Thematic funds chosen by selectors for 2020

27 JUL, 2020

By Sara Giménez

Investing in megatrends represents a typology of investment with great opportunities today. This topic that has developed in recent years and the crisis provoked by COVID-19 has shown that thematic funds can be great allies for portfolios. Artificial Intelligence, scarce resources management or aging population are just some of the topics which more and more investment funds decide to focus on. But, what are the best thematic funds?

Last May we launched the first edition of our RankiaPro Megatrends and Thematic Investment survey. Thanks to it, we were able to discover favorite investment themes among professionals for 2020.

In this article we gather the most chosen thematic funds according to responses to the question: "Can you list any thematic fund that you currently have in your portfolio?" In the table below you can find the 11 thematic funds most present in the selector's portfolios in 2020. In addition, we have added their categories, 3-year returns and the sharpe ratio.

Thematic funds chosen by selectors for 2020

| ISIN | Fund | Category | 3 year performance | Sharpe Ratio |

| LU1279333329 | Pictet-Robotics | RV Sector Tecnología | 18.48% | 0.79 |

| LU0104884605 | Pictet-Water | RV Sector Agua | 7.04% | 0.50 |

| LU1722863211 | BGF World Technology | RV Sector Tecnología | - | - |

| LU0386856941 | Pictet-Global Megatrend Selection | RV Global Cap. Flexible | 8.78% | 0.56 |

| LU1548496709 | Allianz Artificial Intelligence | RV Sector Tecnología | 21.55% | 0.79 |

| LU0348927095 | Nordea 1 – Global Climate and Environment Fund | RV Sector Ecología | 8.83% | 0.53 |

| LU0256845834 | Pictet-Security | RV Global Cap. Flexible | 10.99% | 0.70 |

| LU0415391514 | Bellevue Funds (Lux) BB Adamant Medtech & Services | RV Sector Salud | 12.47% | 1 |

| BE0948502365 | DPAM Invest B Equities NEWGEMS Sustainable | RV Global Cap. Grande Blend | 17.69% | 1.05 |

| AT0000A03N37 | ERSTE WWF Stock Environment | RV Sector Ecología | 16.26% | 0.77 |

| LU1819480192 | Echiquier Artificial Intelligence | RV Sector Tecnología | - | - |

*Data obtained as of July 1, 2020 from Morningstar. Order of appearance based on the number of portfolios in which they are present.

Pictet-Robotics

Comment from the Pictet-Robotics management team

The Pictet-Robotics was the most chosen thematic fund. It invest in global companies operating in areas such as robotics, automation, autonomous systems, sensors, microcontrollers, 3D printing, data processing, activation technology applications and components, as well as image, motion and voice recognition, and other technologies and software that make it possible:

It stands out positively (+ 33.08%, class I in USD) in the last 3 months:

The strategy has benefited from the rebound in semiconductor and software stocks after falls during a volatile March.

Before the COVID-19 outbreak, we had been relatively constructive about the prospects for our companies. The markets had a good start to the year, and we reaped profits for fear of the potential risks of the virus. We know that COVID-19 has had a great impact on certain markets and companies. However, we rely on the medium-term drivers of the areas the fund focuses on: robotics, automation, and AI.

Historically, in periods of market weakness the fund has generated positive returns, especially in areas of the portfolio that are both cyclical and secular in growth.

Movements towards local production and multiple sourcing are positive for the fund, as they can only be achieved through the most efficient use of new technologies, automation (Daifuku), factory automation (Fanuc, Yaskawa, Siemens, SMC , Rockwell Automation) for example.

In the long term, the coronavirus crisis could even accelerate some important trends, such as 1) rollback/multisourcing due to deglobalization, 2) the move to software as a service (Saas) and cloud infrastructure, as directories of companies prioritize business resilience, operational redundancy, and resource flexibility.

Pictet-Water

Comment from the Pictet-Water management team

The second most-chosen thematic fund is also from Pictet AM: the Pictet-Water. It Invests in shares of active global companies in the water sector, focusing on those dedicated to water supply, treatment services, water technology, as well as environmental services. This strategy can be included in the allocation of portfolios from 4 points of view:

The strategy has remained positive in the first months of the year

The water supply segment has been the weakest segment, with stocks rebounding less than the portfolio average as a result of their stronger resistance in March. Similarly, investors took advantage of lowered prices for water technology stocks, especially in the diversified industrial and consumer segments, which exhibit a higher correlation with prospects for economic growth.

Ecolab (water and hygiene products and services), Danaher (water treatment and quality monitoring), Thermofisher (quality monitoring) and Sabesp (Brazilian water service) were the most important contributors. On the downside, Xylem was the main detractor. In the medium term, active companies in monitoring water quality (Danaher, Thermo Fisher, Agilent) could continue to be well positioned with their products, as they also produce analytical instruments for laboratories, hospitals and disease control centers.

