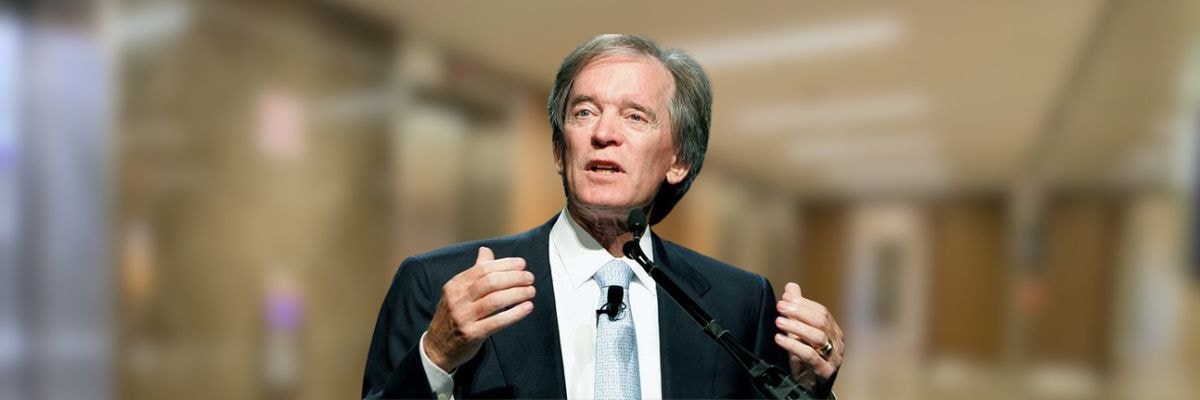

The ‘bond king’, Bill Gross, gives his new investment perspectives in the current market

3 APR, 2024

By RankiaPro Europe

The legendary pioneer of bonds and fixed income, William H. (Bill) Gross, also known as 'the bond king' published a new investment perspective, "Time Traveller".

In the article, Gross cites the infamous comment of 'irrational exuberance' from former Federal Reserve Chairman, Alan Greenspan, which characterizes the markets since 2022. 'But 'how will we know it,' as Greenspan once asked?', he wrote.

'It's hard to say. An investor can only measure a measure of their own exuberance and assume that it looks a bit like the masses. That and the high Shiller P/E (the cyclically adjusted price-earnings ratio popularized by Yale University professor, Robert Shiller) and the potential for Federal Reserve cuts in the second half of 2024. And the ongoing fiscal deficits in the range of 1 to 2 trillion dollars, as far as can be seen, will continue to prop up the economy'.

Gross says he has limited his own 'exuberance' in investing to projects of limited partnership companies (Master Limited Partnerships or MLPs), including Western Midstream Partners LP (WES) and regional banks such as Truist Financial Corp. (TFC).

'MLPs have never been covered by the press and are not owned due to legal restrictions by most mutual funds', wrote the 'bond king'.

'That and higher oil prices have led to average earnings of 28% along with deferred tax yields of 9%-10% since 2023. Better total performance than the S&P 500 over the same period of time. Regional banks? If you bought just at the time I wrote about owning a bank, maybe nine months ago, now an investor would celebrate gains of 27% along with yields of 4%-5%', Gross pointed out.

And U.S. Treasury bonds?

Gross does not like 10-year Treasury bonds. 'Too much supply', he says. 'And real rates at 2% imply a breakeven rate of 2.3% against inflation, with nominal rates at 10 years of 4.3%'.

'If inflation reaches 2.3% by the end of the year (something unlikely in my book), what can the 4.3% yield (of the 10-year bond) do? I don't understand any of the new bond gurus on CNBC when they promote bonds over the next 12 months', Gross said.

These 'new gurus' are 'betting on a flattening of the negative yield curve. Sooner or later it must become positive if the economy wants to stay positive. I'm long at two years and short at five and 10 years', he explained.

Bill Gross's Experience

Bill Gross has been a pioneer in fixed income investing for over 40 years and is considered the "king of bonds". He co-founded PIMCO in 1971 and served as CEO and CIO until he joined Janus Henderson Investors in 2014.

He retired in 2019 to focus on managing his personal assets and his private charitable foundation.

Throughout his career, he has received numerous awards, including Morningstar's Fixed Income Manager of the Decade from 2000 to 2009 and Fixed Income Manager of the Year in 1998, 2000 and 2007.

Mr. Gross became the first portfolio manager inducted into the Fixed Income Analysts Society Hall of Fame in 1996 and received the Distinguished Service Award from the Bond Market Association in 2000.

Gross oversees the William, Jeff and Jennifer Gross Family Foundation, with assets of US$ 465 million, which annually donates up to US$ 21 million to non-profit organizations involved in humanitarian causes, healthcare, arts and education.

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe