Buybacks fell 14% in 2023 while dividends rose to new record

25 APR, 2024

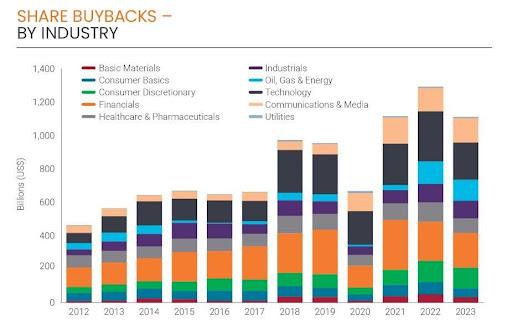

- Global share buybacks fell to $1.11 trillion in 2023 – down by $181 billion or 14.0%.

- Dividend growth continued even as buybacks fell.

- US buybacks fell faster than the wider world, especially amongst US technology companies.

- UK buybacks fell only 2.6% as lower oil company spending was offset by banks and others.

- European buybacks were up in 2023, reaching a record in Italy, Spain, Norway and Belgium, but they fell sharply in Switzerland.

- Cuts in buybacks among Australian banks brought Asia Pacific ex-Japan’s total down.

- Sector patterns were heavily influenced by the US, but globally, telecoms, banks and vehicle manufacturers made the most significant increases in 2023.

Despite global dividends climbing to a new record in 2023, companies spent much less buying back their own shares, according to Janus Henderson’s latest annual Share Buyback study. The $1.11 trillion total was $181 billion lower than in 2022, a significant decline of 14.0% year-on-year and large enough to take 2023’s buybacks below the 2021 total, too. However, the decline comes from a very high base and leaves the annual total still well above pre-pandemic levels.

Us companies bought back the most shares in 2023

US companies were the biggest buyers of their own shares, totalling $773 billion in 2023 and accounting for $7 in every $10 globally. However, they also made a disproportionately large reduction; US buybacks fell by $159 billion last year, down by 17% year-on-year. US technology companies cut back the most, spending $69 billion less than the previous year. Among these, Microsoft and Meta reduced buybacks by almost one third, and Apple by one seventh.

There were also big reductions across much of the US healthcare sector and among financials, though not across the banking sector, where cuts by some banks were more than offset by rises elsewhere. Overall, in the US, the number of companies spending less on share buybacks outnumbered those spending more by 1.8. Nevertheless, the value of buybacks was 1.2x larger than the value of dividends paid by US companies in Janus Henderson’s Global Dividend Index.

Companies in the UK also made significant share repurchases

Outside the US, companies in the UK were the biggest buyers of their own shares, accounting for $1 in every $17 of the global total in 2023. Purchases of $64.2 billion were just 2.6% lower year-on-year and equalled 75% of dividends paid. Shell is the largest non-US buyer of its own shares, (accounting for almost a quarter of the UK total) but it cut quite sharply in 2023, as did BP, BAT, Lloyds and a number of other large UK blue chip companies. Significant increases by HSBC, Barclays and others almost offset these cuts, meaning only a small overall decline for the year.

Appetite for increased buybacks amongst European companies is growing

Buybacks are becoming more generous in Europe. Across the region, the total paid rose 2.9% to $146 billion in 2023 (compared to a 20% underlying increase in dividends for the same period). There was considerable variation from one country to another: buybacks reached a record level in Italy (driven by Unicredit and Stellantis), Spain (driven by Santander, Iberdrola and Telefonica), Norway (Equinor) and Belgium (AB-Inbev and KBC), though France, Switzerland and the Netherlands saw the largest value of shares repurchased. The biggest decline was in Switzerland where the majority of companies reduced buybacks; Nestle made the largest impact, almost halving its programme to $5.8 billion. Roughly the same number of European companies increased buybacks in 2023 as reduced them, though very strong dividend growth in 2023 meant buybacks grew less than dividends and they fell as a proportion of shareholder returns to 48% of dividends paid, down from 55% in 2022.

Share buybacks remain less prominent in Asia Pacific

Companies in Asia Pacific ex-Japan are the least likely to conduct buyback programmes. The big year-on-year reduction (-40.0%) mainly reflects lower share buybacks by Australia’s large banks, more than offsetting increases in Hong Kong and South Korea.

Data from Japan lags the rest of the world as annual results for 2023/24 have not yet been published. The large increase (+18%) largely reflects activity in the calendar year 2022. A closer look at interim reports suggests that share buybacks are likely to also be lower year-on-year for 2023/24, though this will not be clear until the reporting season has begun in early May.

Across sectors, telecoms, banks and vehicles companies repurchased the most shares

At a sector level, technology, healthcare, and financials saw the biggest reductions, with the largest impact seen amongst US companies. In fact, outside the US, healthcare companies increased their buybacks. Companies in the chemicals, mining and consumer basics sectors, such as tobacco and household products, also cut back on their share repurchases. Globally, telecoms, banks and vehicles companies made the most significant increases.

It is worth noting that buybacks are highly concentrated. Just over half the companies in Janus Henderson’s index of 1,200 companies repurchased shares in 2023, but just 45 of these accounted for half the annual total spent on buying back shares globally.

Many companies use buybacks as a release valve – a way of returning excess capital to shareholders without setting expectations for dividends that might not be sustainable long term. This is especially appropriate in cyclical industries like oil or banking. That flexibility explains why buybacks are more volatile than dividends. It also means there is no real evidence that buybacks are taking over from dividends. Meta, for example, paid its first dividend in 2024. Moreover, the relative size of buybacks when compared to dividends shrank in every region except Japan and emerging markets (where there are data lags). The dividend is clearly still well supported by corporates as a means of returning capital to shareholders.

Higher interest rates have played a role in the decline of share buybacks – when debt is cheap it makes sense for companies to borrow more (as long as they borrow prudently) and use the proceeds to retire expensive equity capital. With rates at multi-year highs, that calculation is more nuanced; some companies are paying down debt at this point in the cycle, using cash that might otherwise have gone to buybacks, but very few are cutting dividends as our forthcoming Global Dividend Index will show.

It’s tempting to extrapolate a new trend of decline for buybacks. But one down year from multi-year highs is not evidence that this is happening. It is all about companies finding the appropriate balance between capital expenditure, their financing needs and shareholder returns via dividends, buybacks or both.

Ben Lofthouse, Head of Global Equity Income at Janus Henderson