Risk management in emerging market debt: the case of the MFS Fund

14 OCT, 2023

By Andrea Sepúlveda from LatamSelf

MFS Emerging Markets Debt Hard Currency

First, it is important to note that the MFS Emerging Markets Debt Hard Currency mutual fund invests primarily (at least 70% of its assets) in emerging market debt instruments. The fund generally focuses its investments in US dollar-denominated debt instruments and in government and government-related issuers of emerging market countries, although it may also invest in other emerging market debt instruments. The fund may allocate all of its assets to debt instruments rated below investment grade. In addition, the fund will promote environmental features in accordance with Article 8 of the EU Regulation.

The fund does not distribute dividends but accumulates dividends and its benchmark is the JP Morgan Emerging Markets Bond Index Global Diversified (USD).

In terms of performance, the fund has had a positive performance in recent years, outperforming its benchmark. In 2020, the fund returned 6.5%, while its standard returned 5.5%. This shows that the fund has been able to generate value for its investors, even in a year marked by the pandemic and volatility in the financial markets.

Regarding risks, the MFS Emerging Markets Debt in Hard Currency mutual fund is exposed to several risks, including credit risk, foreign exchange risk, and political risk. Credit risk refers to the possibility that bond issuers may not be able to meet their payment obligations. Foreign exchange risk refers to the possibility that fluctuations in exchange rates will affect the value of foreign currency-denominated bonds. Political risk refers to the possibility that changes in government policies or geopolitical tensions will affect the fund's performance.

To mitigate these risks, the MFS Emerging Markets Debt in Hard Currency mutual fund uses a diversification strategy, investing in a broad range of bonds issued by governments and companies from different countries and sectors. In addition, the fund has an experienced management team that conducts a thorough analysis of bond issuers before investing in them. The management team has a long history and experience in this asset class with a total of more than 50 years of experience.

In terms of opportunities, by the nature of its investment strategy, the fund benefits from growth opportunities in emerging markets. These markets have great growth potential due to their young and growing population, growing middle class, and developing infrastructure. In addition, emerging markets often offer higher yields than developed markets, which can be attractive to investors seeking higher returns.

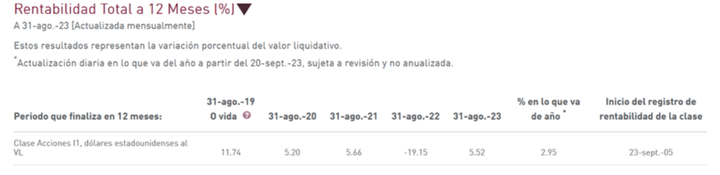

Fund performance

Note: Past performance is not a predictor of future returns. Fund returns may increase or decrease as a result of changes in exchange rates.

Note: Past performance is not predictive of future returns. Fund returns may increase or decrease as a result of changes in exchange rates.

Source: MFS info as of the end of August 2023 for I1 class

As can be seen from the chart above, it is a fund that has a long track record, that has performed well even in pandemics and its risk comes from emerging market volatility.

| Participation characteristics (as at 31 August 2023) | |

| Number of emissions | 446 |

| Number of emitters | 207 |

| Average coupon | 5.31 |

| Average effective duration | 6.93 |

| Average effective maturity | 11.64 años |

| Yield to Worst | 8.24% |

| Average credit quality of rated securities | BB+ |

Source: MFS info as of end-August 2023 for class I1 USD.

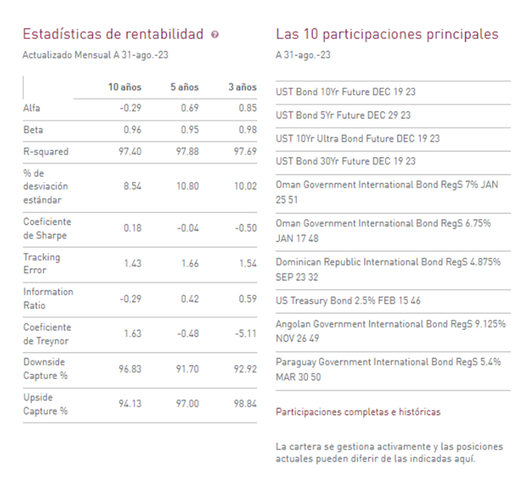

It is a fund with a duration of just under 7 years and a yield of 8.24% at the end of August. When considering the fund's alpha and its Information Ratio over 3 and 5 years, we see that it adds value. In relation to the market Beta, this indicates that it is a more conservative fund than the market.

Other indicators

Source: MFS info as of end-August 2023 for class I1 USD.

In conclusion, the MFS Emerging Markets Debt in Hard Currency mutual fund is an attractive investment option for investors looking to diversify their portfolios and earn attractive returns in emerging markets. While the fund is exposed to a number of risks, its diversification strategy and experienced management team can help mitigate these risks. In addition, the fund benefits from growth opportunities in emerging markets, which may be attractive to investors seeking higher returns.