What Happened during the First Fed Meeting of 2024 ?

1 FEB, 2024

By Johanna Zidani from RankiaPro Europe

The first Federal Reserve meeting of the year has unfolded against a backdrop of shifting market narratives and economic uncertainties

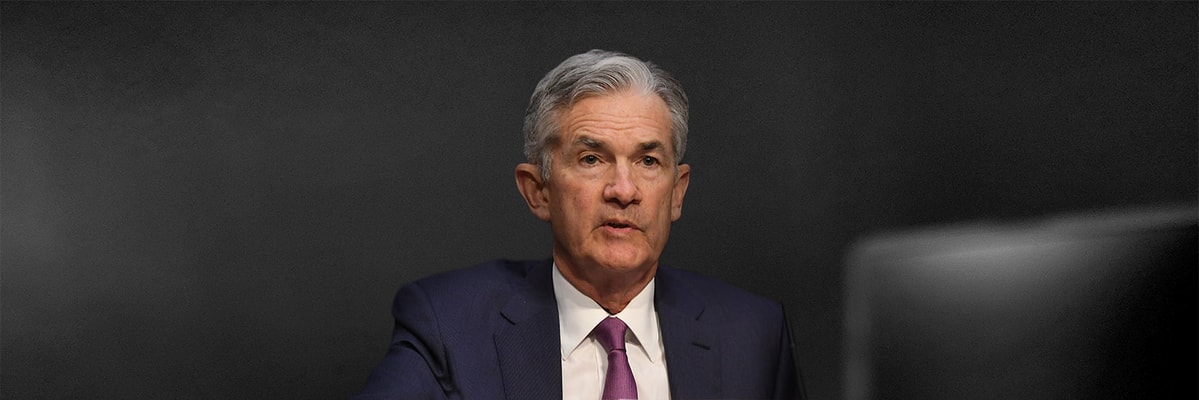

Following the December meeting, during which they acknowledged the possibility of at least three interest rate cuts in the coming year, Jerome Powell's January discourse reflects a more cautious tone. While they removed the reference to "further tightening," signaling no anticipated rate hikes, they also emphasized that inflation is not entirely under control, making a rate cut in March seemingly off the table.

Benoit Anne, director of the Investment Solutions Group at MFS Investment Management

The Fed has delivered a cautious message, signaling that a rate cut in March is not the baseline scenario. In addition, there was no announcement yesterday about a QT adjustment. Instead, it was signaled that the QT discussions would be initiated at the next policy meeting. On this basis, we expect that in the near term the implied probability of a rate cut at the March FOMC as priced by Fed fund futures will go down markedly. It now appears that the balance is skewed towards a first rate cut to be delivered in May or June. That sounds reasonable to us. We had been in the camp of thinking that the rate market had been a bit ahead of itself.

Paolo Zanghieri, senior economist at Generali Asset Management

The almost immaculate deflation the Fed has been busy advertising since early 2023 looks increasingly likely, also thanks to the ongoing unwind of the legacy from COVID. The Fed will lower rates this year - the vast majority of FOMC members is in favour- but it is still unsure on the timing. The only certainty is that the first cut will not happen in March.

The extensively changed press release listed the favourable evolution of inflation the cooling of labour market and removed any reference to tight financial conditions but, in an unusual twist, explicitly stated that the FOMC is not yet comfortable to cut, given the still high level of inflation. Powell added that that to him and many other committee members March remains too early for the FOMC to be confident enough that the progress on inflation seen over the last six month are durable.

The economy has shown very good progress, as inflation has come massively down, while the unemployment rate has remained below 4% for two years and the non interest-sensitive sector of demand have continued to growth at a solid pace. Yet it is too early to call it a soft landing, as a lot of this improvement has to with the unwinding of the bottlenecks the pandemic has created, especially to the labour market. This creates uncertainty, especially on the durability of disinflation once the economy returns to full normality. There have been six months of good inflation data, which are sending a solid signal, but to start cutting rates the FOMC want to see a few months of equally good prints. A lot of disinflation has come from goods as global supply chains restarted working smoothly, but from now on it is the service sector that will have to contribute more. A key risk preventing early cuts is not that inflation may come back up, but that it stabilises at the current, still too high, level (core PCE inflation was 2.9% yoy in December). Moreover, uncertainty surrounds the level of the neutral rate. The current strength of the economy suggests that it may be higher than the 2.5% implicit in the FOMC dots, and Powell himself thinks that it may be higher than the estimates of most models. Therefore, risk management suggests a bit more of patience.

This meeting staged some discussion on the evolution of the balance sheet, but a more in-depth analysis will be conducted in March. Powell stressed again that the balance sheet and the fed funds rate are two independent policy tools, and the cut in rates need not be followed immediately by the end of quantitative tightening.

The outcome of the meeting confirmed our view that the Fed will start cutting rates in May and will ease policy by a total of 100basis points this year. On Quantitative tightening, we expect the March discussion to lead to a reduction in the pace of the balance sheet runoff during the summer, and to a halt around the turn of the year.

Markets took the meeting as not dovish enough: the S&P lost around 1.5%, while the 2-year Treasury yield was flat at 4.3%.

Kevin Thozet, member comitee at Carmignac

The goldilocks scenario is in full play. The US economy is running at 3%* and the immaculate disinflation narrative appears validated. The pace of disinflation is hastier than expected – the combination of immigration flows and bottlenecks easing have helped on the supply side of the equation and deflation in China has helped on the demand side.

