Will China’s economy rebound?

8 APR, 2024

By Diogo Gomes

Will there be an organic recovery for China’s economy? Investors often ask this, which is understandable given the downcycle of almost three years amid global economic uncertainties. It is too early to answer definitively at this point, but there are definitely encouraging signals.

We look at signals in and outside of China. So far several leading economic indicators show positive changes, pointing to stronger export demand that could precede a Chinese rebound as well as a recovering global economy.

Global signals

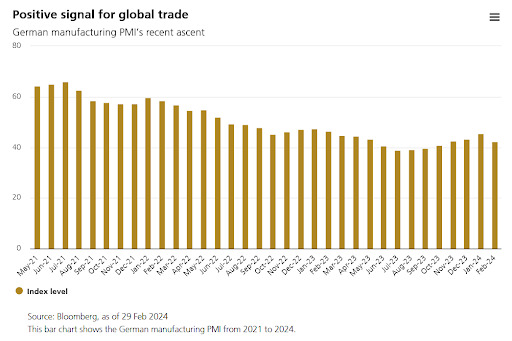

Germany is Europe’s largest economy, and the state of its manufacturing sector gives an insight into the overall European economy and even the health of global trade. Manufacturing activities, measured by the Market Germany Manufacturing PMI, appear to have bottomed out last year.

The German PMI has been trending downward since late 2021, falling to its lowest point in three years last summer. Since then the PMI has climbed back, and because it measures the activity level by surveying purchasing managers who tend to have early access to data about their company’s performance, the index’s ascent is a good signal for global trade. That said, it remains to be seen if the nascent rebound can find its legs and pick up momentum, particularly as the PMI pulled back in February and still signals a recession (i.e. below 50).

Germany is not the only country with positive data. Export growth turned expansionary for South Korea and Taiwan about the same time the German PMI started to improve last year, with a recovery in semiconductor exports playing a big part. China continues to be the largest trading partner for South Korea and Taiwan.

For South Korea, exports grew for four consecutive months and their January gain is the largest in almost two years. The fastest semiconductor sales in six years hurried the overall pace, as did sales of cars and home appliances. Shipments to the US and Japan increased alongside shipments to China, which rose for the first time since May 2022.

Taiwanese exports followed a similar pattern. Electronic components sales spanning from semiconductors to audio and video equipment accelerated early this year, ending a 14-month decline for these strategically important sectors for Taiwan. China bought more Taiwanese goods, while shipments to the US and ASEAN countries also rose.

Signals from China

Turning back to China, we expect to see more improvement in the domestic economy this year. The Chinese Producer Price Index (PPI), which tracks the change in prices domestic producers receive for their goods and services, offers telltale signs on wholesale inflation and the health of the overall economy. The PPI has been declining since late 2021 and may have reached a bottom last summer. It has since moved steadily higher, suggesting possible stabilization of the Chinese manufacturing sector.

After a 12 to 18 month destocking cycle, PC and smartphone sales in China are recovering from their trough last year. Smartphone sales started to look up during the fourth quarter of last year, marking the first quarterly increase in more than two years. This could be an early indication that a bounce back in domestic demand and consumer confidence is just around the corner. Indeed, consumer confidence appears to have stabilized after a sharp drop off in 2022. Organic demand alone is probably not enough to drive a “V” shaped turnaround for the Chinese economy, but we are not ruling out the possibility.

Signals on the ground

Even though sustained policy support for the economy was pledged, changes and measures announced at the 'Two Sessions' strongly suggest a low likelihood for aggressive stimulus in the near future. Stricter controls on local government financing vehicle (LGFV) debt, insolvent property developers, securities regulations and so on tell us that policymakers are still very much focused on de-risking, which is in-line with our findings on recent research trips to Zhejiang, Hunan and Guangdong. We observed less-than-exciting industrial activities, much stricter debt controls and project reviews for new infrastructure investments by LGFVs as well as more focus being put on reducing leverage ratios for local state-owned enterprises (SOEs). In our view, these policies will slow the total social financing (TSF) growth this year and hurt earnings outlook for the market. Given the tone of the Two Sessions, we now see stronger pro-growth policies at the next Politburo meeting late April to be less probable.

That said, there are positive signals on the ground. For example, export growth so far this year appears decent in Yiwu (a manufacturing hub of daily commodities), and manufacturing investment demand looks better than expected despite compressed margins overall and a still negative PPI. It is encouraging that entrepreneurs are working to improve efficiency and upgrading equipment amid a tough market environment, and industrial capital expenditure is being supported by local governments through subsidies.

Field trips and company visits in different regions of the country may enable us to pick up and gather early hints of a change in demand or direction in the real economy. This could help us identify any signals that might have been missed by others.

Related articles

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients worked

This is how the deposits that the Argentarii, the ‘bankers’ of Ancient Rome, offered to their clients workedBy RankiaPro Europe