Analysis of the Wellington Global Stewards Fund

11 JAN, 2024

By Andrea Sepúlveda from LatamSelf

Wellington Global Stewards Fund is a UCITS fund domiciled in Ireland and falls under Article 9 in SFDR, indicating a clear sustainability objective, well explained in its investment goals. The fund states its aim to provide investors with a total return higher than the benchmark, which is the ACWI (MSCI All Country World Index), by investing in equity securities of companies worldwide that generate high return on capital compared to peers. The companies targeted should also exhibit superior stewardship from their management and board of directors to sustain this profitability over time, hence the name of the fund.

It's important to note that the fund also aims for net-zero emissions by 2050, aligning with the Paris Agreement.

The fund defines stewardship as how the companies in which it invests balance the interests of all stakeholders and their pursuit of profits (customers, employees, communities, and the supply chain). It also considers how these companies incorporate material environmental, social, and/or governance (ESG) risks and opportunities into their corporate strategy. Thus, ESG is not an end in itself, but rather the fund's process begins with stewardship, involving a thorough review of the company's management and board, their work, and a focus on long-term results, which should emphasize ESG aspects at a strategic level as well.

Regarding its investment process, the fund has a long-term objective, aiming to hold company stocks for approximately 10 years. They believe that maintaining companies in the portfolio for a longer period allows them to reap greater benefits from good stewardship. Additionally, the fund is concentrated (with 35 to 45 instruments), a result of its selective investment process where they use their own scorecard instead of third-party Data ESG or screening. Once a company enters the portfolio, the fund engages with each one, encouraging them to commit to net-zero carbon emission goals in line with the Paris Agreement.

The investment team is composed of highly experienced investors, led by Mark Mandel and Yolanda Courtines, with over 30 years of experience, having spent 29 and 17 years respectively at Wellington. This is crucial, as in a fund focused on identifying companies with high-quality management and a long-term perspective, experience plays a fundamental role.

As of the end of October 2023, this strategy had over $1.5 billion USD in assets under management.

Evolution of the Wellington Global Stewards Fund

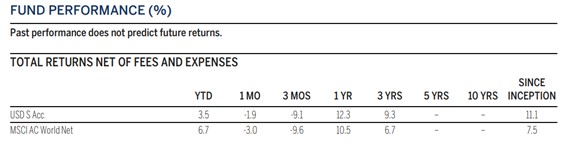

Note: Past performances do not predict future returns. Fund yields may increase or decrease due to fluctuations in exchange rates. Source: Factsheet Wellington Global Stewards Fund, Class USD S Acc Unhedged, as of 31-10-2023

As seen in the upper graph, it is a fund that manages to outperform its benchmark in different time periods. It was launched in January 2019, so we are not far from seeing 5-year metrics as well, as we always recommend looking at results over 3 and 5 years to assess consistency and performance.

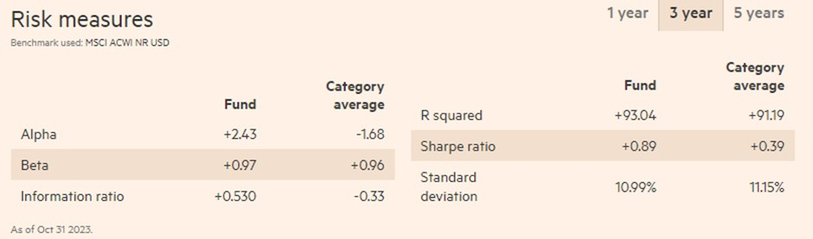

Source: https://markets.ft.com/data/funds for Wellington Stewards Funds, Class USD S Acc Unhedged, as of 31-10-2023

When reviewing the risk indicators in the table above, the first thing to note is that the 3-year Alpha is positive (excess return), indicating that it adds value over its benchmark (MSCI ACWI).

The second important aspect is that the Information Ratio, which is the alpha over the tracking error, essentially how the fund uses the benchmark's deviation, is positive. This implies that the team is adept at having specific positions, meaning they have high conviction.

Regarding the Market Beta, it is less than 1 over three years, indicating that the fund selects from the investable universe and has slightly lower systemic risk than the benchmark. It represents a more selective strategy rather than an aggressive one compared to the overall market. However, this was expected.

Other indicators of the Wellington Global Stewards Fund

Source: Factsheet Wellington Global Stewards Fund, Class USD S Acc Unhedged, as of 31-10-2023

One of the best examples of the fund's active management is the regional and sectoral allocation compared to its benchmark. Here, we can observe significant differences in regions such as the United States and Europe (with variances of +10% each). On the sectoral side, the differences are not as substantial, but collectively, each percentage contributes to the fund looking at sectors that the index weighs less heavily.

Conclusions

| Advantages | Disadvantages |

| •Positive Alpha and Information Ratio. • Experienced team. • Article 9 under SFDR. • Institutional fund, with a long-term approach. • Large size. | • For investors who prefer to "have control," a fund managed so actively may be unsettling. • It is important to thoroughly understand the selection process, as holding it for the long term is recommended. |

The Wellington Global Stewards Fund is a sustainability-oriented fund, but its primary focus is on effective management by company executives and boards. ESG considerations and risk assessments are integral to the process but not an end in themselves. Approaching its 5-year track record, the fund boasts an experienced team, favorable 3-year risk indicators, and maintains a high conviction on a global scale.