The real problem in reaching net zero carbon

3 JUN, 2021

By Roland Rott

The last twelve or so months have seen a flurry of corporate commitments and a huge ramp-up in ambition to reduce carbon emissions. It has been estimated that almost one quarter of global CO2 emissions and more than half of global GDP were covered by Net Zero commitments by June 2020. However, the gap between ambition and reality can often be very significant, for example, due to a lack of standards.

Global warming and the role of GHG emissions is a well-established fact. In response, carbon reduction efforts in the private sector have been made for decades. Such carbon reductions were reported, for example, as part of energy efficiency programmes. The goalposts have shifted in recent years due to the urgency of the climate crisis. Global warming has gained worldwide attention not least due to the Paris Agreement in 2015. Countries are now strengthening their commitments through setting Net Zero targets. Six countries have enshrined Net Zero reduction in law, five countries and the EU have proposed legislation, fourteen countries have targets in policy documents, while many more are discussing Net Zero targets.

In the private sector, carbon reduction has since become a strategic objective for many businesses and has evolved well beyond the isolated environmental targets of the past. Today, carbon reduction is a priority for many companies and their stakeholders - including shareholders and creditors.

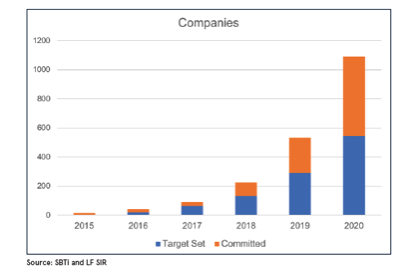

Number of companies per year with science-based targets (2015-2020)

Yet, the voluntary nature of most efforts means that targets can be set through arbitrary parameters. What is needed to solve the climate crisis are commitments to reduce GHG emissions that are aligned with scientific global warming scenarios. A study of companies with science-based targets shows that these companies reduce emissions at far greater rates relative to emissions trends in the wider global economy.

Investors need to hold companies accountable

Institutional investors will play a pivotal role in tracking carbon reduction progress. At present, there is no formal enforcement mechanism to ensure that companies deliver on carbon reduction. Target setting and reporting of carbon data is largely voluntary. There is no sanction for a lack of success.

Given the short-termism inherent in financial markets, investors should proceed carefully when assessing companies’ long-term climate goals. CEO turnover reached a record high in 2018, with less than 1-in-5 CEOs remaining in their position for 10 or more years.

Put differently, four out of five CEOs are not likely to be at their company long-enough to see through their carbon targets to 2030, let alone 2050. This issue is compounded by the lack of verification and accuracy in reported carbon data. Investors need to assess carbon reduction targets with at least the same care and rigour that they do financial targets.

Therefore, investors should play an active role in ensuring that companies set and deliver carbon reduction targets. Investors are well-equipped to perform this task. For example, carbon reduction requires capex and questions about capex are typical of meetings with corporate management. Investors increasingly have expertise in integrating environmental data within their investment process. Additional guidance for companies on progress reporting is expected to be released in 2021 by the SBTi (Science-based Targets Initiative) and CDP (Carbon Disclosure Project).

The SBTi is currently working on a process to track companies’ progress on their targets. These are positive developments that can help investors overcome some of the challenges of carbon reporting. However, as with financial targets, investors will still need to frequently monitor progress. Carbon footprinting is not sufficient as headline emissions numbers will only give a partial view on what is going on and does not capture the corporate planning for reaching the next milestone. The latter requires ongoing assessment of material developments as well as a clear understanding of the business model.

Many asset management firms maintain close interaction and engagement with company management. Engagement can also take the form of collaborations like Climate Action 100+. Engagement action could comprise the proposal or support of shareholder resolutions, for example, requesting major oil companies to take the first step and set more stringent targets considering all emission scopes in order to reach Net Zero by 2050. Investors that engage with company management act as enforcement agents in the delivery of carbon reduction.