In the medium and long term, water technology may experience greater structural demand. For example, advanced disinfection of water using UV technologies (Xylem, Danaher, Coway) is capable of inactivating pathogens more quickly and effectively than chlorine or other traditional methods.

BGF World Technology

The BGF World Technology Fund was launched in March 1995 and is currently managed by Tony Kim since 2017. Tony and his team are based in San Francisco, right next to Silicon Valley, where many of the leading and emerging tech companies are located.

The team's philosophy is to diversify across industries, geographies, capitalization, and investment styles. Furthermore, the fund usually includes companies that are not in the benchmark and has a bias towards emerging markets and mid-cap companies relative to its benchmark.

The fund strikes a balance between established leading technology companies that drive innovation, and disruptive startups that will become tomorrow's winners.

Its portfolio, which ranges between 80 and 120 stocks, is headed by the giants Microsoft, Amazon and Apple.

Pictet-Global Megatrend Selection

Comment from the Pictet-Global Megatrend Selection management team

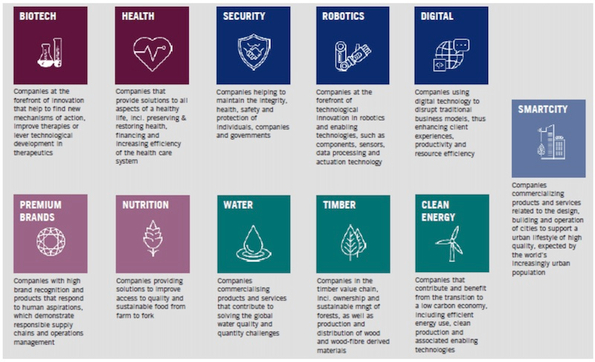

Through a portfolio that invests in a balanced way in each of Pictet AM's 11 individual thematic strategies, the fund allows to take advantage, in a single investment vehicle, of the set of global megatrends that sustain the long-term growth of the companies selected in our 11 thematic strategies:

All the thematic strategies contributed positively (robotics, biotechnology and the clean energy strategy mainly) with the exception of water, which had a more or less flat route, and nutrition, which did not take advantage of the rebound due to its defensive nature.

In the last 3 months, the thematic strategy has grown by + 23.06% (class I USD):

In the short and medium term, companies that propose solutions to improve the telework environment, as well as those that invest in health solutions, should be well positioned. This is the case of our Digital and Security strategies, as well as Biotech and Health, respectively.

In the long term, many of our themes invest in companies that are structurally well positioned. Beyond the obvious candidates mentioned above, industrial automation could also be a gamble, due to crisis-driven deglobalization. Robotics and Clean Energy invest in these companies. Cities will need to increase their resilience to future epidemics, in addition to the current urban transformation agenda in the face of climate change, including the importance of water treatment to ensure that pathogens are adequately controlled and eliminated. SmartCity and Water benefit from these trends.

Allianz Artificial Intelligence

Comment from Sebastian Thomas, manager of the Allianz Global Artificial Intelligence fund

The investment in the subject of Artificial Intelligence (AI) has shown great strength during the moments of tension experienced in the markets at the beginning of the year. Companies linked to teleworking or the new reality of confinement (such as online commerce, streaming video platforms or video games) were able to weather the storm well.

Artificial intelligence has also shown how it can help in the event of a future pandemic, both in the design of new treatments and in the development of tracking applications. In the recovery of the last months in the markets, many of these companies have kept the good tone.

But the appeal of this trend is not only what we have seen during recent years or in this turbulent 2020. The best is yet to come. Artificial Intelligence (AI) is already becoming part of our daily lives. Upcoming innovations not only integrate technology more seamlessly, but usher in the emergence of new products and services that will improve our lives.

More and more companies are exploring how they can use AI to improve their products and experiences, and get competitive advantages. The deployment of 5G networks, the Internet of Things and the search for solutions to protect the environment (with smart cities or agriculture of low impact and high performance, for example) go through the use of AI applications.

Nordea 1 – Global Climate and Environment Fund

Comment from Thomas Sørensen, Co-Manager of Nordea's Global Climate and Environment Strategy

The Covid-19 pandemic is the world's main focus right now, but when we get over it, normal life will resume. People will continue to need transportation to reach their destination, and automakers and aircraft manufacturers will continue to improve their energy efficiency.We invest in the medium term, and we believe that this megatrend remains intact.

