What are the best ETFs in LATAM?

16 MAR, 2023

By Constanza Ramos

Although investing in Latin America may seem risky, there are more and more mutual fund options for investing in this region. In this article, we focus on the top ETFs for investing in Latin America over the past three years, i.e. the exchange-traded funds that have achieved the best returns in this time period, according to Morningstar data.

When it comes to investing in Latin America through mutual funds, Mexico stands out as the most prominent country. This country, which ranks 10th in population globally, is also the one with the most valuable Latin American country brand, with an estimated brand value of $771 billion, according to the Brand Finance Nation Brands 2022 report. Globally, the United States has the most valuable country brand followed by China.

The best ETFs of the last 3 years in Latin America

Within the three best ETFs that invest in Latin America in euros, we can find the following funds: iShares VII PLC - iShares MSCI Mexico Capped ETF USD Acc, HSBC MSCI Mexico Capped UCITS ETF and Xtrackers MSCI Mexico UCITS ETF 1C.

| ETF | ISIN | 3-year returns | Return YTD |

|---|---|---|---|

| HSBC MSCI Mexico Capped UCITS ETF (EUR) | H4ZS | IE00B3QMYK80 | 22,95% | 13,56% |

| iShares VII PLC - iShares MSCI Mexico Capped ETF USD Acc (EUR) | CSMXCP | IE00B5WHFQ43 | 22,89% | 13,33% |

| Xtrackers MSCI Mexico UCITS ETF 1C (EUR) | D5BId | LU0476289466 | 22,63 | 14,55% |

Source: data obtained from Morningstar as of March 14, 2023. 3-year annualized return.

HSBC MSCI Mexico Capped UCITS ETF (EUR)

The ETF's objective is to match the performance of the MSCI Mexico Capped index as closely as possible. The HSBC MSCI Mexico Capped UCITS ETF will invest in or seek to gain exposure to stocks of companies that are part of the index.

The index is composed of the most important companies listed on the Mexican stock exchange, as established by the provider. The management of this ETF is passive and its objective is to invest in shares of companies that are in the index, in general, in the same proportion as in the index. However, there are circumstances in which the exchange-traded fund cannot invest in all the constituents of the index. In such cases, the fund may gain exposure through other investments such as certificates of deposit, derivatives, or funds. Specifically, the fund may invest up to 35% of its assets in securities of a single issuer in exceptional market conditions, up to 10% in total return swaps, and up to 10% in other funds, including HSBC funds.

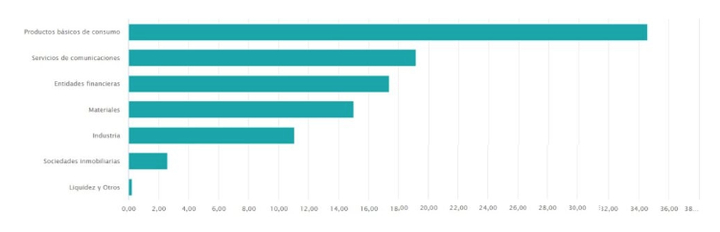

Sector allocation (% of economic exposure) of HSBC MSCI Mexico Capped UCITS ETF

Source: HSBC Asset Management as of February 28, 2023.

iShares VII PLC – iShares MSCI Mexico Capped ETF USD Acc (EUR)

The exchange-traded fund, managed by BlackRock, seeks to mimic the performance of an index comprised of Mexican companies. What are the reasons BlackRock believes investing in this fund is a good idea? In summary, three points stand out: the opportunity to gain exposure to a wide variety of companies in Mexico, the ability to invest directly in Mexican companies, and the possibility of gaining exposure to a single country.

In the following table, you can see which are the five companies with the highest weight within the portfolio of the iShares VII PLC - iShares MSCI Mexico Capped ETF:

| Compañía | Sector | Clase de activo | Peso |

|---|---|---|---|

| AMERICA MOVIL L | Comunication | Equities | 16,51% |

| GPO FINANCE BANORTE | Financial | Renta variable | 13,10% |

| WALMART DE MEXICO V | Consumer commodities | Equities | 11,95% |

| MEXICAN ECONOMIC DEVELOPMENT | Consumer commodities | Equities | 10,39% |

| GROUP MEXICO B | Materials | Equities | 8,71% |

Fuente: BlackRock a 3 de marzo de 2023.

Xtrackers MSCI Mexico UCITS ETF 1C (EUR)

Although inflation remains a problem in Mexico, there are signs of improvement: the headline inflation rate has declined in 2022 and core inflation has stabilized. In addition, the manufacturing industry has registered growth that has surpassed pre-pandemic levels in the past year. Also, the labor force has increased above pre-pandemic levels throughout 2022. These favorable trends in employment and real incomes of the population point to positive consumption going forward.

The Xtrackers MSCI Mexico UCITS ETF is an interesting option for investing in Mexican equities. This exchange-traded fund tracks the performance of the MSCI Mexico TRN index, which represents the performance of large- and mid-cap publicly traded Mexican companies. The index covers about 85% of the available market capitalization of stocks, adjusted for free float, and is reviewed quarterly.

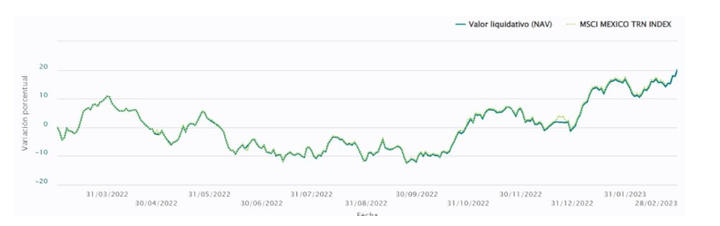

Performance of Xtrackers MSCI Mexico UCITS ETF 1C (EUR) over the last year

Source: DWS as of March 3, 2023. Yield calculated between 03/03/2022 - 03/03/2023.