Core PCE and wages are at levels in line with the Fed’s 2% target, meaning all signals are turning green for it to start adopting a more dovish policy if needs be, as current policy rates are far above the neutral level of interest rates.

Powell will likely want to avoid becoming too much of a market mover. The Fed is lowering the probability of a March cut. Instead, he’ll stick to the data dependency plan. Two inflation prints are still expected prior the next “live” meeting of March, along with two Non-Farm Payrolls publications.

Further down the year, questions will arise over how far and fast the Fed can go with rate cuts. Changes in labour supply dynamics, with immigration becoming an electoral issue, the impact of geopolitics on commodities, the potential for more substantial Chinese support measures and lower rates inherently feed into easier financial conditions, which in turn, feed into both economic growth and inflation. But for now, the soft landing of the US economy is a reality most had discarded.

Tiffany Wilding, Managing Director and Economist, and Allison Boxer, Economist at Pimco

Balancing progress on taming inflation against still-resilient U.S. economic growth, the Federal Reserve in January clearly signaled its next move is likely to be a rate cut, but it is keeping its options open on timing – and the next meeting in March may be too soon.

Barring a material weakening in economic activity, we believe the Fed will wait until closer to midyear to begin its easing cycle with a 25-basis-point (bp) rate cut. As for subsequent rate cuts, the Fed’s latest projections (from December) suggest a 25-bp cut at every other meeting, but that pace could be adjusted depending on macro developments.

In our view, the risk of inflation getting stuck at above-target levels, or even reaccelerating, remains crucial for Fed policy, although we agree with the Fed’s assessment that risks have moved into better balance recently.

Waiting for more good data

While technically March could be in play after the Fed (as expected) removed the hawkish hiking-bias language previously present in its policy statement, the Fed also added the caveat that it does not expect to reduce the policy rate until it has gained “greater confidence” that inflation is moving sustainably toward its 2% target. At the post-meeting press conference, Fed Chair Jerome Powell said, “I don’t think it is likely that the Committee will reach a level of confidence by the time of the March meeting to identify March as the time [to cut], but that is to be seen.”

Developments on inflation and other macro factors since the December Fed meeting have had mixed implications for policymakers. U.S. core PCE (personal consumption expenditures) inflation has continued to move in a good direction, and is back in “2-point-something” territory. However, core CPI (consumer price index) data has remained firmer than PCE for several reasons, including the higher weight of shelter costs within the CPI calculation, and a faster decline in some non-market pricing categories within PCE – mainly healthcare. Although PCE is the Fed’s preferred inflation measure, the sticky CPI data does complicate its policy decisions, perhaps prompting some of the hesitation conveyed in the “greater confidence” line.

Various econometric models suggest that most of the post-pandemic increase in inflation resulted from pandemic-related factors (fiscal stimulus, supply chain bottlenecks, etc.), and similarly, most of the recent good news has stemmed from these same factors fading (or even reversing). However, labor markets remain tight, adding to inflationary pressure.

Other factors that could prompt the Fed to wait longer to cut rates include the U.S. economy’s persistent resilience in the face of more contractionary fiscal policy in the latter half of 2023 and slower credit growth. Meanwhile, easier financial conditions will likely support near-term growth momentum in the most rate-sensitive sectors, such as residential real estate investment.

Historical precedent also provides insights into the behavioral aspects of monetary policymaking: Central bank officials usually tend to lag in easing. Typically, they would begin easing when their economies were already in recession. As we discussed in our Cyclical Outlook, “Navigating the Descent,” there have been a handful of instances when central banks eased absent a recession. However, fear of Arthur Burns’ legacy (he chaired the Fed amid rampant inflation in the 1970s) may well keep policymakers focused on managing inflation risks for a few months longer.

Questions about the Fed balance sheet

Although the Fed did not adjust its current balance sheet policy – since June 2022, it has been gradually reducing its holdings of U.S. Treasuries and agency mortgage-backed securities – Chair Powell fielded a question about it. He replied that while policymakers did discuss the balance sheet at this meeting, he anticipates they will have more in-depth discussions in March, and he indicated that as always the Fed is focused on maintaining ample reserves in the financial system.

The balance sheet has been a topic of interest following a speech earlier this month by Dallas Fed President Lorie Logan, who suggested the Fed should slow the pace at which assets are allowed to run off its balance sheet. Following Logan’s comments, many forecasters now expect the Fed will slow and then conclude its runoff program (often known as quantitative tightening or QT) sometime this year.

We believe that balancing the risk of unwanted volatility in money markets versus a clearly communicated preference to reduce the balance sheet would argue for the Fed to use a “taper and watch” strategy that continues to reduce Fed holdings and eventually drains reserves. To date, the Fed’s QT policy hasn’t actually tightened bank liquidity materially, and key money market rates have been generally stable, suggesting that reserves can decline somewhat and still remain ample.

As a result, we believe conditions should allow the Fed to continue to run off its balance sheet likely through 2024. That said, developments in the banking sector (greater demand for reserves, potential regulatory changes) could argue for a slower decline in reserves before they reach the top of the range of estimates ($2 trillion – $3.5 trillion, according to various models), and the Fed then proceeding slowly enough to be able to react to changing money market dynamics.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe