Perspectives for European and Spanish banks: stability but with nuances

6 MAR, 2024

Scope keeps a stable outlook for European banks, as improved profitability, balance sheet clean-up, and excess capital all constitute significant buffers against deteriorating operating conditions and a moderate economic recovery.

The sector will continue to resist this year, thanks to stronger credit fundamentals built in recent years. The risk of worsening and improvement factors are broadly balanced. In our opinion, the sector's profitability will have peaked in 2023 and will begin to decline in 2024 and 2025 due to a normalization of net interest margins and a moderate increase in credit risk. Despite, none of the banks in our sample will register net losses in 2024 according to the base scenario we handle.

Marco Troiano, head of financial institution ratings at Scope Ratings

The risks of worsening include:

- Any risk of economic recession in the major countries of the European Union, particularly an increase in unemployment that could more deeply affect asset quality.

- Increased competition for deposits, both among banks and between banks and alternative savings products, which could harm revenues and profitability and, in more extreme scenarios, cause funding shortages.

- A significant financial or geopolitical problem that undermines confidence in the sector, which, as the cases of Silicon Valley Bank and Credit Suisse have shown, remains somewhat unpredictable.

The improvement factors include:

- An increase in the slope of the yield curve that drives a greater expansion of net interest margins.

- Faster than expected economic growth, which supports both volumes and asset quality.

- An acceleration of institutional reforms leading to the culmination of the European Banking Union and greater consolidation within the single market.

Although it is likely that official interest rates will pivot in 2024, short-term banking revenues will continue to increase in the first half. However, margins will begin to contract at a moderate pace in the second half of the year, as competition for deposits increases following TLTRO repayments and the ECB accelerates quantitative tightening.

The growth in fee income will not be enough to offset the decline in interest margin. Therefore, we believe that global revenues will decrease marginally this year and will drive a slight deterioration in cost/income ratios, although from very comfortable levels.

Marco Troiano, head of financial institution ratings at Scope Ratings

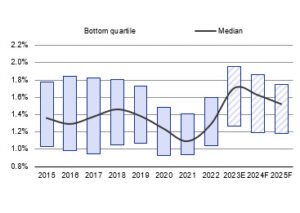

Intermediation margins reach their peak in 2023

Source: Scope Ratings. Note: Intermediation margins calculated on the total of interest-generating assets

Asset quality will deteriorate in 2024 due to the modest economic recovery coupled with the persistence of high borrowing costs. However, we expect the increase in non-performing loans to remain modest and that their effects can be easily offset by the banks' ordinary profitability. "It is unlikely that areas of credit vulnerability, such as the commercial real estate sector, will become a systemic banking problem, given the adequate degree of diversification of the large European banking groups," Troiano said, "while the cost of risk will only increase modestly compared to current levels, as banks still have large excesses of unused provisions that should help to smooth the impacts on losses and gains from credit deterioration, at least initially".

In 2024, we foresee a recovery of the Eurozone economy of 1.1%, after an estimated growth of 0.7% in 2023. However, the region's growth will remain below potential this year, due to weak growth in Germany (0.3%) and growth around potential in France (1.0%), Italy (0.8%) and Spain (1.8%).

Spanish Banks

Although overall profitability could moderately decrease, it will continue to support the credit profiles of Spanish banks in 2024, along with controlled asset quality and adequate capital positions.

A greater performance gap between domestic and international operations in 2024 will be mainly due to higher loan growth in emerging markets, as loan volumes in Spain stabilize and finally decrease as demand adjusts to lower growth expectations and high interest rates.

Liquidity Coverage Ratios

Source: Scope Ratings, ECB. EU Single Supervisory Mechanism (SSM): EU banks supervised by the ECB.

Asset quality is stable, but the retail sector and SMEs could generate greater credit risk. Asset quality metrics have proven resilient so far, although the decline in defaults seems to have bottomed out. We expect some deterioration in the first half of 2024.

The risk of an extension of the extraordinary tax beyond 2024 adds uncertainty to the operating environment of banks in Spain, a trend that is also observed in other EU countries.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe