Analysis of the Nordea 1 – Emerging Market Corporate Bond Fund

28 NOV, 2023

By Andrea Sepúlveda from LatamSelf

Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) is a Luxembourg-domiciled fund that primarily invests in bonds from emerging market companies, seeking to leverage valuation differences inherent in these assets. It uses the JPM Corporate Emerging Markets Bond Index Broad Diversified (CEMBI Broad Diversified) in USD as its benchmark.

In its investment policy, the fund primarily invests in USD-denominated instruments from emerging markets. Specifically, it allocates at least two-thirds of its total assets to USD-denominated debt issued by companies based or predominantly active in emerging markets. The fund may also be exposed (through investments or cash) to currencies other than the base currency and may use derivatives for risk hedging and investment gains.

Regarding its strategy, active portfolio management is emphasized, with the management team selecting securities that appear to offer superior investment opportunities.

In terms of sustainability, a notable strength of Nordea, the fund complies with the requirements of Article 6 of the SFDR. This means that the selection process for the underlying investments in the fund may incorporate environmental, social, or corporate governance (ESG) considerations, although it is not explicitly stated in the selection process or may not be considered relevant.

Despite not explicitly considering sustainability factors, an integration of sustainability risk is performed, including them in the investment decision-making process alongside traditional financial factors such as risk metrics and portfolios.

Performance of the Nordea Emerging Markets Corporate Fund

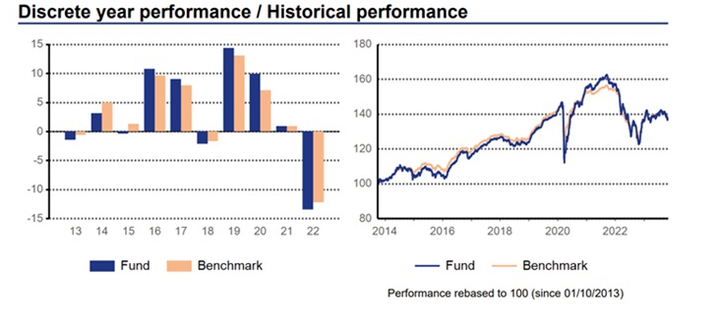

Source: Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) Factsheet, as of Oct 2023.

With a strong track record and several years of history, the Nordea Emerging Markets Corporate Fund has demonstrated notable performance. Additionally, considering the reputable background of Nordea as a Nordic European institutional house with a strong sustainability focus, the fund has delivered an impressive return of over 55% since its inception, annualized at 3.78%, slightly outperforming the benchmark.

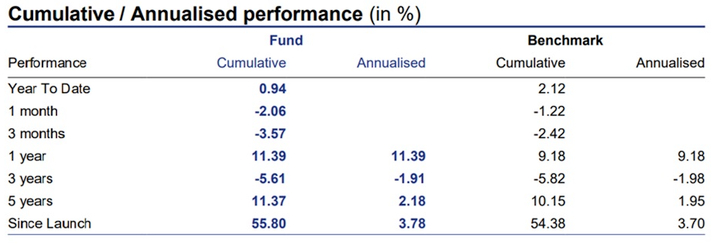

Source: Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) Factsheet, as of Oct 2023.

The cumulative return over 3 and 5 years surpasses its benchmark, crucial metrics for evaluating a manager's performance, especially for institutional investors where consistency in fund performance, management, and the team is pivotal.

Source: Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) Factsheet, as of Oct 2023.

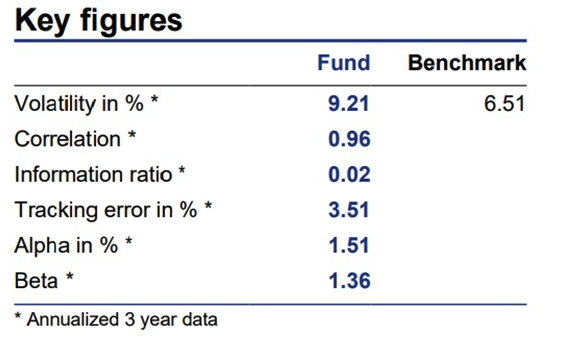

Reviewing risk and positioning indicators in the upper graph, the fund is strongly positioned against the benchmark over three years. The Alpha index is at a positive 1.51%, signifying value addition to the portfolio compared to the index. However, it has a Beta of 1.36, indicating a more optimistic stance than the market, thus carrying higher risk than its index.

Key Ratios and Indicators of Nordea Emerging Markets Corporate Bond Fund

Source: Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) Factsheet, as of Oct 2023.

The fund has a 4-year duration, an 8.8% yield, and an average rating of BB.

Source: Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) Factsheet, as of Oct 2023.

Despite having a credit quality lower than its benchmark, it leans towards High Yield rather than Investment Grade. This makes it a suitable product for those looking to invest in a risk-taking scenario within the asset class.

Largest Positions in Nordea Emerging Markets Corporate Bond

Source: Nordea 1 - Emerging Market Corporate Bond Fund (BI-USD) Factsheet, as of Oct 2023.

Conclusions

| Advantages | Drawbacks |

|---|---|

| Positive Alpha | For investors with a more conservative market view, it might be a fund with a high Beta. |

| Strong History and Track Record | |

| Backed by a Reputable Management Firm |

The Nordea Emerging Markets Corporate Bond Fund boasts a robust track record, delivering strong results across various timeframes. It presents a more aggressive and optimistic option than the market, with a significant component in high-yield investments in emerging markets