Analysis of the GAM Multistock Fund – Luxury Brands Equity

27 MAR, 2024

By Andrea Sepúlveda from LatamSelf

The fund GAM Multistock - Luxury Brands Equity is a global equity thematic fund focused on growth through investments in luxury brands considering social and environmental aspects, but without a sustainable investment objective.

In this research we examine its peculiarities and identify the possible investment opportunities it offers.

Characteristics of the GAM Multistock - Luxury Brands Equity fund

The GAM Multistock - Luxury Brands Equity fund is based in Luxembourg, and was launched at the beginning of 2008. It belongs to GAM Investments, an independent wealth management group based in Zurich. It is an active investment management company, with over 40 years of experience, operating in 14 countries and employing over 500 people. As for the assets managed, GAM fund management services had over 20 billion euros in AUM.

- Investment strategy of the fund: the fund's strategy invests at least 70% of the assets in an equity portfolio of 25-35 global luxury companies, offering products and services in this sector and having their legal headquarters or the majority of their business activities in recognized countries. Given the portfolio's concentration, the investment team selects leading companies in the luxury sector with market-recognized brands, offering high-quality products and continuous innovation. The thesis is that the products and services of the luxury industry differentiate from other comparable ones available on the market and this differentiation can be sustainable in the long term. In addition, they look for well-capitalized companies with a compounded growth of revenues and high and stable margins.

- Fund management: the investment process is active, with a bottom-up style

- Benchmark index: the benchmark index, for comparison purposes only, is the S&P Global Luxury Brand in EUR Net Total Return index.

- Investment team: the investment team of GAM Luxury Brands is led by Niall Gallagher, Investment Director, responsible for investment strategy, portfolio construction, research and the financial sector. Flavio Cereda is Co-Investment Manager for the strategy, with over 30 years of experience in investing in the luxury sector.

- Assets: as of the end of February 2024, the strategy had over 420 million euros in assets under management.

Evolution of the GAM Multistock - Luxury Brands Equity fund

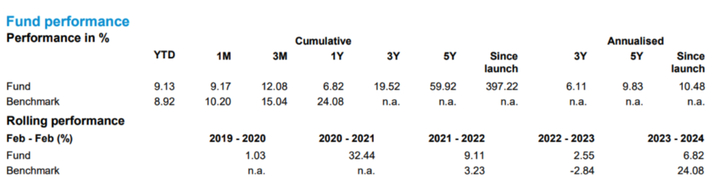

Note: Past performance does not predict future performance. The fund's returns may increase or decrease due to exchange rate fluctuations.

The fund indicates that the S&P Global Luxury Brand in EUR Net TR index is applicable from mid-2021 and that there was no benchmark for profitability before this date. For this reason, there is no historical comparative analysis of 3 years or more.

| 5 years | 3 years | 1 year | 6 months | 3 months | 1 month | |

| GAM Multistock - Luxury Brands Equity | 9.29% | 4.98% | 4.66% | 10.95% | 6.73% | 2.78% |

| Sector Equity Consumer Goods & Services | 4.11% | -1.73% | 9.26% | 8.07% | 5.45% | 3.03% |

| Fund quartile | 2nd | 1st | 3rd | 2nd | 2nd | 2nd |

| Funds category | 59 | 92 | 120 | 132 | 143 | 143 |

Source: Financial Times / https://markets.ft.com/data/funds/tearsheet/risk?s=LU0329430473:EUR Comparable category: Consumer Goods and Services Equity Sector

If we consider another source of information and evaluate what the manager shows in the factsheet, it is hard to say that the fund manages to do well consistently, both in terms of numerical results and consistency in its quartile.

Comparable category: Sector Equity Consumer Goods and Services

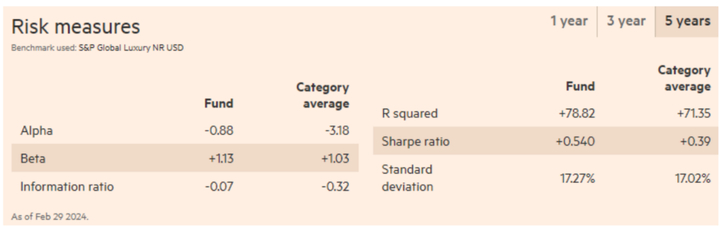

As for risk metrics, since we want to evaluate over a period of 3 or 5 years, we will again use an external source. In this case, a 5-year analysis was selected.

The first thing that stands out is the alpha, which is consistent with what was seen previously in the performance results. Therefore, the investment team has not achieved better returns than an appropriate benchmark for it (S&P Global Luxury NR USD). On the other hand, the fund's beta is above 1, which indicates that the selected companies (remember that there are not many, due to their high conviction) move more than the market and, as a whole, present a higher risk.

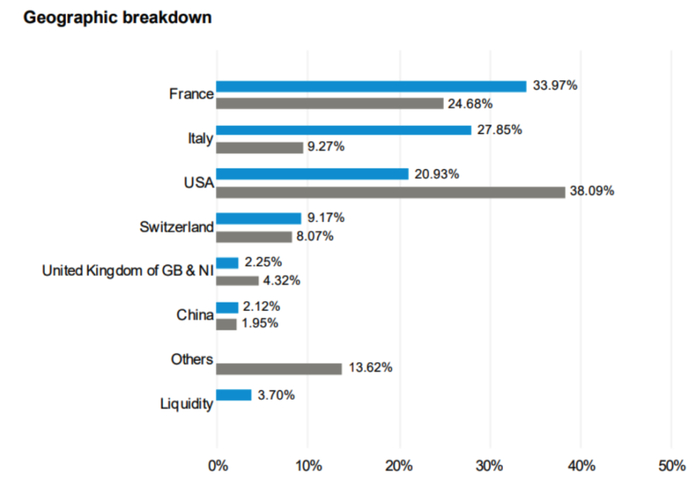

As can be seen from the geographical and sector breakdown, the fund team makes an active selection outside of the benchmark and focuses on those companies where they really see value and that meet their environmental and social criteria. In fact, as mentioned, even though the fund does not have a sustainable investment focus, it still has an exclusion criterion (it does not invest in companies whose environmental and social impact is negative) - which could explain, in a way, the differences in sectors compared to the benchmark (such as in the automotive sector) and a sort of favoritism for European countries.

The top 10 positions of the fund include companies like Hermes International SCA, Ferrari, LVMH Moet Hennessy Louis Vuitton SE, and together they represent almost 60% of the portfolio. This really speaks of a high conviction fund.

Conclusions

Advantages

- Institutional size and history to analyze.

- Exposure to global equity with a thematic and high conviction approach.

Disadvantages

- The fund's specific theme does not guarantee success in terms of performance compared to a global equity fund that does not have it.