Sustainability, three reasons to go beyond decarbonisation

12 MAR, 2024

By Eva Cairns

Over the past few years, sustainability investments have focused on climate change. According to Morningstar, by the end of 2022 there were about $415 billion invested in climate related funds, up from about $220 billion just two years before.

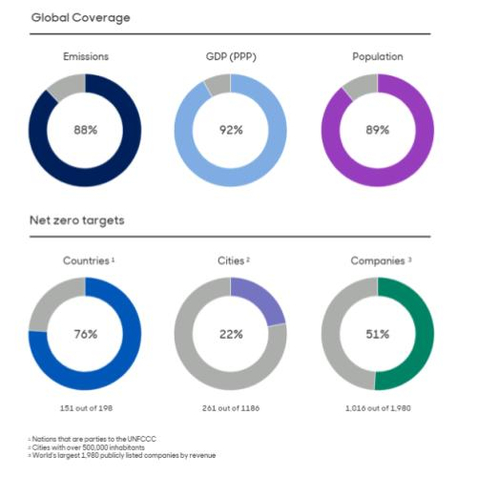

In addition, we have also experienced a significant increase in net-zero carbon emission commitments. According to Net Zero Tracker, 92% of global economic activity, linked to 88% of global emissions, is now covered by a net zero emissions target.

More than half of the world's 2,000 largest companies have a zero emissions target, representing 66% of their total annual revenues. What's more, the number of corporations committed to zero emissions grew by more than 40% in just 16 months: from 702 in June 2022 to 1,016 in November 2023.

Beyond climate change

Towards 2024, we expect to see more measures to help turn these good intentions into reality. Nevertheless, focusing on decarbonisation alone will not be enough. Climate transition plans also need to deliver results and drive:

- A fair transition

- A positive transition for nature

- A resilient transition

They are pathways to neutrality that neither harm the natural world nor society. They also recognise the importance of adapting to the physical risks - storms, floods and droughts - caused by climate change.

This was a key point of the annual UN climate conference, COP28, held last year in Dubai. Investors' efforts are focused on being able to assess the interrelated effects of these transition targets, as well as meeting the demands of increasing regulatory disclosure. However, getting data to help make decisions will be a major challenge. Below, we look at the main developments in each of these areas:

A fair social transition

We expect much more attention to be paid to social factors in 2024. The energy transition cannot succeed without taking into account key players: it needs appropriately skilled workers, supportive local communities and consumers who can afford to use these new low-carbon technologies.

In addition, we expect the requirement to measure and disclose social parameters in investment portfolios to increase. For example, in the UK, the Taskforce on Social Factors was launched early last year with an approach to integrate social parameters into pension investments.

This year will also see the launch of the Taskforce on Inequality and Socially Related Financial Disclosures (TISFD), which follows in the footsteps of the Taskforce on Climate Related Financial Disclosures and the Taskforce on Nature Related Financial Disclosures (TNFD). This initiative will contribute to an increased focus on demonstrating how social issues - human rights, labour standards, diversity, equity and inclusion - are assessed for their financial impact on investments and integrated into the investment process.

Another social issue that we expect to become more relevant is the impact of technology, and in particular artificial intelligence (AI), on people.

A positive transition for nature

There is no emissions neutrality without preserving natural capital, i.e. the stocks of plants, animals, air, water, soil and minerals that together provide benefits to people. For example, land use is an important source of carbon that can become a carbon store with the right measures, such as combating deforestation.

Increasing attention will be paid to food production, which contributes to about a third of global emissions but has so far not received the same attention as energy.

We have seen increased investor interest in nature and biodiversity following the launch of the Global Biodiversity Framework in 2022 and the publication of the final TNFD report on nature-related disclosure requirements. Over time, attention will shift to obtaining data to meet these requirements and, more importantly, to identifying nature-related investment opportunities. But getting useful data is a major challenge. Our survey of data providers shows that they are competing to develop methodologies, as companies themselves disclose very little data.

Regulation is also expected to be a key factor. In the UK, for example, the "net biodiversity gain" policy will come into force this year. This policy will require developments to have a positive impact on biodiversity.

A resilient transition

The world has already reached a warming of 1.25°C above pre-industrial levels, with 2023 estimated to be the hottest year on record.

Climate change is having a devastating impact on communities around the world, yet emissions continue to rise, with another 1.2% increase in 2022, a new record. It is too late to focus solely on reducing greenhouse gas emissions. We also need to invest in adaptation measures to increase resilience to the physical impact of climate change. For example, we need to invest in new infrastructure to cope with rising sea levels, as well as in innovative technologies to make crops more resilient to heat. Most climate strategies focus on transitional solutions, but we expect that by 2024 there will be a shift and capital will increasingly flow into these adaptation solutions.

Conclusions

In 2024, investors must be prepared to demonstrate how they take these complex and interconnected requirements into account in their investment processes and transition plans. Investors must focus on measuring and evaluating data to understand transition-related risks and opportunities, as well as comply with the more demanding sustainability-related disclosure environment coming next year.

We believe that emerging technologies, such as artificial intelligence and satellite data analytics, could transform the way we measure and disclose sustainability-related data.

To achieve a just, nature-positive and resilient transition, we need continued technological innovation, political will and a strong policy landscape to mobilise private capital. Here, investors can play their part by working with policy makers and companies to promote credible and comprehensive transition plans and seek greater transparency.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe