BofA: The longest streak of inflows since Covid

5 APR, 2024

By Bank Of America Merrill Lynch

Bank of America Global Research publishes a new credit analysis named 'Follow the Flow'. By Ioannis Angelakis, Credit Derivatives Strategist MLI (UK) and Barnaby Martin, Credit Strategist MLI (UK).

Uninterrupted inflows into IG/HY funds

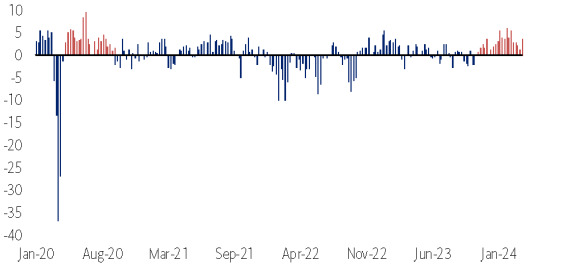

Inflows continue uninterrupted into IG and HY funds. A lower sovereign bond yield backdrop over the past couple of weeks, along with rates vol that has declined to levels last seen in early 2022, is supportive for risk-taking in fixed income space. Should government bond yields and rates vol continue to decline, we see improved inflows into higher-beta pockets in fixed income world. Overall, rate cuts and subsequent lower "risk-free" rates will incentivise fixed income investors to add more risk, benefitting the credit universe in our view.

Last week inflows

High grade funds recorded another inflow last week, the 21st in a row and largest inflow in five weeks. On the duration front, inflows were recorded across short-term, mid-term and long-term IG funds, with mid-term IG funds seeing the largest inflow. High-yield funds recorded a significant inflow last week; the largest inflow since May 2023. HY ETF funds also recorded inflows last week, more than reversing the previous week's outflow. Looking into the domicile breakdown of HY funds (chart 12), inflows were recorded across Global, Euro and US-focused funds with Global-focused funds significantly outperforming.

Government bond funds recorded another inflow last week; the sixth week of inflows in a row and largest in four weeks. Money market funds recorded a second week of outflows last week. Global EM debt funds recorded an outflow last week, the seventh in a row. Overall, fixed incomefunds posted another inflow last week, the 15th in a row. Equity funds continued to record outflows for another week; the 13th week in a row. Note that equity funds have recorded only six weeks of inflows since Feb'22. Commodity funds saw a marginal inflow last week, after 11 consecutive weeks of outflows.

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe