Investing in the era of artificial intelligence

14 FEB, 2024

By DWS

Author: Björn Jesch, investment director at DWS

The "prompting" is quickly becoming a key skill. Very soon, knowing how to interact with artificial intelligence (AI), and providing it with context and nuances, will be essential for any student or worker. The generative artificial intelligence promises great increases in productivity. Its various uses are already becoming clear in areas such as programming or the synthesis of existing human knowledge of possible relevance to a specific customer question, for example, in business consulting. Large language models (LLM) can also offer a much more natural user interface with specialized applications adapted to the task at hand. The trick is to evaluate their responses with specific objectives.

Let's take the question of how (not) to identify the long-term beneficiaries of AI in the stock market. This is a good example of what AI can do, but also where there are likely to be limitations, at least in the foreseeable future. "It only knows what it has seen and what it has seen enough times to make sense", as an excellent manual for newcomers to the subject says. As we have already said, recent advances in artificial intelligence can be very useful, if used correctly, to enhance human experience, not to replace it. Pattern recognition tends to be of limited use, if rare or unusual problems are encountered. And perhaps most importantly, AI users, both individuals and companies, will take time to reorganize their way of working around the new possibilities opened by AI. For example, a good question about stock beneficiaries could include a reference to Clayton Christensen's thinking about different types of innovation (see our article "Electrification: The Innovator's Dilemma") or ideas about the selection of high-quality values in general (see our article "Quality: guide for value selectors"). However, do not expect it to "understand" the relevant context automatically.

As for identifying the long-term beneficiaries of AI, two elements of context that any experienced human investor knows are:

- Forecasts are extremely delicate for disruptive technologies.

- AI has been a hot topic in recent months, which has raised relative valuations.

Markets adapt. Companies have incentives to tell their investors what they want to hear. Knowing this, one could, for example, use AI to search for companies that have been researching -and boasting- about their transformative potential in the sector for years, instead of focusing on recent conversions or comments during the latest earnings calls. It also helps to pay attention to events beyond the U.S., especially in Asia.

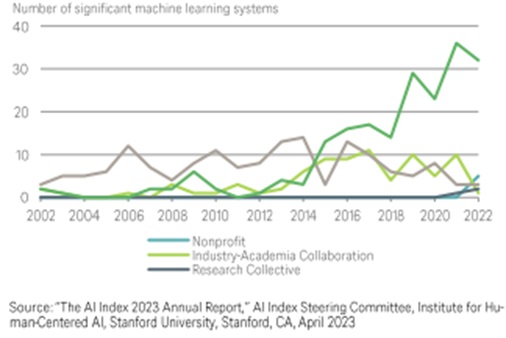

Recent progress has been years in the making. Consider, for example, how far AI has come in chess. In 2017, it was announced that Deep Mind's AlphaZero could defeat the "strongest superhuman chess engine", exclusively by teaching itself, "without learning the established human wisdom about chess strategy." Of course, self-taught AI programs wouldn't work nearly as well if the rules kept changing. However, in many areas, AI is already accelerating scientific discovery and innovation. This includes an increasing proportion of applied research by industry, rather than academia (see the chart), promising easily applicable advances.

Industry, more than academia, takes the lead

"We believe that AI beneficiaries have powerful levers to drive future revenue and profit growth. In our analysis, we place special emphasis on the "moat" -that is, the enduring competitive advantage- around a company's AI product, as well as its growth potential".

Tobias Rommel, senior portfolio manager at DWS

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe