Offense trumps defense as global growth expands

11 MAR, 2024

By Jaime Raga

The recent level of exceptionality in the United States may be about to run out of steam. Developments in geography, economics and equity markets are about to converge in relative terms. We look at what this and other key macroeconomic factors mean for investors.

Key drivers

- Our view is that there is more reason for optimism in regions whose equities have more exposure to cyclical sectors outside the US, such as Japan and Europe, as the global manufacturing sector turns upwards.

- US equities could also continue to benefit from the high weighting of technology giants in their main artificial intelligence-driven benchmarks.

- We prefer financing from defensive markets such as Switzerland and the UK.

- A potential negative side effect of a pick-up in manufacturing activity is a stalling of the disinflationary trend in asset prices.

- The US dollar is useful for hedging purposes, although growth expands if inflation weighs on stocks and bonds.

The defining feature of the macroeconomic backdrop has been the US exceptionality characterised by better relative economic growth, better equity market performance and, to top it off, a strengthening currency.

While we at UBS AM continue to anticipate resilience in the US economy, we now see new breakouts in the rest of the world. The global manufacturing sector is picking up, which is positive news for those economies most leveraged to manufacturing activity.

However, this positive news for the goods sector may be paired with potentially bad news for inflation. The pick-up in demand, alongside tight inventories, creates some upside risk to goods prices, which have played an important role in bringing headline inflation down from its peak and closer to central banks' targets. Some tightness in price pressures increases the likelihood that central banks will wait even longer before starting to lower policy rates, and becomes a source of bond volatility affecting risky assets.

US Exceptionalism

The US economy has long outperformed most other major regions. There have been several reasons for this, as a number of one-off and structural elements have come together. Fiscal stimulus in the US has been more generous and consistent than in other countries, resulting in a lasting boost to consumer spending and a "pull" effect on business investment. Business dynamism is also higher, which has translated into improved productivity relative to the rest of the world, especially Europe. The dominant product in the US mortgage market is characterised by a long duration, 30-year fixed rate, so rising rates have had less of an impact on disposable income as fewer households have been affected than in other parts of the world. Even geopolitical events have contributed to exacerbating growth differentials: Russia's invasion of Ukraine significantly hampered European industry's output, while the shock to global energy markets was commercially positive for the US.

The outperformance of US equity markets is partly linked to their better economic performance compared to other major regions and, more importantly, has been supercharged by large technology multinationals that have captured an outsized global market share, as well as by the benefits linked to the development and application of artificial intelligence.

This exceptionality extends to the foreign exchange market. Flows into US dollar assets are strong, as US Treasuries are among the highest yielding "risk-free" assets available in the fixed income segment, and equities are expected to deliver better earnings growth than their global counterparts, in aggregate.

Catching up

The US may remain a relative leader among developed markets in terms of economic growth, but we believe that a period of recovery and more generalised global growth may be at hand.

Global industrial activity is improving. In February, the JPMorgan Global Manufacturing Purchasing Managers' Index rose above 50 (the threshold separating expansion from contraction) for the first time since August 2022. Domestic data from this survey is also improving, with new orders improving and inventories contracting, a positive indicator for future production. Given that the US is more service-oriented than other economies, this rebound in manufacturing is more positive for economies outside the US.

Leading indicators suggest that the European economy is rebounding as a whole, even with the weak performance of Germany (its largest component). Europe's economic surprise index recently came in above its US counterpart for the first time in almost a year. And the Asia ex-China region should be well supported by continued strength in the technology goods cycle.

As for China, we expect continued efforts to stabilise the economy amid what is likely to be a long period of real estate sector readjustment. The fact that economic conditions in China are less negative may help to improve the situation. However, we believe that stimulus packages such as those implemented after the global financial crisis of 2007-08 and again in 2016-17, which contributed to higher domestic growth and also produced significant positive spillovers to global growth, are unlikely to be implemented.

The bigger picture is that on aggregate, an environment in which nominal activity remains relatively robust while the rest of the world picks up momentum is a much better scenario for financial markets than one in which expansion is at stake.

