Some numbers are big – and some are HUGE

25 APR, 2023

By Simon Edelsten

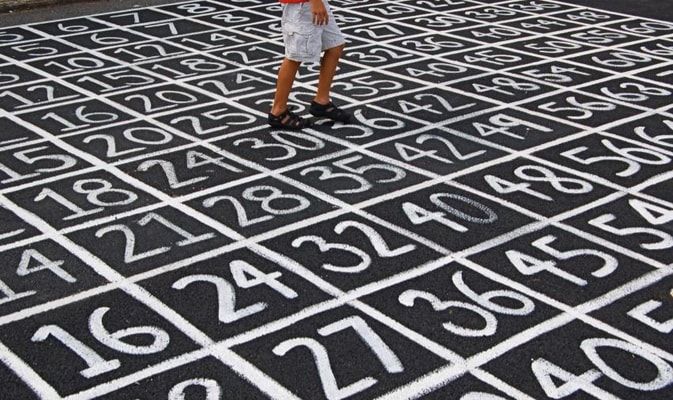

In some early cultures, people counting anything over the number two just used the word “many”. Even today, for a lot of us, words like “million”, “billion” and “trillion” might as well be “many”. Few of us really understand the difference between these large numbers. Smart investors should try.

The US has now passed into law three important acts that have $2 trillion of backing. The US Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law, and the Chips Act aim to address climate change and the need for new infrastructure and reduce reliance on China and Taiwan for critically important semiconductors.

Just think about that number for a second. £2 trillion is TWELVE noughts or 2,000 billion. One billion is a lot in its own right. A stack of $1bn in $100 notes would reach 1.2 km (0.75 miles) into the sky – until the wind blew it away. The US has earmarked 400 of these stacks for climate change projects over a decade.

Companies investing in or manufacturing products in the US that lower carbon emissions will be eligible for generous tax refunds. This is a strategy aimed clearly at boosting the US economy and supporting manufacturing there. Governments in Europe and the UK are still working out how to respond. Investors, too.

Opportunities

Within the US a number of companies look set to benefit – and in many cases, their share prices already reflect this. Take the largest US solar stock, First Solar. Its shares have risen from around $60 to over $200 in less than a year. We bought our shares late in the run but see more opportunity ahead.

First Solar’s unique manufacturing technique uses cheaper semiconductor material and is simpler than its competitors. It means it has relatively high-profit margins, and though these may fall as volumes increase, it should hopefully still deliver attractive returns to investors.

Array Technologies is another in this field that may benefit. Its systems ensure panels on industrial solar sites move to track the changing position of the sun, maximizing exposure and electricity generation. Quanta Services builds, maintains, and improves electricity grids. Engineering company Cummins is working on electrolyzers to develop green hydrogen.

Another area that might interest investors is carbon capture and storage (though this is challenging, and I would argue a high-risk investment area). Perhaps more profitable is improved waste management, which will also be rewarded. Waste Management Inc. is opening new landfill sites supported with tax breaks to help it capture the methane emissions these sites can generate. The plan should also benefit the hazardous waste disposal business Clean Harbors Inc.

Investors should look in particular for companies with a competitive advantage. They may recall the dramatic fall in the value of shares in the European wind farm business Örsted after the oil majors entered the market – they are worth half what they were worth back in January 2021. This was seen as a booming sector, but the competition drove up the price paid for licenses to operate and drove down the profits to be made from them. Remember, just because an area of business is growing, it does not make investing in companies operating in this field profitable – not if the barriers to entry are low and there are lots of players involved.

European beneficiaries

The IRA and other acts will not just benefit American businesses. International companies with subsidiaries in the US could also receive tax breaks. And here share prices look more attractive.

Toyota, for instance, (trading on 10.5x earnings) is planning to convert its Kentucky car plant to electric vehicle production. It intends to manufacture 200,000 electric cars a year, each attracting a $7,500 subsidy from the US government.

The Japanese automaker is partnering with Panasonic to build a new $3.8bn battery plant in North Carolina that looks set to receive $315 million of help from the state government.

Panasonic is one of the largest makers of batteries in the US. It already supplies Tesla (on an eye-watering 51x earnings despite growing competition). If Tesla’s competitors eat into its market, Panasonic should still benefit as it is likely to supply them too. And the market for batteries extends beyond just electric vehicles.

We own Panasonic, as well as Schneider and Siemens – both European electrical equipment makers with strong US businesses that are enjoying the boom. Panasonic is on less than 12x earnings. Schneider and Siemens are on 17x earnings.

Choose well, and investors should make good money from this huge investment in the US – even by investing in companies closer to home.

Related articles

Granolas Stocks: what they are and differences with the Magnificent 7

Granolas Stocks: what they are and differences with the Magnificent 7By RankiaPro Europe