Analysis of the Polar Capital Funds PLC- Global Insurance Fund

23 FEB, 2024

By Andrea Sepúlveda from LatamSelf

The Polar Capital Global Insurance fund, domiciled in Ireland and with over 25 years of experience, has been awarded and evaluated by major financial platforms worldwide. This strategy, which belongs to the house Polar Capital, a British boutique with an AUM of almost 23 billion euros, offers investors the opportunity to participate in the potential of the global insurance sector, supported by a solid investment strategy and an expert team. In addition, it stands out for its classification as article 8 in SFDR.

In this analysis we examine its peculiarities and identify the investment opportunities it offers.

Description of the Polar Capital Funds PLC- Global Insurance Fund

- Investment Strategy: the fund's investment strategy focuses on companies in the insurance sector worldwide, including insurance and reinsurance companies, life, brokerage and other related activities.

- Investment Philosophy: the fund's philosophy is based on the belief that the insurance sector offers attractive long-term opportunities, with growth potential, geographical diversification and stability in times of short-term volatility.

- Management Strategy: The fund adopts an active management strategy, based on fundamental analysis and high conviction bottom-up selection, with a concentrated portfolio of 30-35 companies.

- Benchmark and Profitability Comparison: despite its active strategy, the fund uses the MSCI World Insurance Index as a benchmark to compare its profitability with the behavior of the sector globally.

- Investment Team: The investment team, led by Nick Martin, boasts extensive experience in the sector and autonomy in the investment decision-making process.

- Assets: as of the end of January 2024, the fund's strategy had more than 2.7 billion US dollars of managed assets, highlighting its solid performance and its position in the market.

Evolution of the Polar Capital Funds PLC- Global Insurance Fund strategy

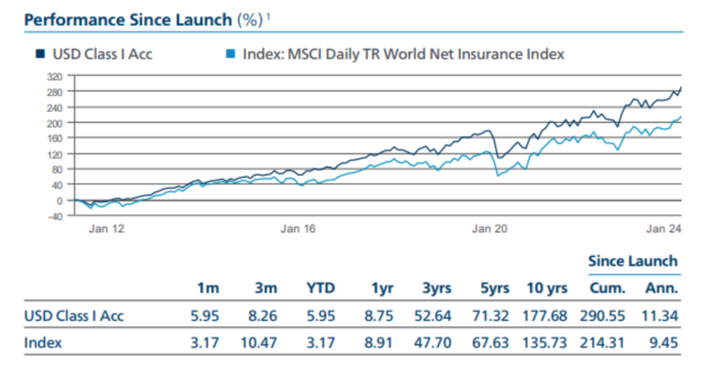

Note: Past performance does not predict future performance. The fund's returns may increase or decrease due to exchange rate fluctuations.

As can be seen from the above chart, it is a fund that achieves returns higher than its benchmark and, moreover, it is consistent.

As always, the measures that should be considered with greater importance are the 3 years and 5 years of history. In this case, it has a return significantly higher than its benchmark, as well as for the current year.

Furthermore, this is a fund focused on the long term, to achieve the best results in the sector, so it should be evaluated from this perspective. In general, it shows that there is consistency in the process of selecting companies in the strategy. It has had the ability to adapt to different market scenarios, taking advantage of the opportunities offered by the insurance sector, which benefits from the economic recovery, the increase in premiums, and technological innovation.

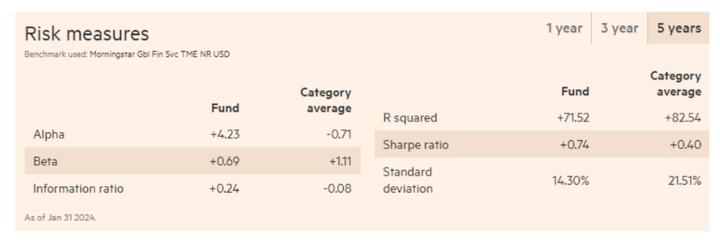

Considering the risk measures used by this source to compare the strategy with a global financial index (a defensive sector par excellence), it can be seen that these also show a good management of the fund and an appropriate selection of instruments by the investment team.

As for the 5-year Alpha, it is very positive, which means that the investment team has been able to add value in its high conviction selection compared to a defensive category. As for the Information Ratio, which tells us how the team uses the deviation (its active investment) compared to the benchmark index, it has a positive value, which means that the team has done well to make high conviction bets and not to adapt to the benchmark.

Regarding the market Beta, this at 5 years is rather less than 1, which indicates that it is a more conservative fund compared to the defensive sector with which it is compared.

Other indicators of the Polar Capital Funds PLC- Global Insurance Fund

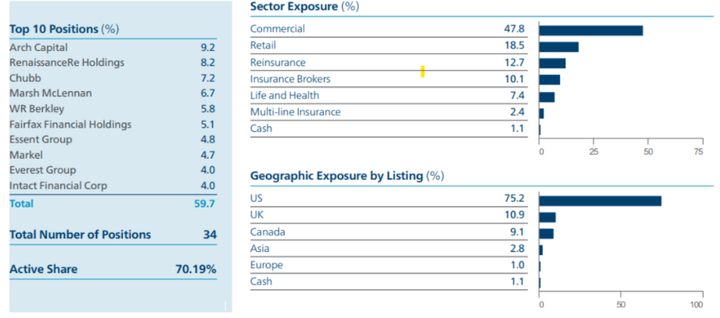

Here you can notice the high conviction of the fund's portfolio, the top 10 positions of this represent almost 60% of the total investment of the strategy. Even if 30-35 companies may seem few, the team manages to find diversification among them - as demonstrated by their performance results - and you can also see in the exposure to sub-sectors within the insurance sector, although as for the regions there is a greater concentration in North America.

Conclusions

Advantages

- Experienced manager and team.

- Institutional fund, of large size.

- Global diversification, defensive sector.

- Proven Alpha and track record.

Disadvantages

- For investors who prefer to "keep control", such an actively managed fund can be worrying.

- Possible risk of concentration if the strategy is considered Core.