Pension Funds and LDI: A Conversation with Bruno Servant, CEO of Generali Insurance AM

21 JUN, 2023

By Teresa Blesa from RankiaPro Europe

Bruno Servant, CEO of Generali Insurance Asset Management

Liability-Driven Investment (LDI) strategies are investment management approaches specifically designed for Pension Funds. The main objective of LDI strategies is to align the investment allocation with future pension benefit payment obligations. This means that investments are planned to cover future financial commitments, taking into account factors such as inflation, interest rates, and credit risk.

In this interview, we have the opportunity to speak with Bruno Servant, CEO of Generali Insurance AM, to delve into the role of Pension Funds and Liability-Driven Investment (LDI) strategies.

How has the investment strategy of pension funds in Europe evolved in recent years and what is their current role in the financial market?

In recent years, pension funds have generally generated positive nominal returns, with 2022 a notable exception. These returns have not been sufficient to offset the impact of high inflation rates, following the historical surge. The prolonged period of ultra-low yields had led pension funds to increase allocations to equities, which however did not fully compensate for the reduction in bond investments. Indeed, pension funds have increased exposure to alternative assets, with a particular focus on private assets, to increase return and diversification, while supporting the real economy.

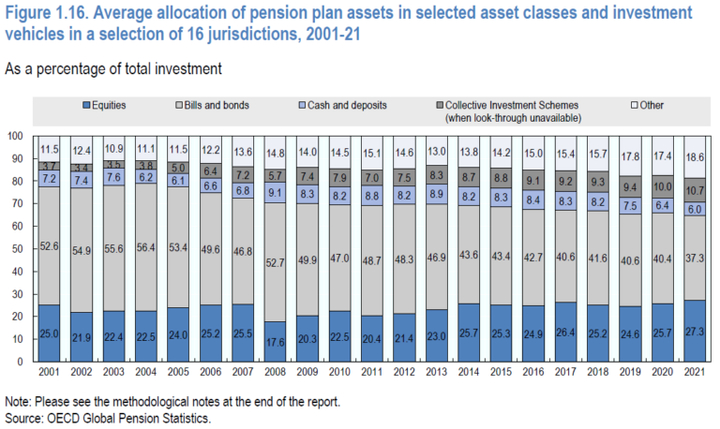

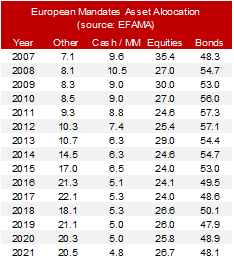

Countries offer varying degrees of flexibility in deploying capital into private assets. For example, certain jurisdictions still have restrictions or prohibitions on investments in real estate. Nonetheless, the proportion of pension assets allocated to alternative investments in major OECD countries surged from 11.5% in 2001 to 18.6% in 2021 (see chart below). EFAMA data on mandates point to the same conclusion: alternative assets moved from 7.1% AUM in 2007 to 20.5% in 2021 (table below). This upward trajectory necessitates increased regulatory scrutiny to ensure effective risk monitoring.

Moreover, the terrible market environment of 2022, characterized by negative returns and a positive bond-equity correlation, prompted pension funds to reassess their diversification strategies – with the less liquid but also less volatile private assets offering some support. Thankfully, returns have improved in 2023 and so has the diversification benefit.

How has the pension funds' approach towards LDI investments changed compared to traditional equity and bond strategies?

The approach of pension funds towards LDI has evolved, driven by changing economic conditions and the improved funded status of many plans. When funded statuses improve as rates rise, plans are expected to de-risk, moving assets from the growth portfolio and focusing more on risk management and a more precise matching of the liabilities.

Traditional growth-oriented assets like equities and private assets are then reduced in favor of more defensive and diversified strategies. There's a growing interest in defensive index strategies and liquid alternatives, and a shift towards true risk diversification over mere asset class diversification. Additionally, the use of synthetic instruments like bonds and equity futures is also on the rise for risk and liquidity management. Overall, pension funds are embracing more sophisticated LDI approaches compared to traditional strategies, leveraging innovative tools and solutions for enhanced precision and capital efficiency.

What are the main advantages of implementing an LDI strategy in a pension fund and how can it help mitigate risks related to future obligations?

In essence, an LDI strategy offers substantial benefits to a pension fund by aligning investment decisions with the fund's liabilities.

The first advantage lies in the cash flow matching, wherein the timing and amount of portfolio cash inflows are strategically aligned with anticipated pension payments. This reduces the liquidity risk of not having the requisite funds available for pension payouts when they're due.

Secondly, an LDI strategy effectively controls interest rate risk. Given that pension liabilities are long-term and sensitive to interest rate movements, a fall in rates can inflate their present value, leading to potential funding shortfalls. LDI strategies tackle this risk through a duration-matching approach. The strategy involves investing in fixed income securities that have durations closely matching the liabilities, thus immunizing the fund against the adverse effects of interest rate fluctuations.

