable funds attracted inflows of EUR 162 billion, while non-sustainable funds suffered outflows of EUR 288 billion. However, considering SFDR classifications, the picture changed. After a rather glorious 2021, fund flows into article 8 funds turned sour and article 8 funds posted monthly net outflows from February to October. At the same time, article 9 funds garnered net inflows in each month. Yet, just in Q4 2022, article 9 assets shrank by 40%. Following tightened EU rules, 348 funds were reclassified from article 9 to article 8 last year and we expect more to come.

We are certainly not in the position to forecast markets nor economic numbers, but 2023 looks likely to provide an environment in which active stock and bond picking - on the long as well as on the short side - can provide clear advantages versus cheap beta exposure. In consequence, active may well return to the winning side.