The Japanese yen: US data will be decisive

26 MAR, 2024

By RankiaPro Europe

Author: Claudio Wewel, currency strategist at J. Safra Sarasin Sustainable AM

As expected, the Bank of Japan (BoJ) left both the YCC and the NIRP at its March meeting. This year's shunto wage negotiations will result in the largest wage increase in more than 30 years. However, the central bank's forecasts were surprisingly dovish in tone. We therefore expect a more limited rise in the yen in the short term. Looking ahead, we expect US data to be key for the yen. In particular, disappointing labour market data could push the currency significantly higher.

With the agreement by Japan's largest companies to raise wages by 5.3%, this year's so-called "shunto" spring wage negotiations will yield the strongest wage growth in more than 30 years. After emphasising that it would focus particularly on wage performance, the BoJ finally took the long-awaited decision last Tuesday to abandon its yield curve control (YCC) and negative interest rate policy (NIRP).

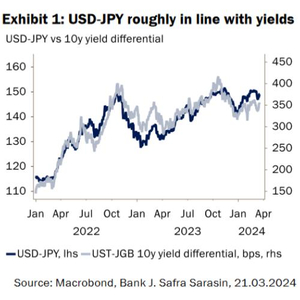

However, markets perceived the Bank of Japan's policy rate hike from -0.1% to 0-0.1% as a moderate move, which was reflected in the immediate reaction of the USD-JPY. While the central bank will end its purchases of equity ETFs and J-REITs and reduce corporate bond purchases, it pledged to maintain accommodative financial conditions. Perhaps most importantly, the BoJ will continue to buy Japanese government bonds, which should contain yield levels and limit short-term rises in the Japanese currency. Given the weakness of growth in Q4 2023, the BoJ also highlighted uncertainties regarding Japan's economic outlook, which is likely to imply a relatively shallow rate hike path. In response, the UST-JGB yield spread has moved again against the yen.

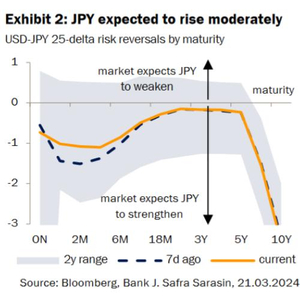

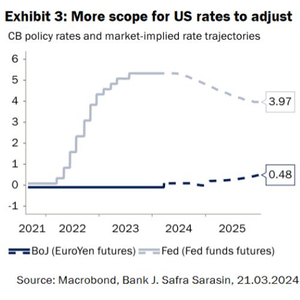

So far, risk reversals indicate that the market is positioned for a moderate strengthening of the yen, although the bias in expectations has become somewhat less pronounced. For the time being, low currency volatility suggests that the yen will remain a funding currency for carry trades. Looking ahead, our focus is on the evolution of global interest rates. In our view, market expectations on the Fed's interest rate path should be key. With the Fed funds rate above 5%, the scope for rate cuts is significant once macroeconomic momentum softens more significantly in the US. And, if history is any guide, rates will be cut over the next few years and rate expectations are likely to react to weaker labour market data in a non-linear fashion, which should push the yen significantly higher.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe