What are the top 3 funds to invest in Indian equities?

27 JUN, 2023

By Teresa Blesa from RankiaPro Europe

India is an emerging market that offers interesting investment opportunities, including in the equity sector. With its robust financial system and well-managed monetary policy, India has attracted the attention of international investors seeking attractive returns and portfolio diversification.

In this article, we analyze the top three funds to invest in Indian equities, based on Morningstar data from the last five years.

Edmond de Rothschild India ID

| ISIN | FR0011076116 |

| Currency | Euro |

| Benchmark | MSCI India NR USD |

Patricia Urbano and Xiadong Bao, managers of Edmond de Rothschild India ID fund

Edmond de Rothschild India is an equity investment fund that selects companies in India with reasonable valuations and high visibility of their prospects. The investment approach is based on macroeconomics and fundamental analysis of securities to build a portfolio focused on strong convictions in different sectors, which means that the portfolio management team is not bound to the benchmark index and adopts a selective approach in stock selection.

The Indian economy has significant structural advantages that support two major growth drivers: consumption and infrastructure investments. In recent years, India has implemented important structural reforms. Not only does it have strong growth potential, but it has also taken measures to prepare for higher-quality growth. India also benefits from being currently geopolitically insensitive to the China-US confrontation, which reassures investors seeking stability and supply chain diversification opportunities.

With better growth visibility, adequate incentives, and an abundant skilled workforce, India has benefited from the ongoing shift in the supply chain: the "China plus one" strategy. Indian-based suppliers have started providing products for multinational companies like Apple, Samsung, Dalkin, and Tesla.

The EdR India fund benefits from an active and conviction-based portfolio management that combines fundamental and macroeconomic analysis. Given the specificities of the Indian market, placing a strong emphasis on in-depth knowledge of selected companies is essential.

The investment process aims to optimize the balance between valuations, profit growth, and visibility, through a combination of top-down and bottom-up approaches that are divided into three stages:

Robeco Indian Equities I €

| ISIN | LU0491217765 |

| Currency | Euro |

| Benchmark | MSCI India NR USD |

The Robeco Indican Equities I € fund was established in 2010. Its benchmark index, similar to the EdR India ID fund, is the MSCI India NR USD.

Its stated investment objective is long-term capital appreciation through exposure of at least two-thirds of its total assets in equity securities of companies that are legally headquartered or primarily conduct their business activities in India.

The fund is predominantly exposed to five sectors, namely financial services (28.97%), cyclical consumer goods (13.73%), technology (12.31%), defensive consumer goods (11.03%), and basic materials (9.63%).

Wellington India Focus Equity Fund USD GD Ac

| ISIN | IE00BF2ZTC24 |

| Currency | Dollaro |

| Benchmark | MSCI India NR USD |

Niraj Dilip Bhagwat, Partner of Wellington Management and manager of Wellington India Focus Equity Fund

The objective of the Wellington India Focus Equity Fund is to generate attractive long-term returns by investing in a concentrated portfolio of high-quality companies that are undervalued by the market and are either based in India or operate in the country.

The fund is managed in a flexible and benchmark-agnostic manner. The sectoral allocations and market capitalization profile of the portfolio are flexible and result from the stock selection process.

We aim to identify and invest in established and emerging companies that exhibit high quality but may not yet be recognized as such by the market, presenting attractive valuations. One key factor in determining the quality of a company is evaluating its governance standards, including how it engages with all stakeholders.

We believe that the higher profitability (in terms of ROE/ROIC) of high-quality companies is often underestimated by the market, and therefore, these companies can generate attractive equity returns. Our investment approach is bottom-up and based on fundamental research. My team, which includes four dedicated analysts, and I are experienced investment professionals with a long-standing focus on the Indian region, averaging 22 years of experience.

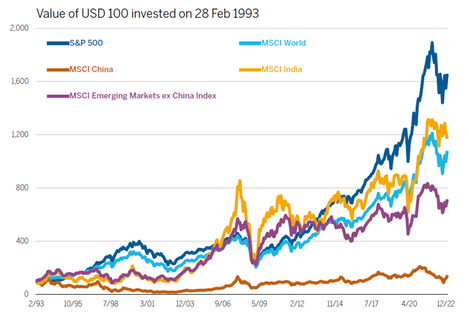

While often overshadowed by the attention many investors pay to China, India has quietly been one of the best-performing equity markets, not only in Asia but globally, for over three decades (see the chart below). We believe that today, India holds the most exciting long-term economic prospects of any market in the Asian region and perhaps any market worldwide.

Source: MSCI, Wellington Management: MSCI, Wellington Management. | Dati del grafico: 28 febbraio 1993 - 31 gennaio 2023

Together with my investment team, we see interesting opportunities in the real estate, banking, and manufacturing sectors, as we believe these sectors are both drivers and beneficiaries of India's structural economic growth. On the other hand, we are cautious about software and IT services companies as we believe they will face increasing challenges due to weakening foreign demand.

Investment Risks

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe