Analysis of the Nordea 1 – Global Diversity Engagement Fund

11 MAR, 2024

By Andrea Sepúlveda from LatamSelf

The Nordea Global Diversity Engagement fund is a Luxembourg-domiciled global thematic equity fund, launched in early 2019, with distinctions and ratings from leading global financial reporting platforms and article 8 in SFDR.

About the asset manager, Nordea is one of the leading investment managers in the Nordic region and has also developed its business worldwide. Nordea stands out for its responsible thinking applied to the investment products it offers to its clients. When it comes to figures, Nordea has clients in 54 different countries, with ~800 institutional clients globally, +900 employees, and manages +250 bn EUR AUM and around 2/3 of its assets are under SFDR article 8 or 9.

Description of the Nordea 1 - Global Diversity Engagement Fund

The strategy of the Nordea 1 - Global Diversity Engagement Fund focuses on buying companies that meet the investment team's expectations in terms of diversity or are actively working towards it. By diversity, the team refers to issues such as gender, ethnicity, age and socio-economic status. However, Nordea highlights that the most data - and the best quality of data - on companies is related to gender diversity, but they expect to be able to measure the other aspects in the same way in the future. On the other hand, in addition to these measurements, the team chooses companies that offer growth prospects and good fundamentals for investment.

So basically the investment strategy of the Nordea 1 - Global Diversity Engagement Fund focuses on sustainability + traditional fundamentals.

This fund is actively managed. It is benchmarked against the MSCI ACWI Index (Net Return) but is used only for performance comparison purposes. The investment team is free to choose the companies in which to invest. This makes sense as the index is global equity with no ESG restrictions.

At the end of January 2024, the strategy had almost USD 450m in assets under management.

Performance of the Nordea 1 - Global Diversity Engagement Fund

Note: Past performance is not predictive of future returns. The fund's returns may increase or decrease as a result of changes in exchange rates.

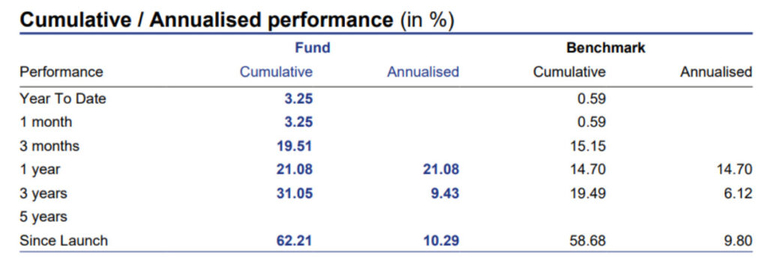

Given the launch date of the Nordea Global Diversity Engagement fund, we know that we can have sufficient track record to evaluate the fund's performance results for up to 3 years, which can be useful in assessing the fund's consistency.

Looking at the table above, we can see that the fund has been able to beat the benchmark (MSCI ACWI Index) over different time horizons, therefore, the fund team has made a good selection of its companies globally, generating value and proving the value of the fund's philosophy.

Other key indicators of the Nordea 1 - Global Diversity Engagement Fund

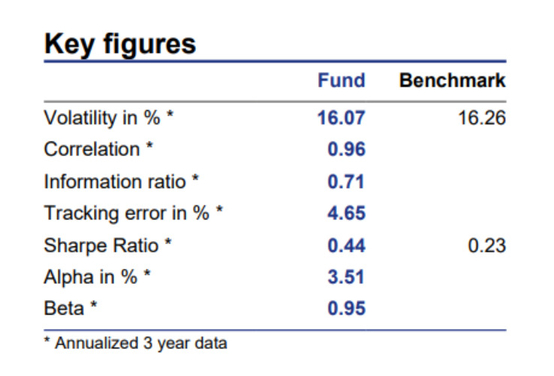

Regarding risk metrics, the fund manager discloses them in the fund's monthly fact sheet. Once again, let's look at the 3-year data compared to its benchmark.

The first thing that jumps out is the alpha, which matches up with what was seen earlier in the performance results. So, the investment team has done a good job selecting companies, which is not insignificant as they have had to take into account their two investment drivers: companies with good diversity metrics and good fundamental metrics.

To put it into numbers, at the end of January 2024 the fund had 94 companies in the portfolio vs. the benchmark which holds +2,900 companies and its top 15 holdings represented approximately 40% of the total fund, a concentrated and well-managed fund.

Compared to the market beta, this is slightly below 1 over 3 years, which indicates that the fund takes a slightly lower risk than the entire market of global companies and that it manages to outperform.

Conclusions

Following an analysis of the fund's philosophy, its performance since launch and key metrics, we review the main advantages and disadvantages of the Nordea 1 - Global Diversity Engagement Fund.

Advantages

- Nordea is globally recognized as a leader in Sustainable Investment.

- Institutional size and good track record.

- Proven alpha.

- Global equity exposure with a thematic approach.

Disadvantages

- The fund's specific philosophy does not guarantee performance success over a global equity fund which does not have a specific philosophy.