Analysis of the BlueBay Investment Grade Bond Fund

18 MAR, 2024

By Andrea Sepúlveda from LatamSelf

The BlueBay Investment Grade Bond fund is a Luxembourg domiciled fund, launched in 2003, which invests in a portfolio of investment grade European fixed income instruments with ESG aspects. In fact, this fund is article 8 in SFDR.

About the company and the management team

BlueBay AM represents RBC Global Asset Management, which is the asset management division of Royal Bank of Canada (RBC) outside North America. With more than 20 years of experience, BlueBay is recognized primarily for its specialized fixed income solutions, several of which are heavily invested by pension funds in Latam, although it also has equity and alternative products. As of December 2023, RBC Global Asset Management held USD 432 bn in assets under management, with 380 investment professionals and 18 specialized investment teams.

The fund's investment team is led by Andrzej Skiba, Marc Stacey and Tom Moulds, who have broad experience in this type of strategy and are in charge of other very successful fixed income funds of the firm. All of them have more than 15 years with the firm and rely on the firm's specialized analysts to carry out the strategy.

Objective of the BlueBay Investment Grade Bond Fund

This fund seeks to outperform the iBoxx Euro corporate Index in different market environments. Its strategy is active and unconstrained. Therefore, the index is only for comparative purposes as the fund team has no restrictions on sectors or companies in which it invests, and the fund has ESG considerations that the index does not have.

Strategy of the BlueBay Investment Grade Bond Fund

The strategy is carried out by making a selection of sectors and issuers based on the manager's in-house analysis that considers both macro aspects as well as specific credit analysis. However, the manager indicates that they are looking for most of the excess return to come from bottom up decisions, meaning the selection of sectors, issuers and specific instruments - as well as maintaining a controlled duration in a narrow range.

At the end of January 2024, the strategy had ~EUR2.3bn in assets under management.

Performance of the BlueBay Investment Grade Bond Fund

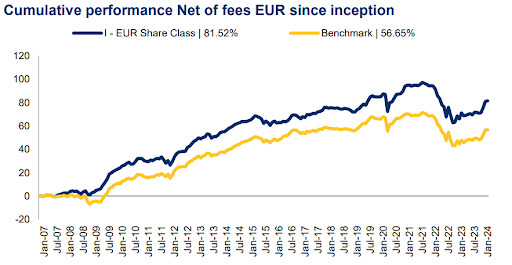

The BlueBay Investment Grade Bond Fund is a fund with a solid track record, and has quite a long history, over 20 years. In addition, the fund manager's track record in this type of asset is also an important asset.

The cumulative 3-, 5- and 10-year performance outperforms its benchmark, measures that are very important when looking at a manager's performance, especially for institutional investors for whom consistency of a fund, its management and the investment team are crucial.

Other comparatives of the BlueBay Investment Grade Bond Fund

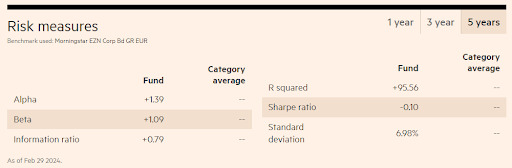

Considering the Benchmark assigned by this external source as the most appropriate to compare the strategy, it can be said that the fund has had good five-year results.

When reviewing the fund's risk and positioning indicators in the chart above, we see that it is very well positioned against this five-year benchmark; the Alpha index is at 1.39% positive, which means that the strategy adds value compared to the portfolio contained in the index, although it has a Beta of 1.09, i.e. the strategy is more optimistic than the market. Thus it also has more risk than its index, at least than the one considered here.

The second important thing is that the Information Ratio, which is the alpha over the tracking error, basically how the team uses its active and non-benchmark bets. This is positive, which means that the team selects credits well under its bottom-up analysis with ESG considerations.

Key indicators of the BlueBay Investment Grade Bond Fund

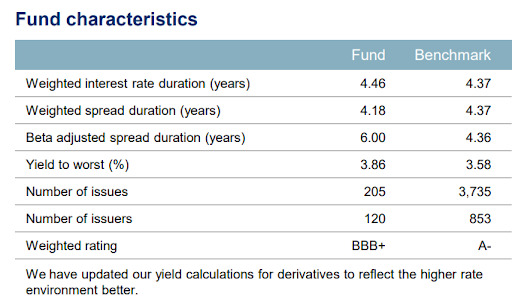

Here we again consider the benchmark declared by the fund, iBoxx Euro Corp Index. Here we can also see the active selection of the investment team, as the issuers selected are one seventh of those contained by the index, which also affects the number of instruments contained in the fund. This, added to the relative performance of the fund, demonstrates the good work the team has done.

Finally, when looking at the credit quality of the portfolio, it can be seen that the fund is slightly lower. This is because the fund admits up to 15% of non-IG instruments.

Here is a breakdown of the above. The fund has a slightly lower duration than the benchmark but it can be seen how it has achieved this portfolio duration by keeping the number of instruments balanced in different durations with respect to its benchmark which tends to be more weighted to short duration.

On the credit quality side, it has already been mentioned that it is slightly lower than its benchmark, given that its policy allows it to do so. Thus, the fund team is betting on a bit of High Yield to complement its Investment Grade selection. It is a product that, while remaining investment grade, has a riskier touch and, let us not forget, ESG considerations at the same time.

Conclusions

Following an analysis of the fund's philosophy, its performance since launch and key metrics, we review the main advantages and disadvantages of the BlueBay Investment Grade Bond Fund.

Advantages

- History and Track Record Highlights

- Institutional Size

- Well known backing Manager

- ESG criteria + good results

Disadvantages

- The asset class may not be the most attractive in the current market environment. IG bonds can offer lower yields compared to riskier bonds.