Earth Day: Investment awareness to protect the planet

22 APR, 2024

By Jose Luis Palmer from RankiaPro Europe

Earth Day is celebrated every 22 April, an initiative that has already been joined by almost 200 countries around the world. It is a commemoration that aims to raise environmental awareness among citizens, but also among institutions. This year's slogan is 'Planet vs. Plastics', as plastic consumption and the waste generated by it is a growing problem in our society, with a tremendous impact on the environment.

In March 2022, 175 countries agreed to create a landmark global anti-plastic agreement, with the aim of fighting against pollution by 1 December 2024. However, progress has been slow and only two crucial sessions remain before the treaty enters into force in 2025. Will an effective agreement be reached?

On the occasion of this day, under the slogan "Planet versus Plastics", several experts from the asset management industry explain the need to protect the environment and the natural resources we have, and how this affects our investments.

The Plastic Planet: Towards a Global Agreement on Pollution

Frédéric Yo, ESG analyst for La Française AM

In March 2022, 175 countries reached an historic agreement to create a Global Plastic Treaty by 1 December 2024, a legally binding global treaty to combat plastic pollution worldwide. However, progress in the subsequent intergovernmental negotiating committees (INCs) has been slow. With only two INC sessions remaining in 2024 before the treaty enters into force in mid-2025, the outcome of the next session, to be held from 23-29 April, will be critical to shaping an effective treaty. As our planet faces the devastating consequences of plastic pollution, it is imperative that we act quickly.

Plastic, an integral part of modern life, offers numerous benefits, but its uncontrolled proliferation poses major threats. From single-use plastics choking our oceans to microplastics infiltrating our food chain, the consequences are undeniable. A staggering 50% of all plastics manufactured have been produced since 2000, and projections indicate that current production will double by 2050. The majority of plastic waste, a shocking 76%, ends up as environmental waste, and a substantial part of it pollutes our oceans, totalling around 10 million tonnes per year. This pollution endangers not only ecosystems and wildlife, but also human health through the release of harmful chemicals and its negative contribution to climate change.

The plastics treaty represents an unprecedented opportunity to manage plastic pollution, but its successful enactment depends on decisive action, global cooperation and a shared commitment to safeguard our planet for future generations. Governments will need to implement key regulations to curb plastic use, strengthen recycling infrastructures and hold companies accountable for their environmental impact. Ahead of INC-4, the United Nations Environment Programme (UNEP) released a revised 'Zero Draft' outlining possible policies and actions covering all aspects of the plastics value chain. However, disagreement persists among delegations on the focus of the treaty, with some advocating upstream measures to reduce production, while others, mainly fossil fuel producing countries, prioritise waste management, due to economic considerations.

The investment sector can influence the outcome of the treaty through effective commitments, both at political and business level. It is estimated that alternatives to plastic will reach a market size of more than $9 billion by 2027, with an annual growth rate of 16.8%.

Regardless of the final content of the agreement, its consequences will be profound, especially for the private sector, as most activities depend to varying degrees on plastics. One study found that more than half of the world's disposable plastic items can be attributed to the actions of just 20 companies, almost all of them petrochemical companies. Pending a legally binding treaty, it is important that companies take responsibility for their products and lead the fight against pollution. For plastics manufacturers, the adoption of sustainable alternatives such as bioplastics, derived from renewable resources, represents a promising pathway to reducing the carbon footprint. Although they currently account for less than 1% of plastics production, bioplastics, a greener alternative, are poised for significant growth. For consumer-oriented companies, redesigning products to encourage reuse could significantly reduce plastic waste. Research indicates that a 10% increase in reuse could halve the amount of plastics polluting the oceans. It is also up to consumers to adopt the right behaviour and make the right choices. On 22 April, Earth Day 2024, the slogan 'Planet Against Plastics' reminds us that society as a whole can contribute to solutions to plastic pollution.

How resource scarcity, geopolitics and globalisation will affect your investments

Reto Cueni, Chief Economist at Vontobel

Resources are key drivers of geopolitics. Access to resources defines a nation's ability to survive, maintain or increase its standard of living and limits its sphere of geopolitical influence. Resources and their price are intimately linked to investment.

Why should investors worry about resource scarcity and geopolitics?

Global demand for raw material extraction seems, if anything, to be growing throughout the century. Competition for resources leads to scarcity, and population growth is a key factor. Scarcity leads to price pressures that can radically affect global investment. Resources, and their price, are at the heart of investment. Investing for the future therefore requires an understanding of the world we operate in today and will inherit tomorrow. Resources literally shape that world.

Understanding the hierarchy of resources

Level 1: Vital resources

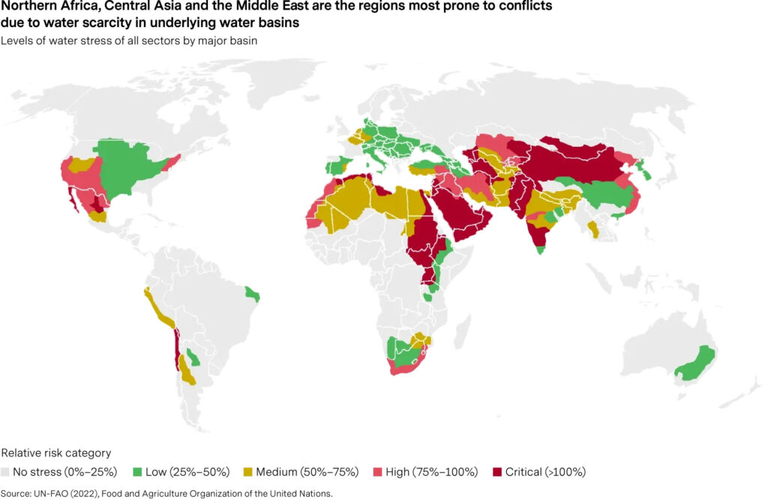

A shortage of the set of resources that a population needs to survive immediately triggers social unrest and geopolitical action. This block usually includes air, water, food and (heated/cooled) shelter (including some form of energy).