Inflation is another risk that LDI strategies adeptly manage, if it is required by the mandate and the agreement with the final clients. From this perspective, an adequate exposure to inflation-linked instruments and to those equity sectors that are positively correlated to it, generates a hedge against this risk.

In all, LDI strategies contribute to maintaining the stability of the pension plan's funded status. By focusing on liability-matching investments, LDI strategies help reduce the risk of underfunding and provide a more predictable funding path.

What considerations must be considered when constructing an LDI solution to suit the specific needs and characteristics of a pension fund?

Everything has to start from a deep understanding of the nature and duration of the liabilities. This requires a granular analysis of the pension fund's obligations, considering factors like the projected retirement dates of beneficiaries, longevity expectations, and potential inflation impacts on the benefit payouts. Then, the current funded status of the pension fund vs its obligation and possible guarantees, along with its funding and risk tolerance levels, need to be carefully assessed. After this, an in-depth analysis of the asset-liability correlation is essential. This involves determining the sensitivity of the fund’s assets to factors that also affect its liabilities, such as interest rate changes.

A strong correlation can help to minimize funding volatility. In the end, an ongoing monitoring and adjustment mechanism should be in place. This involves regular reviews of the fund's performance and risk profile, coupled with adjustments to the strategy as necessary to align with changing market conditions and the evolving liability profile of the pension fund. The whole process is aimed at producing a tailor-made solution to the specific needs of each pension fund, looking at all the metrics that are relevant to it.

What is the role of risk management in LDI strategies and how do you deal with risks related to market volatility and changes in interest rates?

Playing an active role in safeguarding LDI investors’ interests while supporting Generali Insurance Asset Management (GIAM) long-term sustainability, our Risk Management practice relies on subsidiarity, transparency, and consistency with the high standards of the Generali Group principles. Indeed, each Portfolio Manager is accountable for identifying risks and corresponding control requirements in his or her investment strategy. This individual responsibility is supported and controlled by the governance, which provides the necessary checks and balances, and which creates a coherent and collective understanding of the risks related to the LDI strategies. Acting as a partner, connected to the business - whilst operating in parallel, staying intrinsically tied to the investments’ teams, Risk Management aims at ensuring that risks, to which the LDI strategies may be exposed to are effectively managed and mitigated.

Risk Management continuously monitors the performance and risk exposures of investment portfolios. It tracks market developments thanks to the inputs from the Research department, assesses the impact of potential events on the portfolios, and escalates on deviations from risk limits or guidelines, if any, to the Portfolio Managers and governance as needed. This includes ensuring proper alignment of the investment activities with the characteristics of the investors’ liabilities. Risk factors, notably market volatility and interest rates changes, credit, and liquidity risks, are being duly considered, assessed, and measured through various quantitative risk metrics and techniques such as VaR, historical and research-based stress testing, scenario analysis, and sensitivity analysis. These latter enable to assess the resilience of the LDI portfolios under different market conditions and economic scenarios.

It helps also to identify potential vulnerabilities, refine in collaboration with the investments’ teams risk mitigation strategies (e.g. investment limits and hedging strategies aiming at reducing the volatility and uncertainty of the portfolio’s performance), and evaluate the impact of extreme events related to market volatility and interest rates changes on the LDI portfolios. Overall, we trust our risk framework provides LDI investors with greater predictability and stability in meeting their long-term liability obligations, while balancing the need for returns and managing investment risks.

How are LDI service providers assessed and selected and what factors are crucial in making these decisions?

LDI service providers operate along the whole process that governs the management of the liability. It starts with the strategic planning, aimed at designing the most adequate investment strategy given the liabilities, and continues with the portfolio management activity and the subsequent risk management monitoring and reporting functions. On top of this, the service provider must be able to comply with the relevant laws and regulations in order to grant the fulfilment of its fiduciary duties and prudential standards.

Once this is understood, the selection process of a service provider must go through all these elements to assess their robustness, their compliance with the industry best practices and, as the 2022 experience has taught us through the UK pension crisis, their capability to face and properly manage extreme stress scenarios. The initial assessment and selection will be regularly reviewed. Most importantly, the service requires close interaction between the LDI manager and the client (pension scheme). Typically, during the UK crisis of autumn 2022, quick decisions had to be made, typically about potential capital calls to face the margin calls vs. Potential reduction in hedging. Ideally, such a difficult decision would have been anticipated through ex-ante stress tests.

How the current economic environment, including factors such as inflation and interest rates, affect the investment strategies of pension funds and the LDI solutions?