After launching Nordea's Global Climate and Environment Strategy just a few months before the 2008 credit crisis, we developed a strong risk management approach. This framework is the result of the lessons we learned during this difficult period. To avoid excessive risks from individual and conglomerate stocks, our disciplined approach is applied at the portfolio level, including limits on the contribution of individual and sector stocks to total risk.

The strategy has a broad base with both stable and economically sensitive elements that we have combined into three groups: Resource Efficiency, Environmental Protection and Alternative Energy, to create a solid portfolio. We have seen positive relative performance from the most stable items in the portfolio, such as some of our utilities holdings, and the fund has, of course, benefited from its minimal exposure to finance and energy.

When we came out of a period of high performance in 2019, we entered the first quarter with shares in the industrial areas of energy efficiency and ecological mobility that already seemed expensive, so in the first part of this quarter we reduced or sold some of these, reallocating money towards more stable areas. Now, however, indiscriminate mass selling is creating opportunities in the economically sensitive market parts and we are directing money towards strong companies that offer climate solutions that are well positioned to benefit from the climate and environmental megatrend.

Pictet-Security

Comment from the Pictet-Security management team

Pictet-Security invests in shares of global companies that contribute to ensuring the integrity, health and freedom of individuals, companies and governments. The investment universe is wide and it can be summarized as follows:

The global security market is constantly growing:

In the last 3 months, the strategy outperformed the MSCI ACWI (21.44% vs. 19.67% for class I in USD) mainly due to the strong performance in May of three defensive segments (Cybersecurity, Life Sciences and Data Centers):

Pictet Security is defensively positioned within its investment universe, with an emphasis on the Life Sciences, Cybersecurity, Data Centers (cloud infrastructure) and Payment Processing (fintech) segment, while focusing less in transport safety and in industries.

In mid-May, we witnessed a rebound in cyclical stocks, prompting us to reduce the level of liquidity and add physical security and IT security. We collected benefits from companies like DLR and Extra Space.

We believe that the market is close to a recession. Therefore we reduced our 2021 EPS estimates by 7% on average, 15% for deeply cyclical companies, and applied a multiple of recession. Some stocks are already trading in that environment and could be the first candidates for any reinvestment, should we begin to have more clarity on the next phase of the pandemic.

Currently, we see opportunities in three areas: 1) Telecommuting is increasing the massive emergency notification vulnerabilities: CyberArk, Proofpoint, Everbridge. 2) Strong demand in data centers is accelerating the move to the cloud: Equinix, Digital Realty Trust. 3) Life science companies to accelerate the development, manufacturing and delivery of tools and diagnostics as well as Covid-19 testing: Thermo Fisher Scientific, PerkinElmer, Eurofins.

50% of the Portfolio is in a defensive position and, in general, in a crisis like this, the security industry tends to benefit. In the long term, regulations around the world will change after this crisis and innovation will increase, while urbanization will also benefit from new security solutions.

Bellevue Funds (Lux) BB Adamant Medtech & Services

Comment from the Bellevue Medtech & Services management team

The thematic fund invests in Medical Technology and Services, leaving out everything related to medicines (we do not invest in pharmaceuticals, biotechnology or generics), so it has a lower binary risk. It is a defensive sector thanks to stable demand, not dependent on the economic cycle, taking advantage of the fundamentals of the health sector, considered a mega-trend.

The medical technology part benefits from all the innovation that reaches the sector through companies. An example is Edwards Lifesciences, a leading aortic valve repair company:

The Services part mainly includes insurance companies and hospitals. We have seen some concern in the sector about the promise of Democratic candidates to apply Medicare for All in the US. However, after Joe Biden's victory to face Trump, he leaves a clearer picture for these companies, with great potential.

Making predictions of COVID's impact on the economy is tremendously complicated

At the start of the pandemic, the entire healthcare system was dedicated to COVID-19 patients, with certain surgical procedures postponed, such as hip or knee. This will generate future demand, since they cannot be postponed forever. For this reason and due to its defensive nature, we are convinced of the best performance in this sector. Lastly, the team has attended different virtual conferences with companies in the sector and, since mid-April, they all agree that each week that passes, there is an increase in demand, and that they hope to reach normality by the end of this year.

DPAM Invest B Equities NEWGEMS Sustainable

Comments from the DPAM NEWGEMS Sustainable management team

With a long-term investment horizon, innovation in its DNA, multi-thematic and sustainable; DPAM Invest B Equities NEWGEMS Sustainable is a strategy that focuses on the winners of the future and that, in the current COVID-19 crisis, has proven to be a core resistant and defensive fund of any portfolio. The fund invests in companies that benefit from the 'stay at home' situation and in companies in high growth areas such as Health Software and Technology.