Level 2: Resources for economic security and prosperity

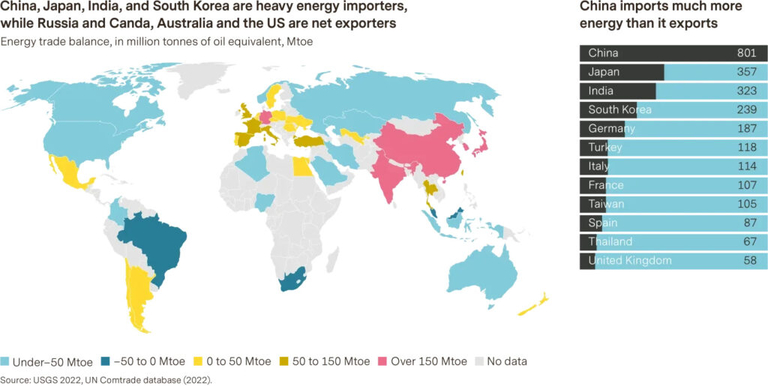

Shortages of this second set of resources, those that help countries keep their economies functioning and prospering, often trigger social unrest and geopolitical action by government. However, the response time ranges from immediate, in the case of an economic security emergency, to protracted, in the case of slowly withering economic prosperity.

Level 3: Resources for geopolitical aspirations

Resource scarcity that threatens the geopolitical aspirations of leaders and populations can trigger social unrest and harsh governmental measures, but response time varies from national security emergencies to long-term, slowly evolving strategic power plays, where response time tends to be gradual.

The stakes in deforestation

Sarah Woodfield, active property manager at Schroders

By 2023, official Brazilian government statistics revealed a 43% increase in deforestation rates in one of the world's most sensitive biomes. Home to rare and endangered species such as the giant anteater, the Brazilian three-banded armadillo and the maned wolf, its territory is increasingly being encroached upon to produce soya and raise cattle. We are not talking about the Amazon rainforest, but the Brazilian Cerrado, a vast savannah, sometimes called the subterranean forest, which is home to about 5% of the world's animals.

Forests are home to more than 80% of all terrestrial species of animals, plants and insects. Protecting this biodiversity is crucial to reversing nature loss and combating climate change. This makes deforestation a critical issue that must be addressed to help achieve global climate goals and mitigate investment-related risks.

And it is precisely from deforestation that a number of risks to our clients' investments arise, including regulatory, operational and supply chain risks. To address this issue, in 2021 we committed to make every effort to eliminate deforestation activities, specifically those driven by forest risk agricultural products in all of our investment portfolios and financing activities by 2025.

As active owners, it is essential that we are transparent about our actions and use our voice to encourage the companies we invest in to accelerate action towards zero deforestation. In 2023, our work to date was recognised in the annual Forest 500 report, where we were the number one financial institution for action on deforestation for the second year in a row.

Engagement outlook

As part of the steps to deliver on our commitment, in 2023 we engaged with 293 companies that we identified as our highest risk holdings. Through these contacts we have identified several areas of weakness in company practices where we believe further action is needed to end deforestation.

- Traceability: Many companies rely on third-party certification to address deforestation risk, without investing in supply chain traceability and third-party assurance that provides robust verification of deforestation and conversion-free raw materials. This puts these companies at risk of having an incomplete view of their supply chain exposure.

- Disruption: Poor visibility of supply chains makes it difficult for many companies to comply with upcoming regulations in consumer markets. For example, the EU regulation on deforestation will come into force in 2025, and companies that fail to comply will face fines of up to 4% of EU turnover. This increases the financial and investment risk for companies exposed to forest risk commodities in their supply chain.

- Collaboration: Smallholder farmers will need more support in the transition to deforestation-free supply chains. Collaboration between policy makers, investors and agricultural representatives is urgently needed to establish incentive structures that enable smallholder farmers to maintain their livelihoods while transitioning to regenerative and sustainable agricultural practices.

- Soy: The risks associated with soy are greatly underestimated. The demand for soy-based feed continues to grow, as does the associated risk of deforestation. Lack of consumer demand for deforestation-free soya may incentivise unsustainable land conversion practices in ecosystems such as the Brazilian Cerrado.

- Human rights: Companies must take more meaningful steps to integrate human rights issues, such as land tenure and indigenous rights, into their management of deforestation risk. Actions such as incorporating human rights impact assessments into deforestation audit programmes and increasing transparency around credible grievance mechanisms will help prevent and mitigate further human rights impacts.

Conclusion

As forest biomes around the world approach potentially irreversible tipping points of ecosystem decline, we know that more needs to be done to protect our investments and the planet. We will monitor the achievements and delivery of our commitments, making adjustments as necessary to meet our targets.