Milan Fashion Week: the time to reflect on how to invest in luxury

19 FEB, 2024

By Teresa Blesa from RankiaPro Europe

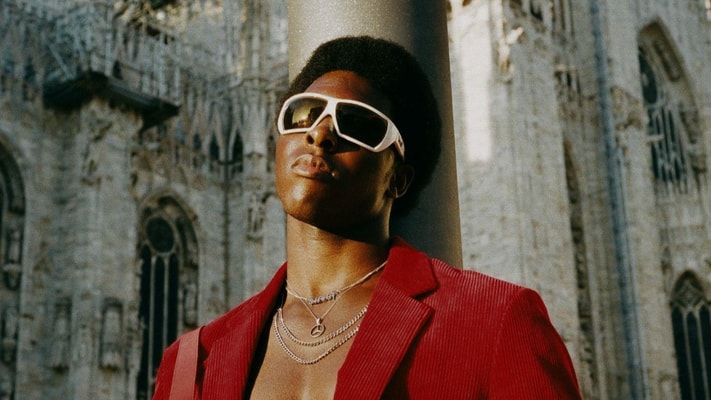

These days, the Milan Fashion Week is being celebrated, an opportunity for designers to showcase their creations: brands like Margiela, Schiaparelli, Chanel or Gautier are just some of the names that will be parading these days. And if there's something all these have in common, it's luxury: the exclusivity of a brand, the reputation of its logo, the lifestyle they evoke, making each maison unique.

For this reason, we decided to take advantage of this event to ask ourselves: what is the correct way to invest in luxury today? To help us answer this question, we have the contribution of two professionals who work for the asset managers who manage the two most well-known luxury investment funds in the world: Pictet Asset Management (Pictet Premium Brands) and GAM (GAM Luxury Brands). Keep reading and discover their opinions.

Desirée Scarabelli, Sales Director, Pictet Asset Management

The results of the fourth quarter of 2023 highlight a contrasting positioning for luxury sector companies. In this context, the most desirable brands, which can rely on a direct distribution channel and a high "pricing power" have achieved better results, such as LVMH, Richemont and LuluLemon, all with strong results in the past quarter and solid prospects for the near future. Disappointment, however, for those companies that are more exposed to the wholesale market, suffering from high levels of inventory and aggressive discount policies such as Remy Cointreau and Burberry.

While the prospects of a recession in the United States seem to be fading and the inflation trend has started to decrease, 2024 offers hopes for more accommodating Central Banks and growing consumer confidence in many parts of the world. Expectations for the travel sector are also favorable globally and the progressive return of Chinese tourists could represent a further positive factor. On the other hand, geopolitical tensions and ongoing wars pose a risk to global stability and could fuel nervousness in the markets. Luxury brands tend to hold up well during various consumption cycles as they show unique know-how, a strong brand reputation, recurring cash flows and solid balance sheets. They also benefit from secular growth factors in the long term that lead to solid sales and profitability parameters. Companies operating in the luxury sector tend to gain market share after periods of crisis and uncertainty.

Asia is still a source of growth, for example Richemont's sales figures in China for this last quarter have increased by 25%, and China could provide a major boost if the support policy took hold. Travel continues, valuations still seem very good and margins are somewhat protected given cost deflation and price stabilization after the strong increases of previous years, and a context of falling rates is generally advantageous for premium brands. US consumption is still quite strong. Certainly, the Luxury market is highly selective, with significant bifurcations in terms of results even for companies operating in the same field such as L'Oreal vs Estee Lauder, LVMH vs Kering. The cause of an outperformance of some companies compared to other direct competitors lies mainly in the comparison on the quality of management both at the corporate level and in distribution. The high-end (Cucinelli, LVMH, Richemont to name a few) is still strong. We also see opportunities in specific US luxury names that are looking at turnarounds with interesting valuations (for example PVH and Ralph Lauren).

Flavio Cereda, Co-Investment Manager Luxury Brands, GAM

Investing in the luxury sector remains interesting. Firstly, the sector represents a solid hedge against inflation, thanks to the good ability to generate cash flows, the solidity of the

balance sheets and the ability to sustain high margins thanks to the prestige of the brands and the basic demand.

Secondly, the luxury sector boasts a proven track record over time and very reliable foundations, even in times of turbulence, as the typical luxury consumer is the last to limit spending

and the first to return. The Covid-19 pandemic has brought unprecedented changes and upheavals to the luxury sector, forcing it to adapt and transform to survive and

prosper. Luxury brands have also experienced a polarization effect, in which the

strongest brands have gained significant market share at the expense of the weaker ones. Volatility is

likely to remain for a while, but with an optimistic outlook the sector will normalize and

continue to grow by 5-6% this year and over 7% next year.

For the many reasons just outlined, investing in luxury brands must be a careful choice. Investing in a diversified portfolio of luxury brands offers several advantages:

- By actively investing in a diversified portfolio of luxury brands globally, instead of a simple selection of stocks, it is possible to achieve higher returns with a lower overall risk. The idea is that, instead of focusing on the risk/return of each individual investment, what is crucial is how these assets interact with each other, i.e. the correlation between the assets. By ensuring a truly diversified set of companies, the portfolio should have less volatility (less risk) than the total sum of its individual parts. Although each individual asset may be quite variable, the volatility of the entire portfolio can be much lower.

- The strategy GAM Luxury Brands, one of the few funds entirely focused on luxury, actively invests

in 25-35 global luxury companies. Unlike a passive investment,

for example an exchange traded fund that follows a stock index, this portfolio seeks to

generate alpha, an outperformance compared to the index (beta), when the stock prices

are interesting.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe