Analysis of the Franklin Gold and Precious Metals Fund

18 APR, 2024

By Andrea Sepúlveda from LatamSelf

The Franklin Gold & Precious Metals Fund is a global equity thematic fund domiciled in Luxembourg, launched in April 2010 and focused on the precious metals sector, particularly on companies involved in the extraction, processing or trading of gold, silver, platinum and palladium.

Subsequently, we will examine its main features and the opportunities it offers to investors interested in gold.

Features of the Franklin Gold and Precious Metals Fund

Among the reasons to invest specifically in this type of thematic fund is the appeal of precious metals as tangible assets not tied to a specific country or financial system. Therefore, in times of economic uncertainty, precious metals can provide stability, diversification and a refuge from inflation and the possibilities of recession in various markets. Moreover, gold in particular has always been considered the universal currency.

- Benchmark Index: the fund is actively managed using the FTSE Gold Mines Index as a reference and for comparison.

- Investment Strategy: Being an active fund, the investment team can select companies and investments with different weights compared to the index. The investment team is composed by experts who analyze and select the best opportunities in the precious metals sector, focusing on high-quality companies with attractive production profiles, solid reserve bases and active precious metals exploration programs.

- Investment Team: the investment team is led by Steve Land, PM and research analyst at Franklin Equity Group, with over 27 years of experience, member of the portfolio management team of the Franklin Natural Resources Fund. Along with him, there is Frederick Fromm, PM and research analyst at Franklin Equity Group, with over 32 years of experience, who also leads the Franklin Natural Resources Fund.

- Assets: As of the end of March 2024, the Franklin Gold & Precious Metals Fund had approximately $400 million USD in assets under management.

Evolution of the Franklin Gold and Precious Metals Fund

Note: Past performance does not predict future returns. The fund's returns may increase or decrease due to exchange rate fluctuations.

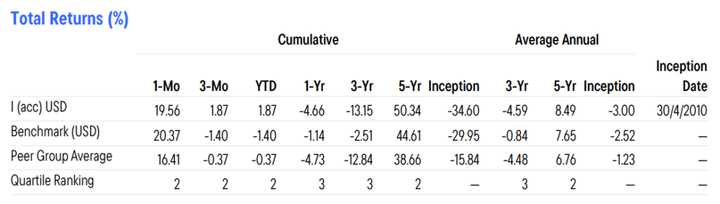

The Franklin Gold and Precious Metals fund is a strategy with returns that exceed its benchmark, but not in all time horizons. This can also be observed in the quartile in which the fund is positioned in different periods, although the strategy tends to be in the second quartile.

Note: Past performance does not predict future returns. The fund's returns may increase or decrease due to exchange rate fluctuations.

On the fund's website, 3, 5 and 10 year risk metrics are provided. It is clear that the fund consistently takes less risk than the market. On the other hand, its Information Ratio, which is the alpha on the tracking error, confirms what was observed in the fund's performance results: at 5 years, better numbers are recorded, although it lacks consistency.

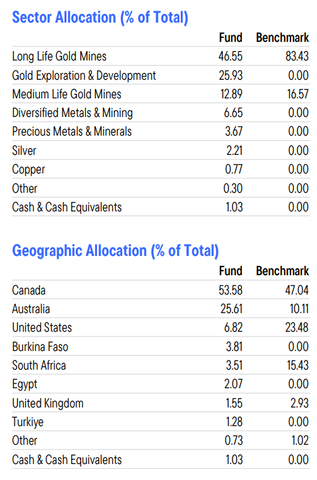

As for its allocation, it can be observed that at the subsector level the fund is quite different from the reference index. The significant position in companies dealing with exploration and development in the gold sector is evident, favoring the potential of these types of companies and their long-term results. In terms of geographical allocation, as one might expect, the fund has most of its positions in developed markets, although it favors Australia over the United States.

Advantages

- This is a fund whose philosophy on precious metals can provide a refuge from current inflation.

- Institutional size and recognized manager.

Disadvantages

- Global fund with a specific theme, which might be suitable for a selected group of investors who understand the level of included volatility.