Due to inflation-driven interest rate hikes, LDI players in general are managing the new competitive environment in the Life policy market with adequate liquidity reserves, reducing somehow the profitability but still granting a limited impact on the liability management. On the other hand, surplus cash benefits from a from higher yield levels also for limited duration risk given where money market rates are. These conditions also push counterparties to offer LDI solutions to minimize risk.

Additionally, LDI investors, driven by market competition, are leveraging historically high yields primarily through portfolio turnover. They're also focusing on using new funds to exploit the current yield environment. However, strategies aimed at closing duration gaps are less needed as rate rise has mechanically helped to reduce them.

The current LDI strategy also emphasizes protecting mandates vulnerable to inflation, mainly through inflation-linked investments or inflation swaps.

Moreover, considering increased probability of corporate defaults given the tighter financial conditions, there is a shift towards high-quality investments to manage credit risk and prevent negative rating changes. In general, a dynamic portfolio management, with a strong focus on the patrolling of its risk metrics, remains key in this phase

What are the key considerations in setting the long-term investment objectives for Pension Funds and how are these objectives reflected in LDI strategies?

In the current market environment, long-term investors like pension funds may have a competitive advantage: a higher tolerance for volatility in a market environment that offers decent yields even in many low-risk market areas.

With central banks approaching their terminal rates but still in data-dependent mode, rates volatility will remain higher than the historical average. In this regard, fixed income-focused pension funds will need to re-define their risk appetite and be as forward-looking as possible, as setting a higher threshold for volatility limits may allow for higher long-term capital appreciation than before.

Portfolio’s LT investment objectives should in general mirror the need to ensure the capacity to meet future payment obligations to retirees / policyholders, bearing in mind, inter alia, inflation, interest rate and credit risk.

As a result, LDI strategies should aim to first and foremost build investment plans aiming to align duration and cash flow profiles of the assets with the projected liabilities, on top of setting adequate return seeking portfolios customized to help meet fund’s return objectives

Ongoing evaluation of actions aimed at optimizing the CFM profile and narrowing the Duration Gap of the mandate along its life should be performed, however allowing for flexibility of implementation to exploit market opportunities which can minimize the implementation cost from a historical perspective. Aside from management of the Interest rate risk, inflation and credit risk hedging should be part of an ongoing evaluation, as discussed above. Finally, a long-term perspective should not leave aside a careful and flexible consideration of the regulatory / accounting framework evolution and of the ESG dimension. As an example of the former, the recent introduction of IFRS9/17 accounting principles brought more needed awareness when dealing with investments failing the SPPI test on certain portfolio categories, customizing the approach accordingly to minimize the associated P&L volatility. As for the latter, the classification of mandates into Article 8 - 9, the introduction of target ESG labelled bond volumes and the setting of decarbonization objectives have generally become an intrinsic part of a long term LDI strategy.

What are the criteria used to determine the allocation of assets in an LDI portfolio and how is this allocation monitored and adjusted over time?

Unlike traditional portfolio construction, there isn’t any common and shared approach to define the asset allocation of an LDI portfolio: it depends on many different factors, such as the combination of investor’s objective with the liability profile or the regulatory framework.

However, there are some main criteria that, in general, can help to build and manage a successful LDI strategy:

Once the allocation is designed and implemented, it’s vital to constantly monitor the evolution of the liability-hedging portfolio to ensure that its objective and target risk are maintained. This may involve:

What are the current trends in the field of LDI and how is it expected that this strategy will evolve in the future?

Given market volatility, the traditional delegation process, where the asset owner defines risk appetite and strategic asset allocation while the asset manager focuses on tactical opportunities, may now be considered outdated. It has become imperative for asset managers to integrate to a greater extent additional balance sheet and strategic Liability-Driven Investment (LDI) objectives into the day-to-day portfolio management. This approach not only enhances balance sheet resilience but also enables asset managers to capitalize on market opportunities. By gaining a deeper understanding of liability reserves and overall balance sheet considerations, asset managers can navigate the evolving landscape more effectively, with greater agility.

Another trend impacting LDI is related to the growing attention to sustainability, in terms of ESG goal and risks integration in decision-making process underlying investment choices. This implies to gather the required data sources and to develop the reporting capacity .

Great focus is driven also by regulators: in the occupational pension space, EIOPA ran for the first time last year a specific stress test to gauge the resilience of European institutions for occupational retirement provision (IORPs) against a climate change scenario.

As said before, in the past 10 years, LDI investors have increased their exposure to illiquid alternative assets in order to increase the performance of their assets. The recent increase in rates may slow down this trend a bit – and we are already seeing this in the most recent flows - because the extra return available from Alt versus LT bonds is being reduced, and the expected return from PE investment may be somehow lower with higher deal funding costs. Still, it has become increasingly important for asset managers to offer packaged and personalized solutions, including a broad set of asset classes, not just in the liquid space.

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe