Analysts predict an improvement in most sectors in the next 12 months, according to Fidelity

6 MAR, 2024

By Jose Luis Palmer from RankiaPro Europe

The last two years have been shaped by fear of the possible magnitude of the first sustained economic slowdown since 2008. However, according to the Annual Fidelity Analysts Survey1, conditions are beginning to arise for companies to look towards expansion and Japan is shaping up to be the economic beacon of the world in 2024.

Fidelity analysts hold more than 20,000 meetings with companies a year. In other words, every working day one of their analysts is talking to a company's management every 10 minutes. Each year, the company surveys its analysts around the world to probe their knowledge of the companies and sectors they cover. Together, these responses provide a revealing picture of the performance of different regions and sectors one year ahead, and beyond.

For the first time since the pandemic, the majority of Fidelity analysts believe that companies' cost inflation will decrease over the next year.

According to our North American analysts, no one is talking about inflation anymore. Wages were the last complication, but these seem to be normalizing quickly as well.

Gita Bal, global head of fixed income analysis at Fidelity

Chart 1: For the first time since the pandemic, the majority of Fidelity analysts believe that companies' cost inflation will decrease over the next year

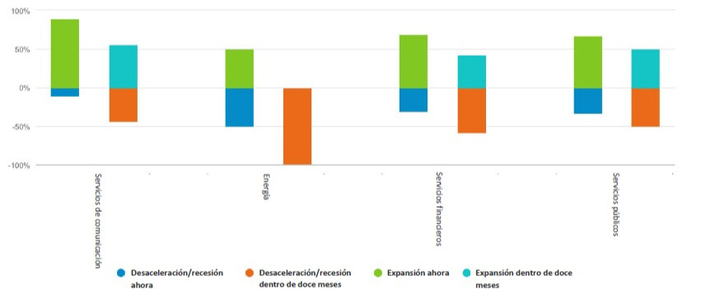

In most sectors, the analysts who cover them expect the sector to improve this year; in this sense, the percentage who say their sector is in expansion goes from 52% currently to 61% who expect that to be the situation in twelve months.

Chart 2: In which phase of the cycle will the sectors be in 12 months?

However, there are a handful of sectors where the responses suggest that conditions could worsen as the year progresses. Analysts covering North American oil and gas companies argue that the falling commodity prices is a drag on the energy sector. The financial sector will also experience the other side of the interest rate drop.

Chart 3: Cycle phase - under threat

A year full of elections around the world exacerbates current geopolitical concerns. However, meetings with management teams have been surprisingly positive regarding the outlook for 2024, despite the immediate risks looming on the horizon. However, the energy and financial services sectors have scored lower, according to our analysts. The fall in commodity prices and the prospect of interest rate cuts are clearly influencing sentiment in these areas.

Gita Bal, global head of fixed income analysis at Fidelity

Optimism surges as Japan's economy reflates

Japan is set to become the world's economic beacon in 2024. Revenue and profit growth expectations in 2024 in Japan are higher than in any other region. Analysts covering Japan are also the most optimistic regarding the expansion of profit margins.

Japan leads in terms of business investment expectations, return on capital, ability to pass costs onto consumers, and whether its companies will be in an expansion phase within the cycle by this time next year.

Chart 4: 88% of Japan's analysts expect their sectors to be in an expansion phase within 12 months

This optimism contrasts with the higher level of caution from our previous annual survey, conducted at the end of 2022. For example, nearly a third of Japan's analysts then indicated that the CEOs of the companies they covered expected zero profit growth in 2023, the most pessimistic region excluding EMEA/Latin America. In the current survey, all of Japan's analysts state that CEOs expect profits to grow.

There is a simple explanation for much of this optimism. The Japanese economy has finally left behind more than two decades of recessions and stagnation and there are encouraging signs of widespread price increases. Although inflation has been a major headache for much of the world in recent years, it is now a welcome problem in Japan.

Gita Bal, Global Head of Fixed Income Analysis at Fidelity

Grey Swans?

A large number of elections are going to be held this year 2024 and the largest number of people in history will have to go to the polls, which raises the risk of disturbances. However, one of the most surprising conclusions of the survey is that the majority of analysts (65%) indicate that the companies they cover do not mention the elections at all.

Those that mentioned the elections, are divided when it comes to talking about the risk associated with the elections. It all largely comes down to specific scenarios in specific sectors.

Only 28% of all Fidelity analysts claim that the current geopolitical context is curtailing investment plans, and this is the lowest percentage of analysts who claim this since we started asking this question in 2017.

Chart 5: How will geopolitics affect strategic investment plans in the companies you cover?

The end of the zero interest rates era was always going to cause tensions. We are already in a period where companies are tightening their belts, demand is under more pressure and price-setting power is decreasing, but this year's survey offers clear signals that, regardless of how the slowdown materializes, for most companies the system will reboot and the next phase will boost them, rather than weigh them down.

Gita Bal, global head of fixed income analysis at Fidelity

1 The Fidelity Analyst Survey was conducted in December 2023 and received responses from 137 analysts around the world.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe