Analysis of the Robeco Sustainable Global Stars Equities Fund

4 APR, 2024

By Andrea Sepúlveda from LatamSelf

The Robeco Sustainable Global Stars Equities fund is a global equity fund, domiciled in Luxembourg, whose main objective is to invest in global companies that demonstrate solid long-term financial performance and also respect environmental, social and corporate governance criteria.

Let's look at the possible investment opportunities it offers.

Characteristics of the Robeco Sustainable Global Stars Equities fund

The Robeco Sustainable Global Stars Equities fund is characterized by the following:

- Investment strategy of the fund: The investment approach is based on the selection of shares of leading companies in their respective sectors in terms of sustainability. The stock selection process involves a thorough analysis of the ESG (Environment, Social, Governance) criteria of each company, as well as its financial fundamentals and long-term growth prospects. The fund incorporates sustainability into the investment process through exclusions, integration of ESG criteria, ESG and environmental footprint objectives, and the exercise of voting rights. The fund does not invest in issuers that violate international standards or whose activities are considered harmful to society according to Robeco's exclusion policy. In this way, the strategy seeks to identify companies that not only generate solid financial returns for investors, but also operate responsibly and sustainably, the latter is a very important factor in the selection of companies.

- Benchmark index: Its benchmark is the MSCI World Index (Net Return, EUR).

- Investment team: As for the investment team, it is led by Michiel Plakman, who is the main portfolio manager and a member of the company's Global Equity team, and therefore also co-leads the Robeco Global Equity team. He is responsible for global equity investments based on fundamentals and focuses on investments related to Sustainable Development Goals (SDGs), as well as on real estate, information technology and communication services companies, in addition to portfolio construction. He has held this position since 2009, although he has been part of the company since 1999.

- Assets: The Robeco Sustainable Global Stars Equities fund, at the close of February 2024, the strategy had managed assets of +3.7 billion euros.

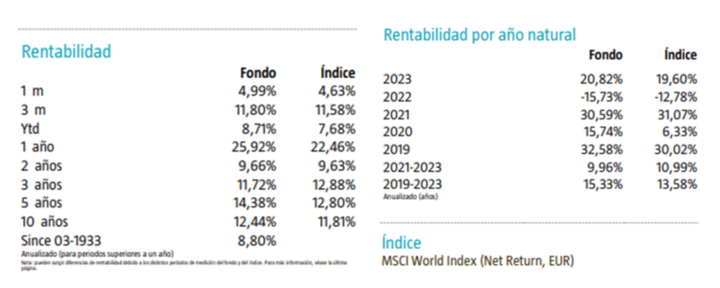

Evolution of the Robeco Sustainable Global Stars Equities fund

Note: Past performance does not predict future returns. The fund's returns may increase or decrease due to exchange rate fluctuations.

This is a fund with good returns on almost all metrics. The 5 and 10 year periods stand out, in which it significantly outperforms its benchmark. This is extremely positive, as for institutional clients the track record and consistency are fundamental aspects to consider for a strategy in their long-term portfolio.

Statistics

| 3 years | 5 years | |

| Tracking error | 3.18 | 5.53 |

| Information ratio | 0.00 | 0.81 |

| Sharpe ratio | 0.83 | 1.02 |

| Alpha (%) | 0.52 | 3.38 |

| Beta | 0.95 | 0.93 |

| Standard deviation | 13.99 | 14.77 |

| Maximum monthly gain (%) | 10.36 | 13.08 |

| Maximum monthly loss (%) | -8.75 | -9.76 |

The above ratios are based on net returns after fees.

This is a fund that has a 3 and 5 year Beta less than 1, which indicates that the fund has a more conservative profile compared to its benchmark (MSCI World Index NR EUR). As for its Alpha, its 5-year performance stands out, which indicates that the company selection by the investment team adds value compared to the benchmark and considering ASG criteria such as exclusion.

Other indicators of the Robeco Sustainable Global Stars Equities fund

| Sector distribution | Deviation Index | |

| Information Technology | 26.2% | 2.1% |

| Financials | 17.1% | 2% |

| Health Care | 14.4% | 2.3% |

| Consumer Discretionary | 12.4% | 1.5% |

| Industrials | 10.2% | -0.9% |

| Communication Services | 7.4% | 0% |

| Consumer Staples | 4.9% | -1.6% |

| Energy | 3.9% | -0.3% |

| Materials | 2.6% | -1.2% |

| Real Estate | 1% | -1.3% |

| Utilities | 0% | -2.4% |

| Regional distribution | | Deviation Index |

| America | 74.1% | 0.2% |

| Europe | 18.2% | 1.3% |

| Asia | 5.8% | -3.2% |

| Middle East | 2% | 1.8% |

The fund's portfolio is overweight in sectors that have stood out for positive returns in recent times, such as Information Technology or Health. The fund takes a more cautious stance on some more cyclical sectors, as they believe that global growth will continue to slow down and that the market will continue to be influenced by concerns about a possible recession. Regarding the geographical position, the fund has a position quite close to the benchmark, although, perhaps due to the selection of companies and ESG criteria, it is slightly underweight in Asia.

Conclusions

Advantages:

- Institutional fund with a good track record.

- The fund, considering the ESG, beats the benchmark in several time horizons.

- Robeco is an institutional management company with a very recognized reputation. In addition, it has a focus on ESG investments, so the fund team has the support to implement its own philosophy.

Disadvantages:

- The global approach developed can be a discouraging element for those seeking Beta in emerging markets.