Italy: domestic investors vital for supporting government funding as market conditions shift

9 FEB, 2023

By Constanza Ramos

By Alvise Lennkh-Yunus and Giulia Branz, Sovereign & Public Sector Ratings at Scope Ratings

Private investors will need to increase their holdings of Italian government debt by about EUR 90-120bn a year in the years ahead given the government’s elevated financing needs and the winding down of ECB bond purchases. The burden will increasingly fall on Italian investors if higher yields fail to re-attract foreign investors.

The government’s reliance on its strong domestic investor base is reassuring, along with Italy’s favourable debt profile, current political stability and EU support. Still, as private investors compensate for the ECB’s declining holdings, market volatility may increase should poor economic and fiscal performance weaken investor confidence.

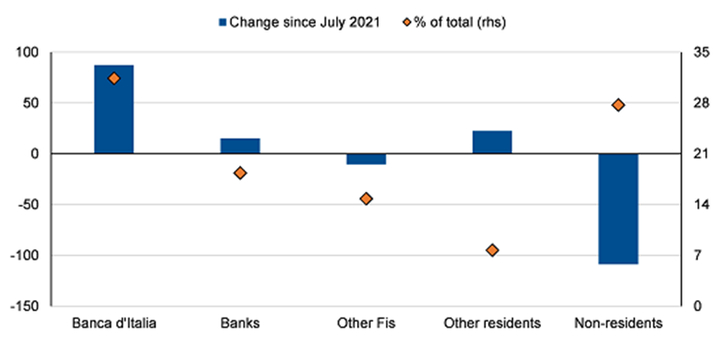

Shifting financial market conditions have changed the pool of investors that the Italian Treasury is used to tapping. Foreign investors reduced government securities holdings to 28% from 33% of total since the summer of 2021, equivalent to a decline of almost EUR 110bn to EUR 635bn in October 2022, the lowest level since 2015, when they held 40% of Italy’s total securities. The Bank of Italy, banks and other resident investors compensated for these declines.

Figure 1: Italy’s government securities, by holding sector

Change in holdings from July 2021 in EUR bn (lhs); share of total securities (rhs)

Source: Banca d’Italia, Macrobond, Scope Ratings.

The Bank of Italy’s holdings, allowing for temporary deviations, should not increase following the ECB’s decision to halt net asset purchases under its QE programs. The ECB’s plans point to a decline of about EUR 20-30bn in the Bank of Italy’s holdings this year. Should the ECB continue with annual APP reductions of about EUR 25bn per month from 2024 onwards, its annual reduction of Italian government securities’ holdings could reach EUR 40bn over the coming years.

European support reduces market volatility...

The ECB will remain a comforting presence in the market for Italian debt. The Eurosystem will continue to refinance most of its holdings of Italian public debt over the coming years, accounting for over 30% of total outstanding Italian government securities (EUR 716bn in November 2022).

Moreover, the ECB can activate additional tools in case of excessive market fragmentation in the euro area, including the possibility to apply flexibility in the reinvestments of its PEPP holdings (EUR 1.7tr, of which EUR 288bn relate to Italian government securities) and the yet to be activated Transmission Protection Instrument. The availability of these tools has helped cap government bond spreads in the euro area in recent months.

...but private investors needed to absorb funding needs

Still, given Italy’s (BBB+/Stable) elevated net issuance of about EUR 90bn in 2023 and EUR 70-80bn until 2027, as well as the reduction of the ECB’s holdings, private investors will need to increase their holdings of Italian government debt by about EUR 90-120bn annually. This compares with a cumulative reduction of around EUR 163bn since the start of QE in March 2015, despite the EUR 448bn increase in outstanding securities over the same period. Should foreign investors not return to Italy’s debt market despite more attractive yields, the resulting gap will need to be compensated by domestic institutional or retail investors.

Italian banks, usually the first to step-in to cushion shifts in other investors’ behaviour, may face limits in their absorption capacity, given an already elevated exposure to government debt, increasing risks of a sovereign-banking nexus. Their holdings amount to over 10% of their assets, which is high compared to Spanish (7%) and Portuguese banks (5%).

For this reason, the Italian government’s funding strategy includes attracting retail investors through dedicated financing instruments, such as the BTP Italia and the BTP Futura. Higher yields should make these investments attractive to domestic households, which have high financial assets of EUR 4.8trn, of which EUR 1.6trn in cash and deposits – a key credit strength.

Similarly, the Green BTP, introduced in 2021, may also attract new ESG-focused investors. However, issuance is likely to remain limited given the constrained pool of sustainable expenditures in the State Budget.

Political stability and commitment to fiscal consolidation key

The relative political stability since the September elections driven by the new government’s parliamentary majority and commitment to an orthodox and Europe-friendly policy on the back of a resilient economic and fiscal outlook for 2023, has eased financial market conditions for Italy in recent months. The 10-year government bond yield has dropped to below 4% and the spread narrowed to 180-200bps.

Critically, this happened with de facto no intervention by the ECB, as reflected in the cumulative net reduction of EUR 746m of its combined Italian PEPP and PSPP holdings since the elections in September 2022. Sticking to a constructive dialogue with the European authorities, achieving its stated fiscal targets and return to a primary surplus is key for the government to maintain investor confidence as the ECB continues its policy tightening.

Figure 2 – ECB net asset purchases of Italian government bonds under the PSPP and PEPP programs EUR bn

*Split equally between months given bi-monthly reporting by ECB. Latest data point Dec/Jan.

Source: Macrobond, Scope Ratings