Analysis of the RobecoSAM Global Gender Equality Equities Fund

6 MAR, 2024

By Andrea Sepúlveda from LatamSelf

The RobecoSAM Global Gender Equality Equities Fund is a fund domiciled in Luxembourg, launched in 2020, whose aim is to achieve good long-term performance results and, at the same time, promote ESG aspects such as Gender Equality and Sustainable Business Practices. This fund is classified as article 8 according to SFDR.

Regarding the management company, Robeco is an international investment house with solid experience. Founded in Rotterdam in 1929, it offers a wide range of active funds, including equities and bonds, and is known for its focus on sustainability and responsible investment. Robeco has 16 offices worldwide, with over 1,000 employees and manages over 181 billion euros in AUM (of which over 176 billion euros are in instruments that integrate ESG).

In this analysis we examine its peculiarities and identify the investment opportunities it offers.

Description of the RobecoSAM Global Gender Equality Equities Fund

- Fund strategy: The fund selects companies globally that respect the fund's philosophy, with a fundamental analysis. The portfolio selects companies that score higher using a gender methodology developed by the management company. The team evaluates the performance of companies on at least 38 criteria, including: diversity in key roles, wage equity, work-family reconciliation, talent management, retention, and others.

- Fund management: The fund is actively managed, has the ability to differentiate (unconstrained) in terms of companies, sectors and regions compared to its benchmark.

- Benchmark index: The index that is considered (only for comparison purposes) and that this fund seeks to outperform is the MSCI World Index TRN.

- Investment team: The investment team is led by Michel Plakman, who is also co-director of Robeco's global equities team. He joined the management company in 1999 and prior to that he worked as portfolio manager at a major pension funds. With him is Audrey Kaplan, PM of the strategy, who joined Robeco in 2021 and previously worked at major asset managers.

- Assets: at the end of January 2024, the strategy had almost 80 million dollars in assets under management.

Evolution of the RobecoSAM Global Gender Equality Equities fund

Note: Past returns do not predict future returns. The fund's returns can increase or decrease due to exchange rate fluctuations.

Here is shown the information on profitability prior to the launch date (2020) as this class has absorbed the Multipartner SICAV - RobecoSAM Global Gender Equality Equities fund. The previous profitability takes into account the past profitability of the absorbed fund which had a similar investment policy and applied higher or comparable expenses.

Considering the previous note, and to only evaluate the current strategy, we will focus on the performance during the last 3 years, which will provides us with a lot of information about what the investment team has done.

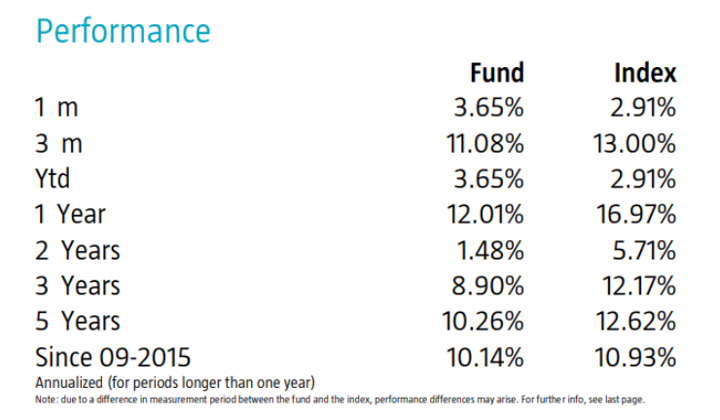

We can see in the table above that the fund has not been able to outperform the benchmark (MSCI World Index TRN) in several time horizons. However, it is important to keep in mind that the index groups 1,500 companies globally without exclusions and does not make a selection as specific as the fund. In other words, the theme of the fund, focuses on ESG and Gender Equality, is leaving a bit of return on the table and betting that in the long run its companies will outperform the rest and achieve better results.

For this reason, the fund team recommends entering this strategy considering to keep it for at least 5 to 7 years.

The management company shares its risk metrics in the fund's monthly sheet. Once again, we will examine the 3-year data compared to its benchmark. The first thing that highlights is the alpha, which corresponds to what was seen earlier in the performance results. Without considering the specific theme of the fund, this means that the investment team has not managed to beat its benchmark with the selection of companies. As for the market Beta, this is slightly below 1 in the 5 years period, which indicates that the fund takes a similar risk to the global market but fails to exceed its result.

On the other hand, the management company provides information on the maximum loss and maximum gain, respectively -7.24% and 8.26%, which represents a considerable range. Therefore, for clients who evaluate their portfolio monthly, movements like these can generate concern. After having a look at these figures, it is even easier to understand why the managers suggest a time frame of over 5 years.

Other indicators of the RobecoSAM Global Gender Equality Equities fund

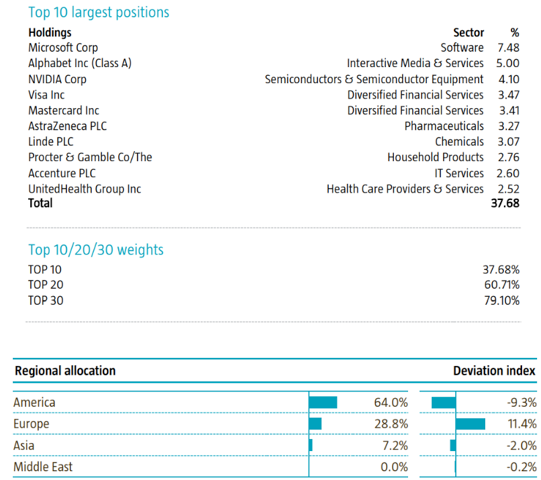

Here you can see that the fund is quite active, especially in regional allocation as it has a significantly higher exposure to Europe. This is what one might expect, since the regional allocation is the result of the selection of companies and we might think that in this region there are many companies that take into account ESG and Gender Equality, in which the investment team would want to invest more heavily.

On the other hand, looking at the weights of the top 10 investment positions, or even the top 30 positions, it can be noticed that the fund actually makes a selection of companies, proving to be a high conviction fund compared to its benchmark, which invests in 1500 companies.

Conclusions

Advantages

- Globally recognized management company.

- Expert and specialized team.

- Sustainable global investment option.

- Specific measurement and reporting on ESG and Gender Equality issues.

Disadvantages

- Requires the investor's commitment to the spirit of the fund and the maintenance of the investment for 5-7 years.

- The fund is still relatively small for institutional clients in the region (80 million USD).