Persistence of inflation risk

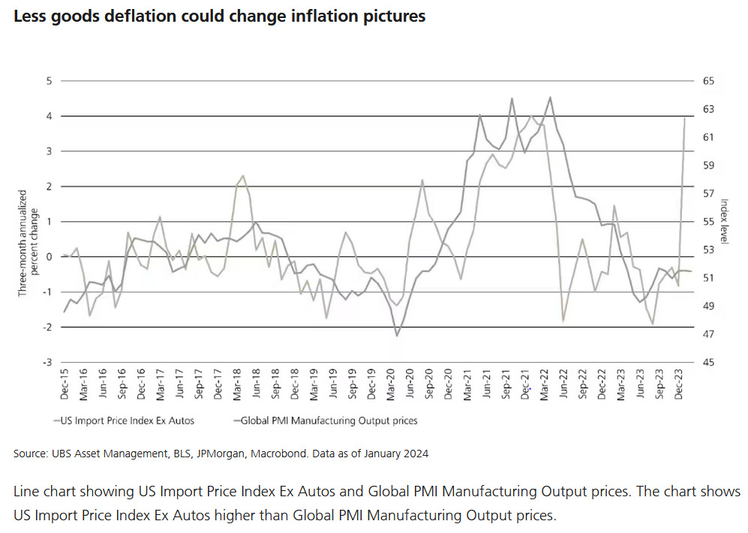

A key reason why inflation has been able to decelerate so much over the past year and a half is the turnaround in prices in the goods sector. Goods prices, which spiked during the supply shortages caused by the pandemic, have been falling since mid-2022. This decline in inflationary pressures was partly due to the recovery of supply chains, but weak demand in the rest of the world and overcapacity in China also contributed. Rising transport costs and maritime geopolitical risks, coupled with a recovery in goods sector demand, suggest less disinflationary support going forward.

January inflation data were higher than expected across the board in the US. One month's reporting of price pressures does not derail the overall disinflationary trend. Admittedly, residual seasonality seems to have contributed to the elevated figure, but it cannot be completely ruled out. There is a risk that some of the strength, especially in non-housing services inflation, will continue to spill over into February. And in Europe, inflation slowed less than expected in February, with pressure on services prices appearing to remain, with recent readings around 4% year-on-year.

Growth and inflation data so far this year have forced a realignment of expectations in which both the start date of the developed market central bank easing cycle is being pushed back and its depth is being reduced. We believe the easiest path is for this trend to continue. In the short term, higher frequency inflation numbers are unlikely to give the Fed the "increased confidence" it needs to believe that price pressures are durably returning to its 2% target.

Within the good performance of risk assets in recent months, we see some signs of speculation in the markets. Not all of this easing of financial conditions may be warranted or desired in the eyes of policy makers, as it may contribute to leaving inflation somewhat stuck above target.

Asset allocation

UBS AM believes that the improvement in global activity still has room to run. Within equities, we prefer exposure to regions leveraged to strong global nominal growth and the nascent manufacturing recovery, such as Japan and Europe, respectively.

Amid this global rally, there remains an element of US exceptionalism: a higher concentration of companies that benefit from artificial intelligence and are poised to grow earnings at a much faster pace than the market average. In our view, the best markets for our preferred long equity positions include more defensive and acyclical markets such as Switzerland and the UK.

Global sovereign bond yields have been repriced significantly to reflect the improved nominal growth outlook. Short-term interest rate markets have moved much closer to our outlook and are more consistent with central bank guidance. Given that risks to the outlook are increasingly dual as confidence in the economic outlook has increased in recent months, we maintain a neutral stance on government bonds.

In general, the US dollar tends to weaken when there are positive inflections in global growth. That said, we believe US dollar exposure is attractive as a hedge. The dollar is among the only important sources of portfolio protection in the event that investors anticipate a "no landing" that involves selling both stocks and bonds. This scenario would include a widening of US interest rate differentials vis-à-vis the rest of the world.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe