Analysis of the Janus Henderson Horizon Biotechnology Fund

13 APR, 2024

By Andrea Sepúlveda from LatamSelf

The Janus Henderson Horizon Biotechnology fund is a global equity thematic fund, based in Luxembourg, launched in 2018 and investing at least 80% of its assets in equity securities of biotechnology companies or related to biotechnology, of any size and in any country. This fund has received distinctions and ratings from major global financial information platforms.

In today's analysis we will examine its main features and what opportunities it offers to investors.

Features of the Janus Henderson Horizon Biotechnology fund

The Janus Henderson Horizon Biotechnology strategy belongs to the manager Janus Henderson, a company with over 90 years of experience, with investment strategies in equities, bonds, multi asset and also alternatives. The company has 24 offices worldwide, more than 340 investment professionals and over 2000 employees. As for the assets managed, Janus Henderson manages over 300 billion euros in AUM. As for the Janus Henderson Horizon Biotechnology fund, as of the end of February 2024, the strategy had over 260 million US dollars in assets under management.

- Benchmark index: the benchmark index for this fund is the NASDAQ Biotechnology Total Return, which broadly represents the companies eligible for this fund, in the sub-sectors and in the base return to be exceeded. Since it is an active fund, the investment team can choose companies and investments with different weights compared to the index or that are not in the index.

- Fund investment strategy: the team of experts looks for attractive opportunities across the biotechnology market because it trusts in the growth potential and innovation of biotechnology, focusing on companies that could change medical practice, maintaining the balance between scientific potential and how the business is managed. Therefore, in the portfolio there may be companies in the initial development phase, with products in commercialization or already profitable, but with the basis that they are companies that have been analyzed through a disciplined investment process that allows to mitigate the volatility associated with these sectors.

- Investment team: The fund's investment team is led by Andy Acker, who is also the head of the Health Care sector at Janus Henderson, has been the PM of the fund since its launch and joined the company in 1999. There is also Daniel Lyons, who is PM of Health Care and Biotech at the company, as well as a Research Analyst in the Bio tech and Life Science sectors of US Small/Mid Cap Growth. Along with them is Agustín Mohedas, PM and Research Analyst of the Health Care team with a focus on the Biotech sector, with experience in this sector in various companies since 2014.

- Assets: as of the end of February 2024, the Janus Henderson Horizon Biotechnology fund had over 260 million USD in assets under management.

Evolution of the Janus Henderson Horizon Biotechnology fund

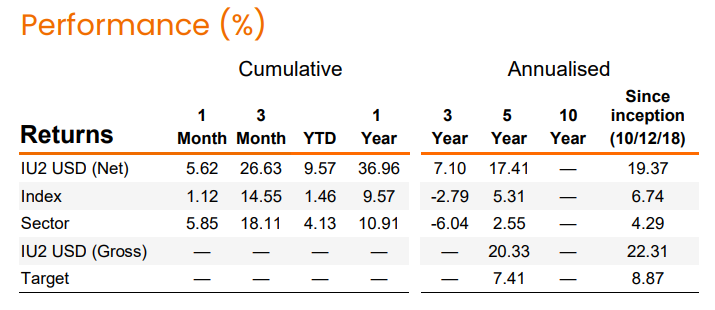

This is a fund with good returns over various time horizons. The 3 and 5 year results stand out, metrics observed by institutions, in which it significantly outperforms its benchmark.

The results are very useful to the strategy as the track record and consistency of the fund are fundamental aspects to consider in a long-term portfolio. Even more considering that it is a sector strategy that could add spice to a portfolio.

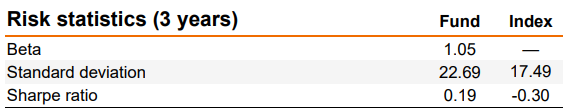

In the fund's factsheet, 3-year risk metrics are provided. It can be noticed that the fund takes on greater risk compared to the market and adheres to its strategy of trying to exploit the potential of companies in the fund's sub-sectors. Therefore, considering also the fund's results, it can be seen that the group of values selected by the fund manages to lead its sector and achieve better results compared to the general market.

| Main positions , 31/12/2023 (%) | Fund |

| Vertex Pharmaceuticals | 7.48 |

| Amgen | 5.42 |

| Madrigal Pharmaceutics | 3.64 |

| Cytokinetics | 3.58 |

| Argenx | 3.30 |

| Regeneron Pharmaceutics | 3.28 |

| Sarepta Therapeutics | 3.27 |

| AstraZeneca | 3.27 |

| Avadel Pharmaceuticals | 3.27 |

| Ardelyx | 2.98 |

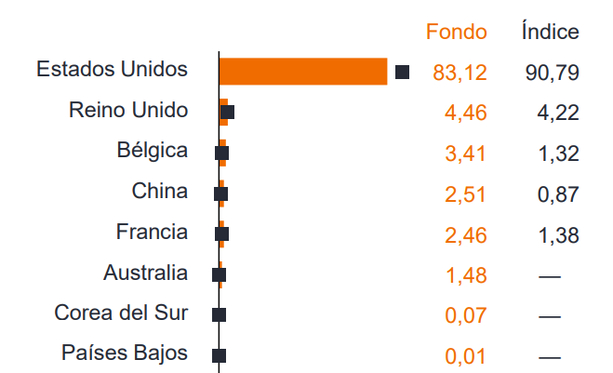

As can be seen from the geographical breakdown, the fund's team manages to maintain a more active position outside the United States compared to the benchmark. On the other hand, the main positions have been highlighted to comment that the top 10 companies represent 40% of the fund, making it quite concentrated. However, the factsheet already mentions this, stating that they have about 80 positions while their benchmark has over 200 components.

Conclusions

Advantages

- Institutional size, good track record and recognized manager.

- Thematic fund that allows to leverage the growth of the specific sector.

Disadvantages

- Global fund with specific theme, which may be for a selected group of investors.