The growth of labelled bonds

17 APR, 2024

Author: Paul Skinner, Investment Director & Campe Goodman, CFA, Fixed Income Portfolio Manager at Wellington Management

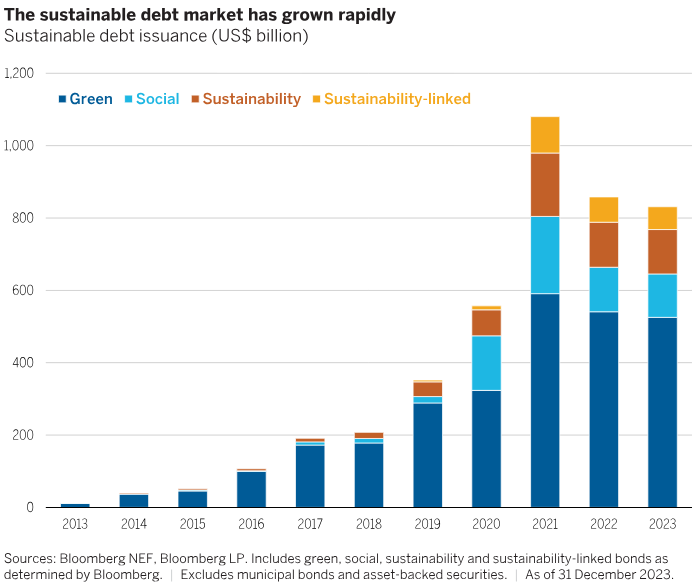

In recent years, the market for labelled, or sustainable, debt has continued to expand — with more than US$4 trillion estimated to be outstanding as of 31 December 2023 — as issuers face increased pressure from investors and regulators to finance a more sustainable future.

Total sustainable debt issuance reached roughly US$830 billion, or 16% of total global issuance, in 2023. Notably, the sustainable debt market continues to benefit from new entrants to the market. Sovereigns, supranationals and agencies remain the largest issuers of sustainable debt; however, corporates are increasingly active — particularly in the financials space.

Although sustainable debt issuance in 2022 and 2023 came down from the highs of 2021, this, in our view, is reflective of lower primary volumes resulting from rising interest rates and higher financing costs. Sustainable debt as a proportion of overall fixed income issuance continues to increase, a trend we expect to continue against a backdrop of improving bond structures as well as supportive sustainability policy and commitments.

Although, we have gained further confidence in the depth and quality of the sustainable bond market, we continue to advocate for establishing a robust framework to assess the suitability of labelled issuance for our fixed income impact portfolios, as outlined below. We also highlight how we can use our engagement edge to seek to combat greenwashing.

Labelled bonds at a glance

Labelled bonds have certain characteristics that allow holders to build customised portfolios and contribute to positive environmental and social impact through fixed income. In addition, there are different types of labelled bonds, giving issuers and holders immense possibilities.

Use-of-proceeds bonds

With their key performance indicators (KPIs) and use of proceeds (UoP) outlined at issuance, green, social and sustainability bonds allow investors to target social and environmental objectives through their fixed income allocations, complementing traditional fixed income securities within an impact portfolio.

We have also identified some secondary benefits that we believe further enhance the potential appeal of UoP bonds:

- Transparency: After issuance of green, social or sustainability bonds, issuers report on the exact projects to which the proceeds were allocated, the amounts, the impact and the achievement (or not) of targets. This helps us to verify, measure and report on the impact of our investments.

- Downside protection: In some periods of volatility, UoP bonds have not sold off as quickly as their non-green counterparts. While this may lead to a pronounced green premium in the secondary market, it highlights the potential for green bonds to exhibit stickier characteristics and offer more stable returns in periods of market stress.

Sustainability-linked bonds

Sustainability-linked bonds (SLBs) allow issuers to raise finance without ring-fencing the proceeds for a social or environmental project. Instead, they tie the future coupon payment to a sustainability performance target (SPT), which measures improvements in the borrower’s sustainability profile — for example, an overall reduction in greenhouse gas emissions associated with products manufactured. Some issuers have faced criticism for SLBs that lack robustness or incentive to allocate the proceeds with sustainable objectives in mind.

Nevertheless, we see a place for robust SLBs within our fixed income impact portfolios. We have identified some secondary characteristics enhancing their potential appeal:

- Accountability: SLBs offer an alternative mechanism for companies to prove their commitment to sustainability. With coupon payments tied to the achievement of a target, SLBs impose a direct financial penalty on the issuer if their target is not met.

- Flexibility: SLBs give issuers greater flexibility than UoP bonds. They allow more types of issuers — including those whose products or services don’t have a direct social or environmental impact — to enter the sustainable debt market and thereby facilitate a larger collective effort towards increasing the sustainability of more issuers’ operations.

Conclusions

We expect the labelled-bond market to keep growing, given the continuing establishment of carbon-reduction commitments by corporations and governments and increased demand from investors. This evolution will pose challenges for investors using an ESG or impact lens.

While robust regulation in the relatively new labelled-bond market remains lacking, the EU’s European Green Bond Standard — a voluntary, high-quality standard for green bonds due to be implemented in December 2024 — should increase the transparency and robustness of green issues. The same principles could also be used to develop a social and sustainability bond standard, leading to greater uniformity across sustainable debt issuance. Conversely, the European Green Bond Standard could reduce the appeal of existing green bonds that don’t meet the standard. This could create a “haves versus have-nots” pricing dynamic, incentivise stronger, more ambitious terms and support the transition to a sustainable future.

Irrespective of regulation, we believe that it is essential for responsible asset owners to have a robust framework for analysing labelled issuance and that this will ultimately help to establish higher ESG standards in the market and increase the likelihood of generating real-world impact.

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe