Artificial Intelligence as an Investment Frontier

7 APR, 2020

By Constanza Ramos

Artificial Intelligence (AI) is already becoming a part of our everyday lives. Upcoming innovations will not only integrate the technology more seamlessly but usher in new products and services that will enhance our lives. More companies every day are exploring how they can use AI to improve their products and experiences, enhance efficiency, and drive competitive advantages. Future innovations will be exciting and world-changing just like the tethered investment opportunities.

Each decade brings core technological advancement. These changes, that often work at the deepest and most essential levels of society have drastic implications on markets. In the late 1990's it was the implementation of the internet. In 2007 Steve Jobs changed the world with the introduction of the iPhone. And today, it seems as if our next jump comes from the AI sphere. And this jump has a good chance of being more impactful and by virtue, more profitable for astute investors.

Investors, both retail and commercial need not tackle this new frontier on their own. There are many top-notch funds revolving around these changes from some of the most respected names in money management.

We started to analyze these funds and reached out to our partners at Allianz Global Investors, La Financière de L'Echiquier, and Polar Capital.

| Fund Name | AUM | Fund Performance |

| Echiquier Artificial Intelligence B | 143 Million Euro | Annualized returns of 6.7% since inception in 2018 |

| Allianz Global Artificial Intelligence Fund | 1.5 Billion Euro | 5.7% Annualized |

| Automation and Artificial Intelligence Fund | 340 Million Euro | 7.6% Since inception after fees (January 2018) |

Key Questions:

Following is a showcase of what we believe to be the top actively managed funds within Artificial Intelligence as well as unique perspective from the Fund managers.

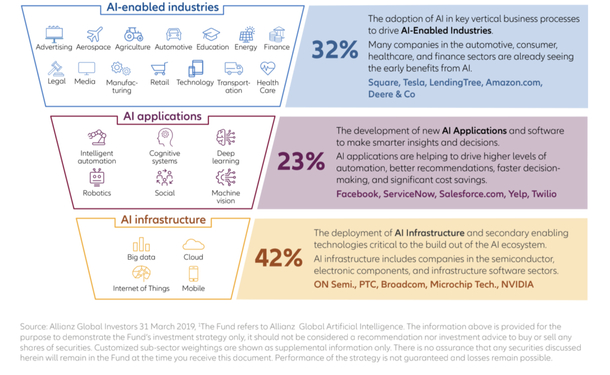

Investment philosophy: The Fund invests across a broad spectrum of technologies and sectors embracing the disruptive power of Artificial Intelligence.

They implement a bottom-up, fundamental strategy investing in Artificial Intelligence investment processes

We believe that those companies that drive the development of AI or use it to transform their business model have the greatest opportunities to expand their market share and generate high returns for investors over the long term.

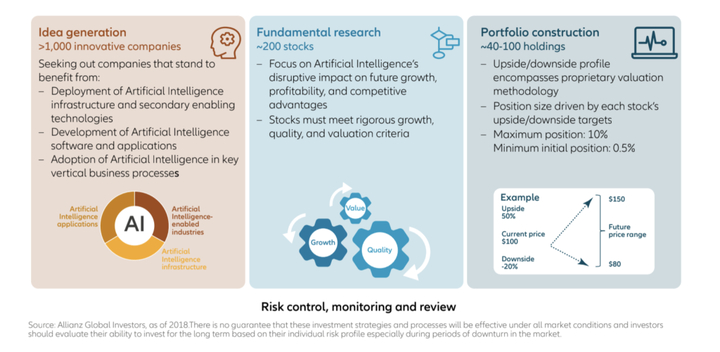

Allianz Global Artificial Intelligence was the first fund in Europe to offer investors access to all areas of the AI segment, allowing investors to participate flexibly in the various developments in the area of AI. Thanks to the comprehensive research and expertise of the fund management team, new trends find their way into the portfolio at an early stage. The strategy is intended to invest in innovative companies that develop or use AI technology across industries and worldwide, like for example semiconductors or robotics. The fund is not based on a typical technology index with a high proportion of very large technology stocks but invests in companies of all sizes.

The fund follows an active and highly selective management approach. The portfolio management team is based in San Francisco - close to Silicon Valley, the heart of digital disruption – and is supported by a large network of analysts from around the world. More than 500 investment experts from Allianz Global Investors in the world's financial hubs monitor markets, companies and their performance. Their first-hand insights and expertise provide the basis for decision making within portfolio management. In our view, fundamental company analysis is essential to understand who is likely to benefit most from disruptive AI technology.

A word from the Fund manager:

In Closing

All three of these funds offer immense upside. They capture the essence of what it means to invest in AI. And they do so in a comprehensive way. Artificial Intelligence is the new wave that will carry business in the coming years. However, this wave won't be evenly distributed.

Many tech-based funds and even those within robotics will not benefit equally to those within AI exclusively. This is due in part to the relative stagnation in those fields. Even though growth rates are still high they pale in comparison to the new frontier Artificial intelligence represents. This new tech offers practical solutions across all spectrums thus exponential growth.

These funds offer investors an ability to profit on the front and back end. Meaning that all are actively involved in the companies producing the disruptive tech. And those who will benefit from it greatly. Thus giving prospective investors the ability to profit two-fold.