The new ‘gold rush’: the central role of emerging countries and sanctions over the Ukrainian war

3 APR, 2024

Author: Zouhoure Bousbih; Emerging Markets Strategist at Ostrum AM (Natixis IM)

Gold prices hit a historic record by surpassing $2,250 per ounce following the latest FOMC. Over the course of a year, gold prices have surged by 12%. While financial conditions determine the short-term outlook for the precious yellow metal, the increasing demand from emerging markets central banks is a significant factor for its long-term trend.

Gold in Central Banks' Reserves

Gold has unique characteristics: no risk of default and a real value. These properties have given it a central role during the development of "paper" currencies, which were based on the gold standard, meaning that currencies were exchangeable for a certain weight of the precious yellow metal. Western central banks then held significant gold reserves to ensure the value of their currencies until the end of the Bretton Woods system in 1971, which ended gold's role as the guarantor of the value of global currencies.

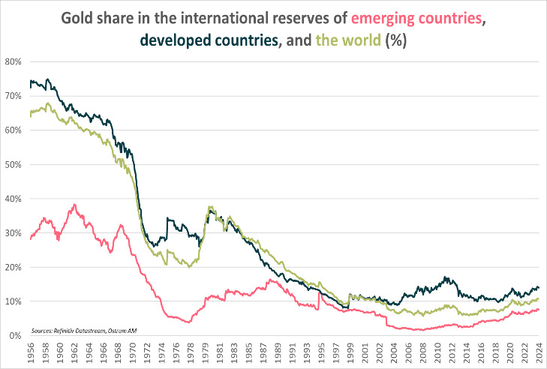

Since then, the share of gold in the reserves of Western central banks has continued to decline, dropping from nearly 72% in 1956 to 20% in the early 1990s, as shown in the graph below.

This is explained by the success of Central Banks in controlling inflation after the 1980s. Gold, which was used to quickly raise capital for interventions in the foreign exchange market to defend currencies, appeared to be less and less necessary. However, gold currently represents 10% of Central Bank reserves, which is not insignificant.

2008, a turning point in EM central banks

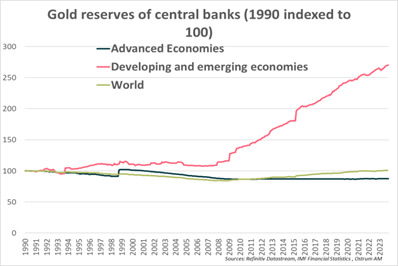

While the precious yellow metal currently represents only 7% of the reserves of Central Banks in emerging countries, their gold reserves have more than doubled since 2008, as shown in the graph below.

China, Russia, India, and Turkey are the main contributors. The rapid increase in the gold reserves of emerging markets central banks reflects a willingness to diversify away from the dollar, which still represents two-thirds of central banks reserves globally.

The declining confidence of emerging countries in the greenback is linked to both economic and geopolitical considerations. Indeed, the 2008 financial crisis highlighted the liquidity risk of the dollar, eroding confidence in the stability of the American financial system. In the same year, China launched its yuan- based currency swap framework to provide liquidity to emerging markets central banks facing a shortage of dollars.

The colossal indebtedness of the United States also raises fears of a loss of confidence in the greenback, which could support the demand for gold. According to the latest projections from the CBO, US public debt could reach 107% of GDP by 2029, surpassing the peak of 105% reached during World War II.

What substitute then for the dollar? The Chinese currency is not yet ready to compete with the greenback, as the growth of its financial markets does not keep pace with its economic expansion. The euro carries a political risk, as demonstrated by the Brexit episode. Therefore, emerging markets central banks have turned to the barbarous relic to diversify their reserves.

War in Ukraine revived the appetite for the precious yellow metal

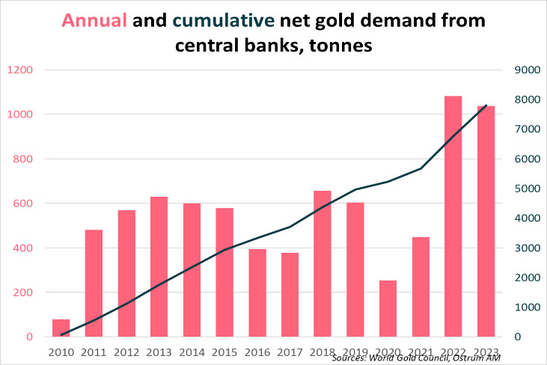

The G7's decision to freeze the 300 billion dollars in assets of the Central Bank of Russia raised the question of whether reserves could be better preserved in another form, shielded from sanctions. Since the outbreak of the war in Ukraine, central banks' net purchases of gold have significantly increased, as shown in the graph below.

Since 2010, central banks have accumulated 7,800 tons of gold, with more than a quarter purchased in the last two years. Most purchases come from emerging countries. China is the largest buyer of gold. Last year, the PBoC reported a total increase of 225 tons in its gold reserves, the largest increase since 1977! Its gold reserves reached 2,235 tons but represent only 4% of its total reserves.

Poland is the second largest buyer. This is explained by the country's proximity to the Ukrainian conflict. Between April and November, the National Bank of Poland (NBP) bought 130 tons of gold, increasing its gold holdings by 57% to 359 tons. This is also a record purchase volume for the NPB. Its governor had indicated a willingness to increase the share of gold in the country's international reserves from 12% (current level) to 20%.

The year 2024 is also expected to be a year of strong demand for gold, due to the geopolitical context – war in Ukraine, tensions in the Red Sea, and conflict in the Middle East – but also because of the busy electoral calendar. Most elections, including the U.S. presidential election, have global ramifications, reflecting the overlap between politics and geopolitics.

Gold to circumvent sanctions: The Example of Russia

Gold transactions offer advantages for bypassing sanctions, such as anonymity, low traceability, and alternatives to Western financial centers where the United States and its allies can restrict trade flows. Following the U.S. and European sanctions imposed after the annexation of Crimea in 2014, Russia began significant gold purchases. The graph below depicts the share of gold in the reserves of the Russian Central Bank.

The proportion of the precious yellow metal in reserves increased from 10% in 2013 to 26% in 2023. Since 2013, Russia had been preparing for potential sanctions. Its strategy of accumulating gold allowed it to withstand the impact, as the gold market remained isolated from the sanctions.

The sanctions imposed by NATO only affected maritime transport and trade to Russia. After British sanctions prohibited gold imports from Russia, the United Arab Emirates quickly became a hub for Russian gold transactions, enabling Russia to exchange its gold for dollars and thus circumvent NATO sanctions. The United Arab Emirates imported 96.4 tonnes ($6.2 billion) of Russian gold in 2022, compared with 1.3 tonnes imported in 2021.

Conclusion

Central banks' interest in gold grew after the 2008 financial crisis, which revealed the liquidity risk of the dollar. In 2022, the freezing of Russia's $300 billion reserves by the G7 countries following the invasion of Ukraine served as an electroshock for emerging countries. In the absence of an alternative to the dollar, gold quickly became the way to preserve reserves from U.S. sanctions. The demand from emerging markets central bank for the precious yellow metal is expected to remain high due to the geopolitical context: war in Ukraine, tensions in the Red Sea, and conflict in the Middle East. This is a decisive factor for long-term price trends.

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe