Top 5 Best Equity Funds to invest in Gold

Updated:

11 MAR, 2024

By Jose Luis Palmer from RankiaPro Europe

Investing in gold is one of the favorite strategies for investors around the world. We wanted to analyze the best current options available when it comes to investing in gold (funds distributed in Spain to invest in Gold), as Its value changes in relation to the metal's demand and offer, but also in relation to the gold as an active. Considered a safe haven asset, it becomes the investors' star in moments of inflation or market crisis, because it has a reverse relation with interest rates. Its price is usually much more steady than other assets.

The Covid-19 crisis has reinforced this tendency and the number of investors deciding to put their assets into this commodity, investing in gold has increased. Furthermore, investing in this commodity represents an important role within the investment portfolio, from a strategic perspective.

During the last few years, Central Banks have been crucial on gold price fluctuations. Rate hikes undertaken by the Fed and the ECB to combat inflation have, once again, boosted the price of gold as a safe haven. 'Gold prices paused from their strong surge since the beginning of the month after hitting a peak close to 2200 dollars on Friday. Gold benefited from continued central bank purchases and Jerome Powell’s comments last week as markets continue to expect interest rate cuts later this year. The forthcoming CPI report will play a crucial role in shaping expectations regarding the Federal Reserve's path toward interest rate cuts. A softer reading could strengthen the case for an earlier rate cut, providing support for gold prices to rise further' Wael Makarem Financial Markets Strategists Lead at Exness.

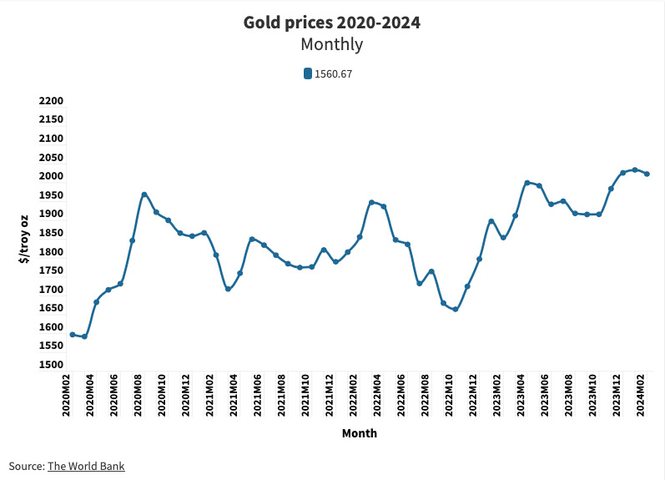

The evolution of the price of gold since 2020 had shown some ups and downs, and with the current situation of the markets, commodities like gold, could be an interesting investment opportunity.

Looking at the above numbers we wanted to see if it is a good moment to invest in gold, as well as what are the best investment opportunities that this yellow metal can offer - How have been the funds that invest in gold affected by the latest events and the central banks' fight against high inflation?

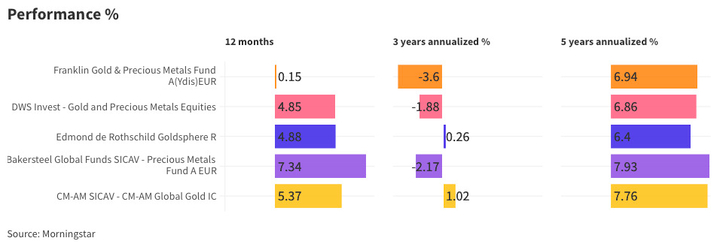

This ranking has been made according to the 5 years annualized performance and only considers funds in the Gold and Precious Metals Sector Equity category at MorningStar.

Edmond de Rothschild Goldsphere R

Fund Manager: Christophe Foliot and Adeline Salat-Baroux

This fund was created in 2008 and manages more than 25M€. The objective of the fund is to outperform the benchmark, the FTSE Gold Mines Price Index, by investing primarily (at least 70% of net assets) in the gold exploration, mining, processing, and/or trading sector. Its volatility over a 5-years period is 32.38% having suffered a maximum drawdown of -35,97%, and it has a Sharpe ratio of 0,25.

Bakersteel Global Funds SICAV - Precious Metals

Fund Manager: Mark Burridge

This fund was created in 2015 and its objective is to achieve an appropriate return commensurate with the investment risk. As a result of its specific investment policy, the sub-fund may be subject to pronounced cycles and widely varying conditions in stock markets. Based on the Investment Manager’s view of global supply and demand factors, the weightings within the portfolio may vary and, from time to time, a substantial portion of the Sub-Fund’s assets may be invested in any one country and/or in securities providing exposure to a specific category of precious metals. During the last 5 years, the fund has a 35,03% volatility with a maximum drawdown of -38,32%. On the same period, the Sharpe ratio was 0,26.

DWS Invest - Gold and Precious Metals Equities

Fund Manager: Avi Feinberg & Darwei Kung

This fund was launched in 2008. The fund invest in shares of promising international companies active in the precious metals sector. The fund, managed actively, does not use a benchmark as a reference and searches for national and international companies whose main actives are related to the precious metal sector. During the last 5 years, the fund had a volatility of 25.7% and a Sharpe ratio of -0.08.

Franklin Gold & Precious Metals Fund A(Ydis)EUR

Fund Manager: Steve Land and Frederick Fromm.

This fund was created in 2010. The objective of this fund is long-term capital growth by investing primarily in publicly traded equity and equity-linked securities that qualify as marketable securities, worldwide including emerging markets. This fund managed by Franklin Templeton registered a volatility of 32,28% during the last 5 years, and a max drawdown of -38,88%, with a Sharpe ratio of 0,28. The fund manages more than 317M€.

CM-AM SICAV - CM-AM Global Gold IC

Fund Manager: Charlotte Peuron and Aloys Goichon.

By Charlotte Peuron and Aloys Goichon

CM-AM Global Gold is a precious metals producers fund. It’s an equity fund. Generally speaking, we invest between 70% to 80% in gold producers and we have some diversification in silver, and platinum group metals producers. We have also a strong position in royalties/streaming companies. We classify the companies into 4 categories according to their production volume, the number of mines, and risk level.

We are stock pickers. To select companies we conduct a dual financial and extra-financial analysis. This allows us to fully understand and measure all risks. All the mines of each company are analyzed:

- 1: Technical characteristics: production, grades, the life of mine, size of reserves, location;

- 2: ESG criteria: energy used, reagent volumes used, local community relationships, safety.

They all have an impact on production volumes, production costs, investments to be made... and therefore the profitability of projects. Of course, we are also focusing on the management track record. Good execution of the project (on time, on budget…) means better returns for stakeholders and shareholders. Of course, we include country risk (tax, mining code…) and security risk into our analysis.

To build the portfolio, the weight of each company depends on the totality of these risks and opportunities identified during this double analysis, and the potential return of the stocks. Our portfolio is concentrated, we can own between 40 to 60 companies.