The fund has outperformed its benchmark, MSCI World, by more than 16% (May 2020), and since the implementation of the current multi-topic investment process in October 2017, it has outperformed the MSCI World more 30%.

It is one of the strategies that best exemplifies DPAM's convictions of sustainable investment globally

Focused on companies that contribute to the society of the future (both at the level of consumers, companies, government and the environment). Through the fund, investments are made in 7 main themes that allow adding value to society: Nanotechnology, Ecology, Well-being, Z Generation, E-Society, Industry 4.0 and Security.

The construction of this portfolio is diversified, both capitalizations and investment themes. It invests in 70-80 stocks with different weightings and is completely invested (maximum 5% in cash). NEWGEMS's main objective is to improve the performance of the MSCI World All Net Return Index over a period of 5 consecutive years.

Experienced team of managers and analysts made up of Alexander Roose (CIO Equity), Quirien Lemey, CFA, Dries Dury, CFA, Tom Demaecker, CFA and Ophélie Mortier (head of ASG) and their team (The Center for Responsible and Sustainable Investment Competence from DPAM).

ERSTE WWF Stock Environment

Comments from the ERSTE WWF Stock Environment management team

The Erste WWF Stock Environment fund invests in companies that seek to solve major environmental challenges such as climate change, water scarcity or the efficient use of resources. The fund applies strict selection criteria: it only invests in solution providers that generate more than 50% of their income from relevant environmental technologies and that have been approved by an expert council in which the World Wildlife Fund (WWF) Austria participates. In this way, the fund prevents its strategy from being diluted, which is the case of many of its competitors.

Since the launch of the master thematic fund in 2001, Erste AM's strategy has been to identify global environmental megatrends at an early stage and select the companies that are most likely to solve these challenges and thus benefit from inherent growth potential. While this approach carries a strong bias toward small and mid-cap stocks, the goal is to buy and hold those stocks as their market cap increases.

We do not believe that environmental companies are experiencing a bubble like the one experienced by dotcoms in the early 2000s, since their potential responds to inexorable long-term physical processes and the segment receives increasingly solid support from the regulatory sphere. However, we do think that the stock selection and the management of positions are decisive for obtaining benefits - Enphase grew by 453% in the 2019 financial year - and to avoid the values that are overheating. Similarly, at specific times we focus more on quality to avoid companies that are affected by the collapse of cash flows, as during the COVID-19 crisis.

We monitor the positive environmental impact generated by the companies in which we invest and regularly publish this information. For example, in 2018 alone, the renewable energy generation capacity added by the fund's companies will reduce CO2 emissions by 793 million tons (MtCO2e) during the life of these facilities.

Echiquier Artificial Intelligence

Comments from Echiquier Artificial Intelligence management team

The ranking of the best thematic funds ends with the Echiquier Artificial Intelligence. It is an equity fund specialized in the most important technological revolution of our time. The fund invests in international companies that develop or adopt artificial intelligence to accelerate their growth and improve their productivity. Launched two years ago, the fund has returned + 67.9% vs. + 12% for its benchmark, the MSCI World Net Euro.

The COVID-19 crisis has demonstrated the important role of technology in our lives and in our economies

The rapid adoption of technological solutions has propelled us into an increasingly digitized world that is beneficial to artificial intelligence. In particular, the topics of cybersecurity, remote medical consultations, the cloud, eCommerce and even streaming have seen an accelerated adoption of these services during the crisis.

The perspectives are extremely interesting, artificial intelligence is still in its infancy and the economic contribution of this revolution should be gigantic as this technology grows in our society. New applications of artificial intelligence are developed every day and our mission is to identify the leaders of this revolution.

Adding value to the strategic approach

The thematic fund aims to benefit from the unmatched value that artificial intelligence generates. Our approach focuses on four company profiles to benefit from the rise of this technology: AI Users, who adopt artificial intelligence to gain competitiveness, such as the constructor FANUC, an example of recent portfolio securities in May 2020, whose robots gradually accumulate intelligence to optimize their operation; AI Vendors, which develop artificial intelligence solutions, such as BLUE PRISM, one of the three world leaders in digital robots that automate administrative tasks; AI Infrastructure, which provide physical or digital infrastructure, such as GDS HOLDINGS, a Chinese company that creates, leases and manages data centers; and finally, the AI Enablers, which give artificial intelligence a meaning and a brain. This is the case, for example, of NVIDIA, which markets graphics accelerators, true brains of artificial intelligence.

Our investment strategy is based on a universe currently made up for more than 150 companies, detected by semantic algorithms (quantitative filters, analysis of listed companies in the world that treat the key terms of artificial intelligence). Our qualitative investment process allows us to select the most promising in terms of future growth, strategic leadership and technological innovation.