China continues with targeted easing steps

27 FEB, 2024

By Christoph Siepmann

Christoph Siepmann, Senior Economist at Generali AM (part of Generali Investments ecosystem)

Due to the Chinese New Year vacations (Feb. 9th to Feb. 24th), macroeconomic data have been scarce. However, two pieces stand out. First, the PBOC cut its 5-year Loan Prime Rate (LPR) by a record 25 bps to 3.95%. At the same time, it left the 1-year LPR unchanged at 3.45%. The 5-year LPR serves as a reference for mortgage rates; thus, the cut is clearly intended to support the housing market. The rate had already fallen close to 200 bps since late 2021, yet housing sales have stayed weak due to demography, slowing urbanization and mistrust in developers’ ability to guarantee the completion of pre-sold homes. Hence, the rate cut alone will not do the ”trick” but in combination with efforts to strengthen developers financing (the long-awaited “whitelist”) we expect the cut to help to mitigate downward pressures but see no fundamental turn-around.

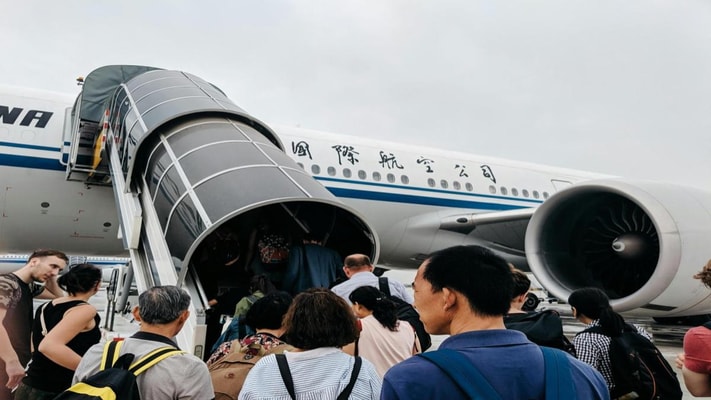

Secondly, New Year holiday travel reached new highs after Covid, but per capita spending seems to have slowed. Thus, private consumption looks supportive but will not alone manage to accelerate China’s growth. It also suggests that inflation development could stay soft. China’s National People's Congress session begins its annual meeting on March 5. We expect more supportive measures but there is no indication of a major stimulus packet coming.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe